2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

2008 Finansiële Jaar - overbergagri

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OVERBERG AGRI BEPERK EN SY FILIALE<br />

Aantekeninge tot die finansiële jaarstate (vervolg)<br />

VIR DIE JAAR GEËINDIG 29 FEBRUARIE <strong>2008</strong><br />

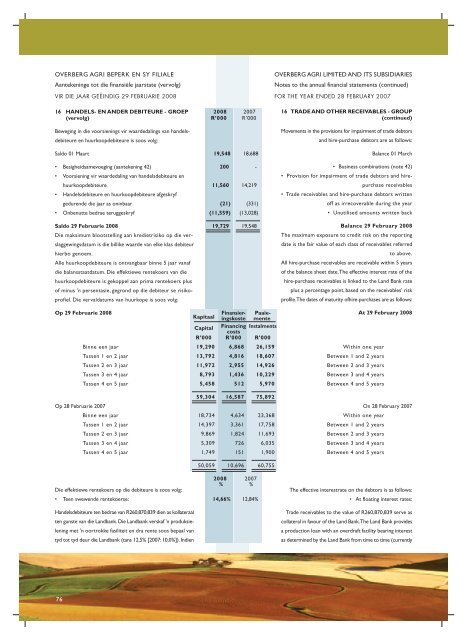

16 HANDELS- EN ANDER DEBITEURE - GROEP <strong>2008</strong> 2007<br />

(vervolg) R’000 R’000<br />

Beweging in die voorsienings vir waardedalings van handelsdebiteure<br />

en huurkoopdebiteure is soos volg:<br />

OVERBERG AGRI LIMITED AND ITS SUBSIDIARIES<br />

Notes to the annual financial statements (continued)<br />

FOR THE YEAR ENDED 28 FEBRUARY 2007<br />

16 TRADE AND OTHER RECEIVABLES - GROUP<br />

(continued)<br />

Movements in the provisions for impairment of trade debtors<br />

and hire-purchase debtors are as follows:<br />

Saldo 01 Maart 19,548 18,688 Balance 01 March<br />

• Besigheidsamevoeging (aantekening 42) 200 -<br />

• Voorsiening vir waardedaling van handelsdebiteure en<br />

huurkoopdebiteure 11,560 14,219<br />

• Handelsdebiteure en huurkoopdebiteure afgeskryf<br />

gedurende die jaar as oninbaar (21) (331)<br />

• Onbenutte bedrae teruggeskryf (11,559) (13,028)<br />

Saldo 29 Februarie <strong>2008</strong> 19,729 19,548<br />

Die maksimum blootstelling aan kredietrisiko op die verslaggewingsdatum<br />

is die billike waarde van elke klas debiteur<br />

hierbo genoem.<br />

Alle huurkoopdebiteure is ontvangbaar binne 5 jaar vanaf<br />

die balansstaatdatum. Die effektiewe rentekoers van die<br />

huurkoopdebiteure is gekoppel aan prima rentekoers plus<br />

of minus 'n persentasie, gegrond op die debiteur se risikoprofiel.<br />

Die vervaldatums van huurkope is soos volg:<br />

• Business combinations (note 42)<br />

• Provision for impairment of trade debtors and hirepurchase<br />

receivables<br />

• Trade receivables and hire-purchase debtors written<br />

off as irrecoverable during the year<br />

• Unutilised amounts written back<br />

Balance 29 February <strong>2008</strong><br />

The maximum exposure to credit risk on the reporting<br />

date is the fair value of each class of receivables referred<br />

to above.<br />

All hire-purchase receivables are receivable within 5 years<br />

of the balance sheet date. The effective interest rate of the<br />

hire-purchase receivables is linked to the Land Bank rate<br />

plus a percentage point, based on the receivables’ risk<br />

profile. The dates of maturity ofhire-purchases are as follows:<br />

Op 29 Februarie <strong>2008</strong><br />

Finansier- Paaieingskoste<br />

mente<br />

At 29 February <strong>2008</strong><br />

Kapitaal<br />

Capital Financing Instalments<br />

costs<br />

R’000 R’000 R’000<br />

Binne een jaar 19,290 6,868 26,159 Within one year<br />

Tussen 1 en 2 jaar 13,792 4,816 18,607 Between 1 and 2 years<br />

Tussen 2 en 3 jaar 11,972 2,955 14,926 Between 2 and 3 years<br />

Tussen 3 en 4 jaar 8,793 1,436 10,229 Between 3 and 4 years<br />

Tussen 4 en 5 jaar 5,458 512 5,970 Between 4 and 5 years<br />

59,304 16,587 75,892<br />

Op 28 Februarie 2007 On 28 February 2007<br />

Binne een jaar 18,734 4,634 23,368 Within one year<br />

Tussen 1 en 2 jaar 14,397 3,361 17,758 Between 1 and 2 years<br />

Tussen 2 en 3 jaar 9,869 1,824 11,693 Between 2 and 3 years<br />

Tussen 3 en 4 jaar 5,309 726 6,035 Between 3 and 4 years<br />

Tussen 4 en 5 jaar 1,749 151 1,900 Between 4 and 5 years<br />

50,059 10,696 60,755<br />

<strong>2008</strong> 2007<br />

% %<br />

Die effektiewe rentekoers op die debiteure is soos volg:<br />

• Teen swewende rentekoerse: 14,66% 12,84%<br />

Handelsdebiteure ten bedrae van R260,870,839 dien as kollateraal<br />

ten gunste van die Landbank. Die Landbank verskaf 'n produksielening<br />

met 'n oortrokke fasiliteit en dra rente soos bepaal van<br />

tyd tot tyd deur die Landbank (tans 12,5% [2007: 10,0%]). Indien<br />

The effective interestrate on the debtors is as follows:<br />

• At floating interest rates:<br />

Trade receivables to the value of R260,870,839 serve as<br />

collateral in favour of the Land Bank. The Land Bank provides<br />

a production loan with an overdraft facility bearing interest<br />

as determined by the Land Bank from time to time (currently<br />

76