2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

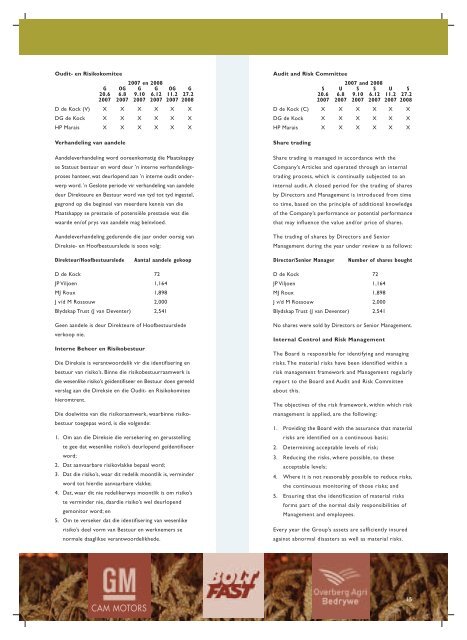

Oudit- en Risikokomitee<br />

2007 en <strong>2008</strong><br />

G OG G G OG G<br />

20.6 6.8 9.10 6.12 11.2 27.2<br />

2007 2007 2007 2007 2007 <strong>2008</strong><br />

D de Kock (V) X X X X X X<br />

DG de Kock X X X X X X<br />

HP Marais X X X X X X<br />

Verhandeling van aandele<br />

Aandeleverhandeling word ooreenkomstig die Maatskappy<br />

se Statuut bestuur en word deur ’n interne verhandelingsproses<br />

hanteer, wat deurlopend aan ’n interne oudit onderwerp<br />

word. ’n Geslote periode vir verhandeling van aandele<br />

deur Direkteure en Bestuur word van tyd tot tyd ingestel,<br />

gegrond op die beginsel van meerdere kennis van die<br />

Maatskappy se prestasie of potensiële prestasie wat die<br />

waarde en/of prys van aandele mag beïnvloed.<br />

Aandeleverhandeling gedurende die jaar onder oorsig van<br />

Direksie- en Hoofbestuurslede is soos volg:<br />

Audit and Risk Committee<br />

2007 and <strong>2008</strong><br />

S U S S U S<br />

20.6 6.8 9.10 6.12 11.2 27.2<br />

2007 2007 2007 2007 2007 <strong>2008</strong><br />

D de Kock (C) X X X X X X<br />

DG de Kock X X X X X X<br />

HP Marais X X X X X X<br />

Share trading<br />

Share trading is managed in accordance with the<br />

Company’s Articles and operated through an internal<br />

trading process, which is continually subjected to an<br />

internal audit. A closed period for the trading of shares<br />

by Directors and Management is introduced from time<br />

to time, based on the principle of additional knowledge<br />

of the Company’s performance or potential performance<br />

that may influence the value and/or price of shares.<br />

The trading of shares by Directors and Senior<br />

Management during the year under review is as follows:<br />

Direkteur/Hoofbestuurslede<br />

Aantal aandele gekoop<br />

Director/Senior Manager<br />

Number of shares bought<br />

D de Kock 72<br />

JP Viljoen 1,164<br />

MJ Roux 1,898<br />

J v/d M Rossouw 2,000<br />

Blydskap Trust (J van Deventer) 2,541<br />

Geen aandele is deur Direkteure of Hoofbestuurslede<br />

verkoop nie.<br />

Interne Beheer en Risikobestuur<br />

Die Direksie is verantwoordelik vir die identifisering en<br />

bestuur van risiko’s. Binne die risikobestuurraamwerk is<br />

die wesenlike risiko’s geïdentifiseer en Bestuur doen gereeld<br />

verslag aan die Direksie en die Oudit- en Risikokomitee<br />

hieromtrent.<br />

Die doelwitte van die risikoraamwerk, waarbinne risikobestuur<br />

toegepas word, is die volgende:<br />

1. Om aan die Direksie die versekering en gerusstelling<br />

te gee dat wesenlike risiko’s deurlopend geïdentifiseer<br />

word;<br />

2. Dat aanvaarbare risikovlakke bepaal word;<br />

3. Dat die risiko’s, waar dit redelik moontlik is, verminder<br />

word tot hierdie aanvaarbare vlakke;<br />

4. Dat, waar dit nie redelikerwys moontlik is om risiko’s<br />

te verminder nie, daardie risiko’s wel deurlopend<br />

gemonitor word; en<br />

5. Om te verseker dat die identifisering van wesenlike<br />

risiko’s deel vorm van Bestuur en werknemers se<br />

normale daaglikse verantwoordelikhede.<br />

D de Kock 72<br />

JP Viljoen 1,164<br />

MJ Roux 1,898<br />

J v/d M Rossouw 2,000<br />

Blydskap Trust (J van Deventer) 2,541<br />

No shares were sold by Directors or Senior Management.<br />

Internal Control and Risk Management<br />

The Board is responsible for identifying and managing<br />

risks. The material risks have been identified within a<br />

risk management framework and Management regularly<br />

report to the Board and Audit and Risk Committee<br />

about this.<br />

The objectives of the risk framework, within which risk<br />

management is applied, are the following:<br />

1. Providing the Board with the assurance that material<br />

risks are identified on a continuous basis;<br />

2. Determining acceptable levels of risk;<br />

3. Reducing the risks, where possible, to these<br />

acceptable levels;<br />

4. Where it is not reasonably possible to reduce risks,<br />

the continuous monitoring of those risks; and<br />

5. Ensuring that the identification of material risks<br />

forms part of the normal daily responsibilities of<br />

Management and employees.<br />

Every year the Group’s assets are sufficiently insured<br />

against abnormal disasters as well as material risks.<br />

CAM MOTORS<br />

15