ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE<br />

FINANCIAL STATEMENTS (CONT’D)<br />

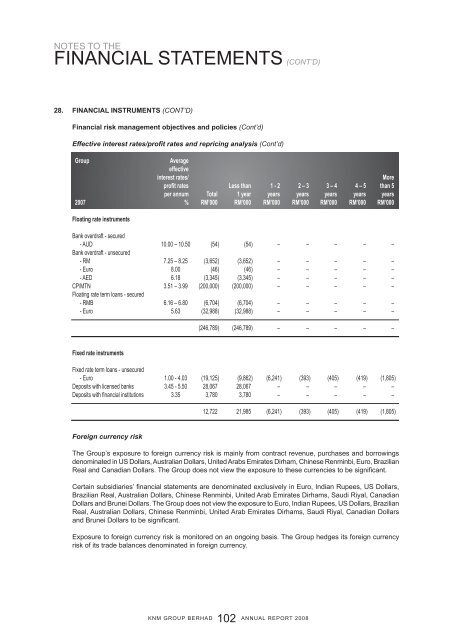

28. Financial instruments (cont’d)<br />

Financial risk management objectives and policies (Cont’d)<br />

Effective interest rates/profit rates and repricing analysis (Cont’d)<br />

Group<br />

Average<br />

effective<br />

interest rates/<br />

More<br />

profit rates Less than 1 - 2 2 – 3 3 – 4 4 – 5 than 5<br />

per annum Total 1 year years years years years years<br />

2007 % RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000<br />

Floating rate instruments<br />

Bank overdraft - secured<br />

- AUD 10.00 – 10.50 (54) (54) – – – – –<br />

Bank overdraft - unsecured<br />

- RM 7.25 – 8.25 (3,652) (3,652) – – – – –<br />

- Euro 8.00 (46) (46) – – – – –<br />

- AED 6.18 (3,345) (3,345) – – – – –<br />

CP/MTN 3.51 – 3.99 (200,000) (200,000) – – – – –<br />

Floating rate term loans - secured<br />

- RMB 6.16 – 6.80 (6,704) (6,704) – – – – –<br />

- Euro 5.63 (32,988) (32,988) – – – – –<br />

(246,789) (246,789) – – – – –<br />

Fixed rate instruments<br />

Fixed rate term loans - unsecured<br />

- Euro 1.00 - 4.03 (19,125) (9,862) (6,241) (393) (405) (419) (1,805)<br />

Deposits with licensed banks 3.45 - 5.50 28,067 28,067 – – – – –<br />

Deposits with financial institutions 3.35 3,780 3,780 – – – – –<br />

12,722 21,985 (6,241) (393) (405) (419) (1,805)<br />

Foreign currency risk<br />

The Group’s exposure to foreign currency risk is mainly from contract revenue, purchases and borrowings<br />

denominated in US Dollars, Australian Dollars, United Arabs Emirates Dirham, Chinese Renminbi, Euro, Brazilian<br />

Real and Canadian Dollars. The Group does not view the exposure to these currencies to be significant.<br />

Certain subsidiaries’ financial statements are denominated exclusively in Euro, Indian Rupees, US Dollars,<br />

Brazilian Real, Australian Dollars, Chinese Renminbi, United Arab Emirates Dirhams, Saudi Riyal, Canadian<br />

Dollars and Brunei Dollars. The Group does not view the exposure to Euro, Indian Rupees, US Dollars, Brazilian<br />

Real, Australian Dollars, Chinese Renminbi, United Arab Emirates Dirhams, Saudi Riyal, Canadian Dollars<br />

and Brunei Dollars to be significant.<br />

Exposure to foreign currency risk is monitored on an ongoing basis. The Group hedges its foreign currency<br />

risk of its trade balances denominated in foreign currency.<br />

<strong>KNM</strong> GROUP BERHAD<br />

102<br />

<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2008</strong>