ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE<br />

FINANCIAL STATEMENTS (CONT’D)<br />

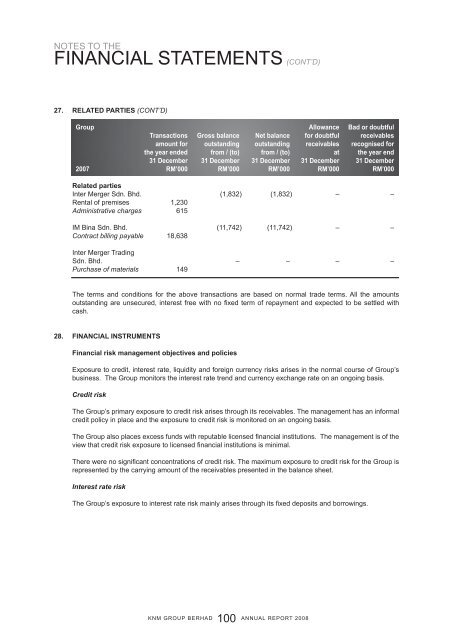

27. Related parties (cont’d)<br />

Group Allowance Bad or doubtful<br />

Transactions Gross balance Net balance for doubtful receivables<br />

amount for outstanding outstanding receivables recognised for<br />

the year ended from / (to) from / (to) at the year end<br />

31 December 31 December 31 December 31 December 31 December<br />

2007 RM’000 RM’000 RM’000 RM’000 RM’000<br />

Related parties<br />

Inter Merger <strong>Sdn</strong>. <strong>Bhd</strong>. (1,832) (1,832) – –<br />

Rental of premises 1,230<br />

Administrative charges 615<br />

IM Bina <strong>Sdn</strong>. <strong>Bhd</strong>. (11,742) (11,742) – –<br />

Contract billing payable 18,638<br />

Inter Merger Trading<br />

<strong>Sdn</strong>. <strong>Bhd</strong>. – – – –<br />

Purchase of materials 149<br />

The terms and conditions for the above transactions are based on normal trade terms. All the amounts<br />

outstanding are unsecured, interest free with no fixed term of repayment and expected to be settled with<br />

cash.<br />

28. Financial instruments<br />

Financial risk management objectives and policies<br />

Exposure to credit, interest rate, liquidity and foreign currency risks arises in the normal course of Group’s<br />

business. The Group monitors the interest rate trend and currency exchange rate on an ongoing basis.<br />

Credit risk<br />

The Group’s primary exposure to credit risk arises through its receivables. The management has an informal<br />

credit policy in place and the exposure to credit risk is monitored on an ongoing basis.<br />

The Group also places excess funds with reputable licensed financial institutions. The management is of the<br />

view that credit risk exposure to licensed financial institutions is minimal.<br />

There were no significant concentrations of credit risk. The maximum exposure to credit risk for the Group is<br />

represented by the carrying amount of the receivables presented in the balance sheet.<br />

Interest rate risk<br />

The Group’s exposure to interest rate risk mainly arises through its fixed deposits and borrowings.<br />

<strong>KNM</strong> GROUP BERHAD<br />

100<br />

<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2008</strong>