Annual Report - Bega Cheese

Annual Report - Bega Cheese

Annual Report - Bega Cheese

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

Period Financial Ended Statements 30 June 2010<br />

Notes Period to Ended the Financial 30 June Statements<br />

2010<br />

Notes to the Financial Statements<br />

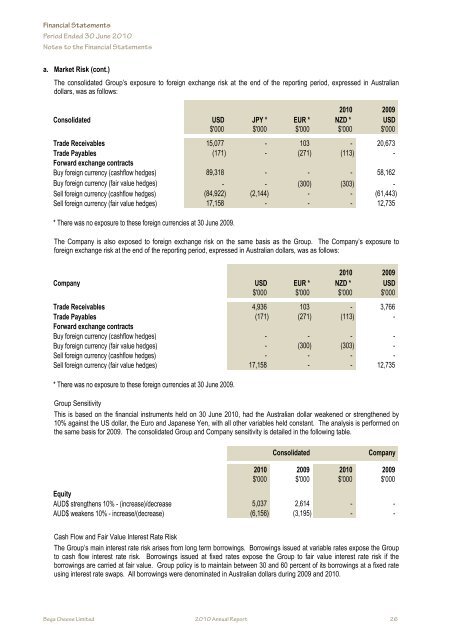

a. Market Risk (cont.)<br />

The consolidated Group’s exposure to foreign exchange risk at the end of the reporting period, expressed in Australian<br />

dollars, was as follows:<br />

2010 2009<br />

Consolidated USD JPY * EUR * NZD * USD<br />

$'000 $'000 $'000 $'000 $'000<br />

Trade Receivables 15,077 - 103 - 20,673<br />

Trade Payables (171) - (271) (113) -<br />

Forward exchange contracts<br />

Buy foreign currency (cashflow hedges) 89,318 - - - 58,162<br />

Buy foreign currency (fair value hedges) - - (300) (303) -<br />

Sell foreign currency (cashflow hedges) (84,922) (2,144) - - (61,443)<br />

Sell foreign currency (fair value hedges) 17,158 - - - 12,735<br />

* There was no exposure to these foreign currencies at 30 June 2009.<br />

The Company is also exposed to foreign exchange risk on the same basis as the Group. The Company’s exposure to<br />

foreign exchange risk at the end of the reporting period, expressed in Australian dollars, was as follows:<br />

2010 2009<br />

Company USD EUR * NZD * USD<br />

$'000 $'000 $'000 $'000<br />

Trade Receivables 4,936 103 - 3,766<br />

Trade Payables (171) (271) (113) -<br />

Forward exchange contracts<br />

Buy foreign currency (cashflow hedges) - - - -<br />

Buy foreign currency (fair value hedges) - (300) (303) -<br />

Sell foreign currency (cashflow hedges) - - - -<br />

Sell foreign currency (fair value hedges) 17,158 - - 12,735<br />

* There was no exposure to these foreign currencies at 30 June 2009.<br />

Group Sensitivity<br />

This is based on the financial instruments held on 30 June 2010, had the Australian dollar weakened or strengthened by<br />

10% against the US dollar, the Euro and Japanese Yen, with all other variables held constant. The analysis is performed on<br />

the same basis for 2009. The consolidated Group and Company sensitivity is detailed in the following table.<br />

Consolidated<br />

Company<br />

2010 2009 2010 2009<br />

$'000 $'000 $'000 $'000<br />

Equity<br />

AUD$ strengthens 10% - (increase)/decrease 5,037 2,614 - -<br />

AUD$ weakens 10% - increase/(decrease) (6,156) (3,195) - -<br />

Cash Flow and Fair Value Interest Rate Risk<br />

The Group’s main interest rate risk arises from long term borrowings. Borrowings issued at variable rates expose the Group<br />

to cash flow interest rate risk. Borrowings issued at fixed rates expose the Group to fair value interest rate risk if the<br />

borrowings are carried at fair value. Group policy is to maintain between 30 and 60 percent of its borrowings at a fixed rate<br />

using interest rate swaps. All borrowings were denominated in Australian dollars during 2009 and 2010.<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 26<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 26