2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

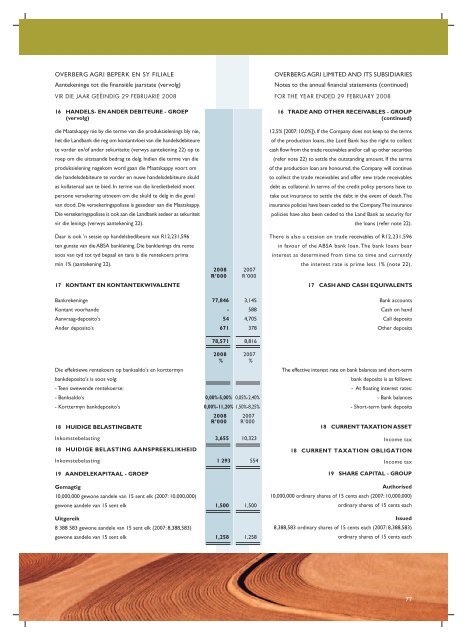

OVERBERG AGRI BEPERK EN SY FILIALE<br />

Aantekeninge tot die finansiële jaarstate (vervolg)<br />

VIR DIE JAAR GEËINDIG 29 FEBRUARIE <strong>2008</strong><br />

16 HANDELS- EN ANDER DEBITEURE - GROEP<br />

(vervolg)<br />

die Maatskappy nie by die terme van die produksielenings bly nie,<br />

het die Landbank die reg om kontantvloei van die handelsdebiteure<br />

te vorder en/of ander sekuriteite (verwys aantekening 22) op te<br />

roep om die uitstaande bedrag te delg. Indien die terme van die<br />

produksielening nagekom word gaan die Maatskappy voort om<br />

die handelsdebiteure te vorder en nuwe handelsdebiteure skuld<br />

as kollateraal aan te bied. In terme van die kredietbeleid moet<br />

persone versekering uitneem om die skuld te delg in die geval<br />

van dood. Die versekeringspolisse is gesedeer aan die Maatskappy.<br />

Die versekeringspolisse is ook aan die Landbank sedeer as sekuriteit<br />

vir die lenings (verwys aantekening 22).<br />

OVERBERG AGRI LIMITED AND ITS SUBSIDIARIES<br />

Notes to the annual financial statements (continued)<br />

FOR THE YEAR ENDED 29 FEBRUARY <strong>2008</strong><br />

16 TRADE AND OTHER RECEIVABLES - GROUP<br />

(continued)<br />

12,5% [2007: 10,0%]). If the Company does not keep to the terms<br />

of the production loans, the Land Bank has the right to collect<br />

cash flow from the trade receivables and/or call up other securities<br />

(refer note 22) to settle the outstanding amount. If the terms<br />

of the production loan are honoured, the Company will continue<br />

to collect the trade receivables and offer new trade receivables<br />

debt as collateral. In terms of the credit policy persons have to<br />

take out insurance to settle the debt in the event of death. The<br />

insurance policies have been ceded to the Company. The insurance<br />

policies have also been ceded to the Land Bank as security for<br />

the loans (refer note 22).<br />

Daar is ook ’n sessie op handelsbedibeure van R12,231,596<br />

ten gunste van die ABSA banklening. Die banklenings dra rente<br />

soos van tyd tot tyd bepaal en tans is die rentekoers prima<br />

min 1% (aantekening 22).<br />

<strong>2008</strong> 2007<br />

R’000 R’000<br />

17 KONTANT EN KONTANTEKWIVALENTE 17 CASH AND CASH EQUIVALENTS<br />

Bankrekeninge 77,846 3,145 Bank accounts<br />

Kontant voorhande - 588 Cash on hand<br />

Aanvraag-deposito's 54 4,705 Call deposits<br />

Ander deposito's 671 378 Other deposits<br />

78,571 8,816<br />

There is also a cession on trade receivables of R12,231,596<br />

in favour of the ABSA bank loan. The bank loans bear<br />

interest as determined from time to time and currently<br />

the interest rate is prime less 1% (note 22).<br />

<strong>2008</strong> 2007<br />

% %<br />

Die effektiewe rentekoers op banksaldo's en korttermyn<br />

The effective interest rate on bank balances and short-term<br />

bankdeposito's is soos volg:<br />

bank deposits is as follows:<br />

- Teen swewende rentekoerse: - At floating interest rates:<br />

- Banksaldo's 0,00%-5,00% 0,05%-2,40% - Bank balances<br />

- Korttermyn bankdeposito's 0,00%-11,20% 1,50%-8,25% - Short-term bank deposits<br />

<strong>2008</strong> 2007<br />

18 HUIDIGE BELASTINGBATE<br />

R’000 R’000<br />

18 CURRENT TAXATION ASSET<br />

Inkomstebelasting 3,655 10,323<br />

18 HUIDIGE BELASTING AANSPREEKLIKHEID<br />

Inkomstebelasting 1 293 554<br />

19 AANDELEKAPITAAL - GROEP<br />

Gemagtig<br />

10,000,000 gewone aandele van 15 sent elk (2007: 10,000,000)<br />

gewone aandele van 15 sent elk 1,500 1,500<br />

Uitgereik<br />

8 388 583 gewone aandele van 15 sent elk (2007: 8,388,583)<br />

gewone aandele van 15 sent elk 1,258 1,258<br />

Income tax<br />

18 CURRENT TAXATION OBLIGATION<br />

Income tax<br />

19 SHARE CAPITAL - GROUP<br />

Authorised<br />

10,000,000 ordinary shares of 15 cents each (2007: 10,000,000)<br />

ordinary shares of 15 cents each<br />

Issued<br />

8,388,583 ordinary shares of 15 cents each (2007: 8,388,583)<br />

ordinary shares of 15 cents each<br />

77