Annual Report - Bega Cheese

Annual Report - Bega Cheese

Annual Report - Bega Cheese

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

Period Financial Ended Statements 30 June 2010<br />

Notes Period to Ended the Financial 30 June Statements<br />

2010<br />

Notes to the Financial Statements<br />

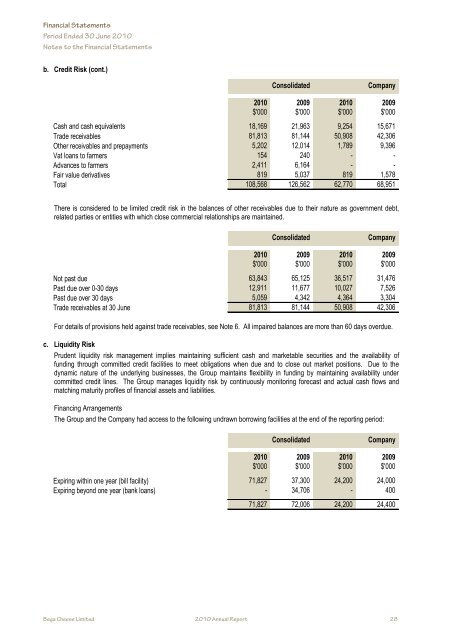

b. Credit Risk (cont.)<br />

Consolidated<br />

Company<br />

2010 2009 2010 2009<br />

$'000 $'000 $'000 $'000<br />

Cash and cash equivalents 18,169 21,963 9,254 15,671<br />

Trade receivables 81,813 81,144 50,908 42,306<br />

Other receivables and prepayments 5,202 12,014 1,789 9,396<br />

Vat loans to farmers 154 240 - -<br />

Advances to farmers 2,411 6,164 - -<br />

Fair value derivatives 819 5,037 819 1,578<br />

Total 108,568 126,562 62,770 68,951<br />

There is considered to be limited credit risk in the balances of other receivables due to their nature as government debt,<br />

related parties or entities with which close commercial relationships are maintained.<br />

Consolidated<br />

Company<br />

2010 2009 2010 2009<br />

$'000 $'000 $'000 $'000<br />

Not past due 63,843 65,125 36,517 31,476<br />

Past due over 0-30 days 12,911 11,677 10,027 7,526<br />

Past due over 30 days 5,059 4,342 4,364 3,304<br />

Trade receivables at 30 June 81,813 81,144 50,908 42,306<br />

For details of provisions held against trade receivables, see Note 6. All impaired balances are more than 60 days overdue.<br />

c. Liquidity Risk<br />

Prudent liquidity risk management implies maintaining sufficient cash and marketable securities and the availability of<br />

funding through committed credit facilities to meet obligations when due and to close out market positions. Due to the<br />

dynamic nature of the underlying businesses, the Group maintains flexibility in funding by maintaining availability under<br />

committed credit lines. The Group manages liquidity risk by continuously monitoring forecast and actual cash flows and<br />

matching maturity profiles of financial assets and liabilities.<br />

Financing Arrangements<br />

The Group and the Company had access to the following undrawn borrowing facilities at the end of the reporting period:<br />

Consolidated<br />

Company<br />

2010 2009 2010 2009<br />

$'000 $'000 $'000 $'000<br />

Expiring within one year (bill facility) 71,827 37,300 24,200 24,000<br />

Expiring beyond one year (bank loans) - 34,706 - 400<br />

71,827 72,006 24,200 24,400<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 28<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 28