Annual Report - Bega Cheese

Annual Report - Bega Cheese

Annual Report - Bega Cheese

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statements<br />

Period Financial Ended Statements 30 June 2010<br />

Notes Period to Ended the Financial 30 June Statements<br />

2010<br />

Notes to the Financial Statements<br />

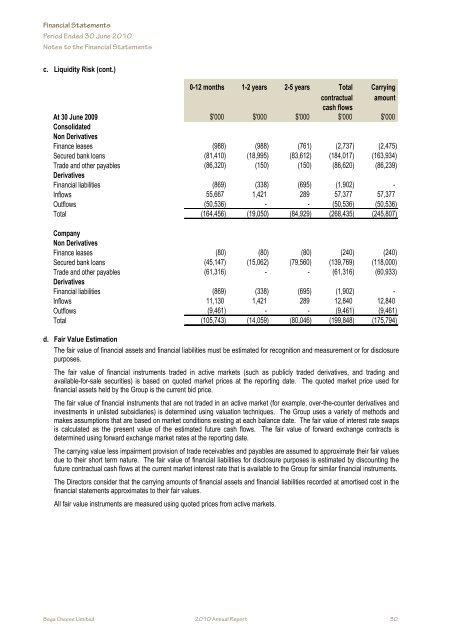

c. Liquidity Risk (cont.)<br />

0-12 months 1-2 years 2-5 years Total Carrying<br />

contractual amount<br />

cash flows<br />

At 30 June 2009 $'000 $'000 $'000 $'000 $'000<br />

Consolidated<br />

Non Derivatives<br />

Finance leases (988) (988) (761) (2,737) (2,475)<br />

Secured bank loans (81,410) (18,995) (83,612) (184,017) (163,934)<br />

Trade and other payables (86,320) (150) (150) (86,620) (86,239)<br />

Derivatives<br />

Financial liabilities (869) (338) (695) (1,902) -<br />

Inflows 55,667 1,421 289 57,377 57,377<br />

Outflows (50,536) - - (50,536) (50,536)<br />

Total (164,456) (19,050) (84,929) (268,435) (245,807)<br />

Company<br />

Non Derivatives<br />

Finance leases (80) (80) (80) (240) (240)<br />

Secured bank loans (45,147) (15,062) (79,560) (139,769) (118,000)<br />

Trade and other payables (61,316) - - (61,316) (60,933)<br />

Derivatives<br />

Financial liabilities (869) (338) (695) (1,902) -<br />

Inflows 11,130 1,421 289 12,840 12,840<br />

Outflows (9,461) - - (9,461) (9,461)<br />

Total (105,743) (14,059) (80,046) (199,848) (175,794)<br />

d. Fair Value Estimation<br />

The fair value of financial assets and financial liabilities must be estimated for recognition and measurement or for disclosure<br />

purposes.<br />

The fair value of financial instruments traded in active markets (such as publicly traded derivatives, and trading and<br />

available-for-sale securities) is based on quoted market prices at the reporting date. The quoted market price used for<br />

financial assets held by the Group is the current bid price.<br />

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives and<br />

investments in unlisted subsidiaries) is determined using valuation techniques. The Group uses a variety of methods and<br />

makes assumptions that are based on market conditions existing at each balance date. The fair value of interest rate swaps<br />

is calculated as the present value of the estimated future cash flows. The fair value of forward exchange contracts is<br />

determined using forward exchange market rates at the reporting date.<br />

The carrying value less impairment provision of trade receivables and payables are assumed to approximate their fair values<br />

due to their short term nature. The fair value of financial liabilities for disclosure purposes is estimated by discounting the<br />

future contractual cash flows at the current market interest rate that is available to the Group for similar financial instruments.<br />

The Directors consider that the carrying amounts of financial assets and financial liabilities recorded at amortised cost in the<br />

financial statements approximates to their fair values.<br />

All fair value instruments are measured using quoted prices from active markets.<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 30<br />

<strong>Bega</strong> <strong>Cheese</strong> Limited 2010 <strong>Annual</strong> <strong>Report</strong> 30