Annual Report - Bega Cheese

Annual Report - Bega Cheese

Annual Report - Bega Cheese

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

Period Financial Ended Statements 30 June 2010<br />

Notes Period to Ended the Financial 30 June Statements<br />

2010<br />

Notes to the Financial Statements<br />

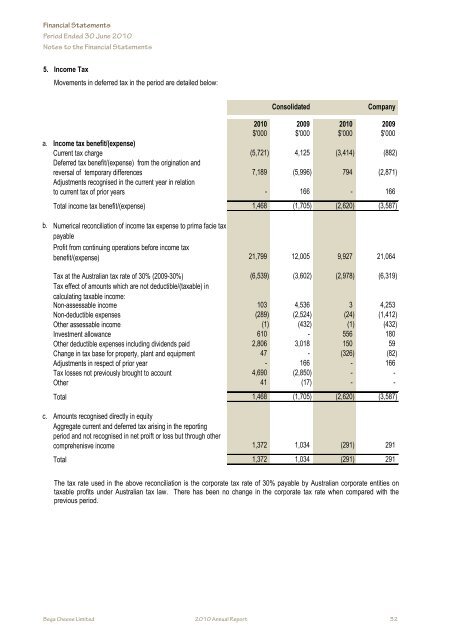

5. Income Tax<br />

Movements in deferred tax in the period are detailed below:<br />

Consolidated<br />

Company<br />

2010 2009 2010 2009<br />

$'000 $'000 $'000 $'000<br />

a. Income tax benefit/(expense)<br />

Current tax charge (5,721) 4,125 (3,414) (882)<br />

Deferred tax benefit/(expense) from the origination and<br />

reversal of temporary differences 7,189 (5,996) 794 (2,871)<br />

Adjustments recognised in the current year in relation<br />

to current tax of prior years - 166 - 166<br />

Total income tax benefit/(expense) 1,468 (1,705) (2,620) (3,587)<br />

b.<br />

Numerical reconciliation of income tax expense to prima facie tax<br />

payable<br />

Profit from continuing operations before income tax<br />

benefit/(expense)<br />

21,799 12,005 9,927 21,064<br />

Tax at the Australian tax rate of 30% (2009-30%) (6,539) (3,602) (2,978) (6,319)<br />

Tax effect of amounts which are not deductible/(taxable) in<br />

calculating taxable income:<br />

Non-assessable income 103 4,536 3 4,253<br />

Non-deductible expenses (289) (2,524) (24) (1,412)<br />

Other assessable income (1) (432) (1) (432)<br />

Investment allowance 610 - 556 180<br />

Other deductible expenses including dividends paid 2,806 3,018 150 59<br />

Change in tax base for property, plant and equipment 47 - (326) (82)<br />

Adjustments in respect of prior year - 166 - 166<br />

Tax losses not previously brought to account 4,690 (2,850) - -<br />

Other 41 (17) - -<br />

Total 1,468 (1,705) (2,620) (3,587)<br />

c. Amounts recognised directly in equity<br />

Aggregate current and deferred tax arising in the reporting<br />

period and not recognised in net proift or loss but through other<br />

comprehenisve income 1,372 1,034 (291) 291<br />

Total 1,372 1,034 (291) 291<br />

The tax rate used in the above reconciliation is the corporate tax rate of 30% payable by Australian corporate entities on<br />

taxable profits under Australian tax law. There has been no change in the corporate tax rate when compared with the<br />

previous period.<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 32<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 32