Annual Report - Bega Cheese

Annual Report - Bega Cheese

Annual Report - Bega Cheese

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

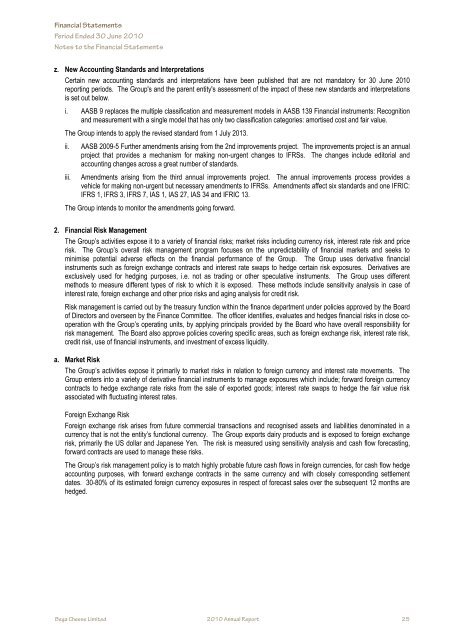

Financial Statements<br />

Financial Period Ended Statements 30 June 2010<br />

Period Notes to Ended the Financial 30 June 2010 Statements<br />

Notes to the Financial Statements<br />

z. New Accounting Standards and Interpretations<br />

Certain new accounting standards and interpretations have been published that are not mandatory for 30 June 2010<br />

reporting periods. The Group's and the parent entity's assessment of the impact of these new standards and interpretations<br />

is set out below.<br />

i. AASB 9 replaces the multiple classification and measurement models in AASB 139 Financial instruments: Recognition<br />

and measurement with a single model that has only two classification categories: amortised cost and fair value.<br />

The Group intends to apply the revised standard from 1 July 2013.<br />

ii. AASB 2009-5 Further amendments arising from the 2nd improvements project. The improvements project is an annual<br />

project that provides a mechanism for making non-urgent changes to IFRSs. The changes include editorial and<br />

accounting changes across a great number of standards.<br />

iii. Amendments arising from the third annual improvements project. The annual improvements process provides a<br />

vehicle for making non-urgent but necessary amendments to IFRSs. Amendments affect six standards and one IFRIC:<br />

IFRS 1, IFRS 3, IFRS 7, IAS 1, IAS 27, IAS 34 and IFRIC 13.<br />

The Group intends to monitor the amendments going forward.<br />

2. Financial Risk Management<br />

The Group’s activities expose it to a variety of financial risks; market risks including currency risk, interest rate risk and price<br />

risk. The Group’s overall risk management program focuses on the unpredictability of financial markets and seeks to<br />

minimise potential adverse effects on the financial performance of the Group. The Group uses derivative financial<br />

instruments such as foreign exchange contracts and interest rate swaps to hedge certain risk exposures. Derivatives are<br />

exclusively used for hedging purposes, i.e. not as trading or other speculative instruments. The Group uses different<br />

methods to measure different types of risk to which it is exposed. These methods include sensitivity analysis in case of<br />

interest rate, foreign exchange and other price risks and aging analysis for credit risk.<br />

Risk management is carried out by the treasury function within the finance department under policies approved by the Board<br />

of Directors and overseen by the Finance Committee. The officer identifies, evaluates and hedges financial risks in close cooperation<br />

with the Group’s operating units, by applying principals provided by the Board who have overall responsibility for<br />

risk management. The Board also approve policies covering specific areas, such as foreign exchange risk, interest rate risk,<br />

credit risk, use of financial instruments, and investment of excess liquidity.<br />

a. Market Risk<br />

The Group’s activities expose it primarily to market risks in relation to foreign currency and interest rate movements. The<br />

Group enters into a variety of derivative financial instruments to manage exposures which include; forward foreign currency<br />

contracts to hedge exchange rate risks from the sale of exported goods; interest rate swaps to hedge the fair value risk<br />

associated with fluctuating interest rates.<br />

Foreign Exchange Risk<br />

Foreign exchange risk arises from future commercial transactions and recognised assets and liabilities denominated in a<br />

currency that is not the entity’s functional currency. The Group exports dairy products and is exposed to foreign exchange<br />

risk, primarily the US dollar and Japanese Yen. The risk is measured using sensitivity analysis and cash flow forecasting,<br />

forward contracts are used to manage these risks.<br />

The Group’s risk management policy is to match highly probable future cash flows in foreign currencies, for cash flow hedge<br />

accounting purposes, with forward exchange contracts in the same currency and with closely corresponding settlement<br />

dates. 30-80% of its estimated foreign currency exposures in respect of forecast sales over the subsequent 12 months are<br />

hedged.<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 25<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 25