Annual Report - Bega Cheese

Annual Report - Bega Cheese

Annual Report - Bega Cheese

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

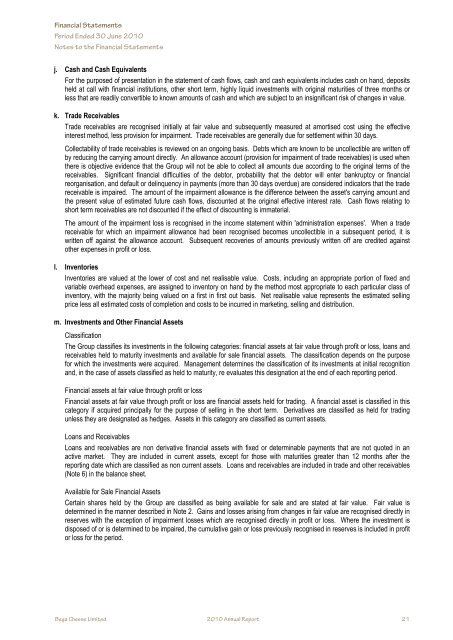

Financial Statements<br />

Financial Period Ended Statements 30 June 2010<br />

Period Notes to Ended the Financial 30 June 2010 Statements<br />

Notes to the Financial Statements<br />

j. Cash and Cash Equivalents<br />

For the purposed of presentation in the statement of cash flows, cash and cash equivalents includes cash on hand, deposits<br />

held at call with financial institutions, other short term, highly liquid investments with original maturities of three months or<br />

less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.<br />

k. Trade Receivables<br />

Trade receivables are recognised initially at fair value and subsequently measured at amortised cost using the effective<br />

interest method, less provision for impairment. Trade receivables are generally due for settlement within 30 days.<br />

Collectability of trade receivables is reviewed on an ongoing basis. Debts which are known to be uncollectible are written off<br />

by reducing the carrying amount directly. An allowance account (provision for impairment of trade receivables) is used when<br />

there is objective evidence that the Group will not be able to collect all amounts due according to the original terms of the<br />

receivables. Significant financial difficulties of the debtor, probability that the debtor will enter bankruptcy or financial<br />

reorganisation, and default or delinquency in payments (more than 30 days overdue) are considered indicators that the trade<br />

receivable is impaired. The amount of the impairment allowance is the difference between the asset's carrying amount and<br />

the present value of estimated future cash flows, discounted at the original effective interest rate. Cash flows relating to<br />

short term receivables are not discounted if the effect of discounting is immaterial.<br />

The amount of the impairment loss is recognised in the income statement within 'administration expenses'. When a trade<br />

receivable for which an impairment allowance had been recognised becomes uncollectible in a subsequent period, it is<br />

written off against the allowance account. Subsequent recoveries of amounts previously written off are credited against<br />

other expenses in profit or loss.<br />

l. Inventories<br />

Inventories are valued at the lower of cost and net realisable value. Costs, including an appropriate portion of fixed and<br />

variable overhead expenses, are assigned to inventory on hand by the method most appropriate to each particular class of<br />

inventory, with the majority being valued on a first in first out basis. Net realisable value represents the estimated selling<br />

price less all estimated costs of completion and costs to be incurred in marketing, selling and distribution.<br />

m. Investments and Other Financial Assets<br />

Classification<br />

The Group classifies its investments in the following categories: financial assets at fair value through profit or loss, loans and<br />

receivables held to maturity investments and available for sale financial assets. The classification depends on the purpose<br />

for which the investments were acquired. Management determines the classification of its investments at initial recognition<br />

and, in the case of assets classified as held to maturity, re evaluates this designation at the end of each reporting period.<br />

Financial assets at fair value through profit or loss<br />

Financial assets at fair value through profit or loss are financial assets held for trading. A financial asset is classified in this<br />

category if acquired principally for the purpose of selling in the short term. Derivatives are classified as held for trading<br />

unless they are designated as hedges. Assets in this category are classified as current assets.<br />

Loans and Receivables<br />

Loans and receivables are non derivative financial assets with fixed or determinable payments that are not quoted in an<br />

active market. They are included in current assets, except for those with maturities greater than 12 months after the<br />

reporting date which are classified as non current assets. Loans and receivables are included in trade and other receivables<br />

(Note 6) in the balance sheet.<br />

Available for Sale Financial Assets<br />

Certain shares held by the Group are classified as being available for sale and are stated at fair value. Fair value is<br />

determined in the manner described in Note 2. Gains and losses arising from changes in fair value are recognised directly in<br />

reserves with the exception of impairment losses which are recognised directly in profit or loss. Where the investment is<br />

disposed of or is determined to be impaired, the cumulative gain or loss previously recognised in reserves is included in profit<br />

or loss for the period.<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 21<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 21