01 cover sbi 152.indd - FIFA/CIES International University Network

01 cover sbi 152.indd - FIFA/CIES International University Network

01 cover sbi 152.indd - FIFA/CIES International University Network

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

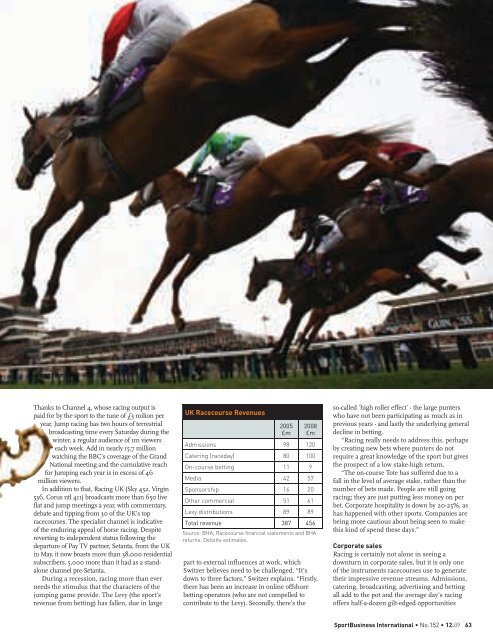

Thanks to Channel 4, whose racing output is<br />

paid for by the sport to the tune of £3 milion per<br />

year, Jump racing has two hours of terrestrial<br />

broadcasting time every Saturday during the<br />

winter, a regular audience of 1m viewers<br />

each week. Add in nearly 15.7 million<br />

watching the BBC’s <strong>cover</strong>age of the Grand<br />

National meeting and the cumulative reach<br />

for Jumping each year is in excess of 46<br />

million viewers.<br />

In addition to that, Racing UK (Sky 432, Virgin<br />

536, Corus ntl 411) broadcasts more than 650 live<br />

flat and jump meetings a year, with commentary,<br />

debate and tipping from 30 of the UK’s top<br />

racecourses. The specialist channel is indicative<br />

of the enduring appeal of horse racing. Despite<br />

reverting to independent status following the<br />

departure of Pay TV partner, Setanta, from the UK<br />

in May, it now boasts more than 38,000 residential<br />

subscribers, 5,000 more than it had as a standalone<br />

channel pre-Setanta.<br />

During a recession, racing more than ever<br />

needs the stimulus that the characters of the<br />

jumping game provide. The Levy (the sport’s<br />

revenue from betting) has fallen, due in large<br />

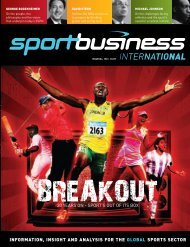

UK Racecourse Revenues<br />

2005<br />

£m<br />

2008<br />

£m<br />

Admissions 98 120<br />

Catering (raceday) 80 100<br />

On-course betting 11 9<br />

Media 42 57<br />

Sponsorship 16 20<br />

Other commercial 51 61<br />

Levy distributions 89 89<br />

Total revenue 387 456<br />

Source: BHA; Racecourse financial statements and BHA<br />

returns; Deloitte estimates.<br />

part to external influences at work, which<br />

Switzer believes need to be challenged. “It’s<br />

down to three factors,” Switzer explains. “Firstly,<br />

there has been an increase in online offshore<br />

betting operators (who are not compelled to<br />

contribute to the Levy). Secondly, there’s the<br />

so-called `high roller effect` - the large punters<br />

who have not been participating as much as in<br />

previous years - and lastly the underlying general<br />

decline in betting.<br />

“Racing really needs to address this, perhaps<br />

by creating new bets where punters do not<br />

require a great knowledge of the sport but gives<br />

the prospect of a low stake-high return.<br />

“The on-course Tote has suffered due to a<br />

fall in the level of average stake, rather than the<br />

number of bets made. People are still going<br />

racing; they are just putting less money on per<br />

bet. Corporate hospitality is down by 20-25%, as<br />

has happened with other sports. Companies are<br />

being more cautious about being seen to make<br />

this kind of spend these days.”<br />

Corporate sales<br />

Racing is certainly not alone in seeing a<br />

downturn in corporate sales, but it is only one<br />

of the instruments racecourses use to generate<br />

their impressive revenue streams. Admissions,<br />

catering, broadcasting, advertising and betting<br />

all add to the pot and the average day’s racing<br />

offers half-a-dozen gilt-edged opportunities<br />

SportBusiness <strong>International</strong> • No.152 • 12.09 63