2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OVERBERG AGRI BEPERK EN SY FILIALE<br />

Aantekeninge tot die finansiële jaarstate (vervolg)<br />

VIR DIE JAAR GEËINDIG 29 FEBRUARIE <strong>2008</strong><br />

3.1 FINANSIËLE RISIKO-FAKTORE (vervolg)<br />

Die Groep se kontantvloei-rentekoersrisiko ontstaan uit<br />

langtermyn- en korttermynlenings. Lenings wat teen<br />

veranderlike koerse toegestaan word, stel die Groep bloot<br />

aan kontantvloei-rentekoersrisiko.<br />

Op jaareinde, indien die rentekoerse met 100 basispunte<br />

versterk/verswak het teenoor die onderskeie geldeenhede<br />

met al die ander veranderlikes wat konstant gehou word,<br />

sou die na-belaste wins vir die jaar R294,779<br />

(2007: R231,018) hoër/laer gewees het, hoofsaaklik as gevolg<br />

van veranderlike rentekoersveranderinge.<br />

(c) Kredietrisiko<br />

Die Groep se kredietrisiko ontstaan van kredietblootstelling<br />

aan landbou, groothandel- en kleinhandel-debiteure, kontant<br />

en kontantekwivalente en deposito's by banke. Deurlopende<br />

kredietevaluerings word van die finansiële posisies, vorige<br />

ondervindings en ander faktore van sodanige debiteure<br />

individueel uitgevoer, asook die vestiging van geskikte<br />

sekuriteite, ooreenkomstig 'n formele kredietbeleid wat<br />

deurlopend aangepas word om veranderings in risiko's in ag<br />

te neem. Die benutting van die kredietfasiliteite word deurlopend<br />

gemonitor. Die Groep se kontant en kontantekwivalente<br />

word geplaas by hoë krediet-kwaliteit finansiële instellings.<br />

OVERBERG AGRI LIMITED AND ITS SUBSIDIARIES<br />

Notes to the annual financial statements (continued)<br />

FOR THE YEAR ENDED 29 FEBRUARY <strong>2008</strong><br />

3.1 FINANCIAL RISK FACTORS (continued)<br />

The Group's cash-flow interest rate risk arises from<br />

long-term and short-term loans. Loans granted at variable<br />

rates expose the Group to cash-flow interest rate risk.<br />

At year-end, should the interest rates have strengthened/<br />

weakened by 100 basis points against the respective<br />

currencies with all other variables being constant, the<br />

after-tax profit for the year would have been R294,779<br />

(2007: R231,018) higher/lower, primarily due to variable<br />

interest rate changes.<br />

(c) Credit risk<br />

The Group's credit risk arises from credit exposure to<br />

agriculture, wholesale and retail debtors, cash and cash<br />

equivalents and deposits with banks. Continuous credit<br />

evaluations are performed individually of the financial<br />

positions, previous experience and other factors of such<br />

debtors as well as the vesting of suitable securities in<br />

accordance with a formal credit policy applied throughout<br />

to take account of changes in risks. The Group's cash<br />

and cash equivalents are placed at high credit quality<br />

financial institutions.<br />

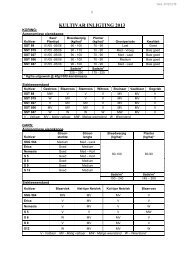

Kredietfasiliteit<br />

Saldo<br />

Credit<br />

facility<br />

Balance<br />

R’000 R’000<br />

29 Februarie <strong>2008</strong> 29 February <strong>2008</strong><br />

Kontant en kontantekwivalente: ABSA 37,000 78,571 Cash and cash equivalents: ABSA<br />

37,000 78,571<br />

28 Februarie 2007 28 February 2007<br />

Kontant en kontantekwivalente: ABSA 30,000 8,816 Cash and cash equivalents: ABSA<br />

30,000 8,816<br />

(d) Likiditeitsrisiko<br />

Omsigtige likiditeitsrisikobestuur impliseer die instandhouding<br />

van toereikende kontant en bemarkbare sekuriteite,<br />

die beskikbaarheid van befondsing deur middel van 'n toereikende<br />

hoeveelheid van goedgekeurde kredietfasiliteite<br />

en die vermoë om markposisies volkome te ontbondel. As<br />

gevolg van die dinamiese aard van die onderliggende besighede,<br />

beoog Bestuur om befondsingsaanpasbaarheid te<br />

handhaaf deur goedgekeurde kredietlyne beskikbaar te hou.<br />

(d) Liquidity risk<br />

Prudent liquidity risk management implies the<br />

maintenance of sufficient cash and marketable securities,<br />

the availability of funding by means of a sufficient number<br />

of approved credit facilities and the ability to fully<br />

unbundle market positions. As a result of the dynamic<br />

nature of the underlying businesses, Management intends<br />

to maintain funding adjustability by keeping available<br />

approved lines of credit.<br />

59