ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE<br />

FINANCIAL STATEMENTS (CONT’D)<br />

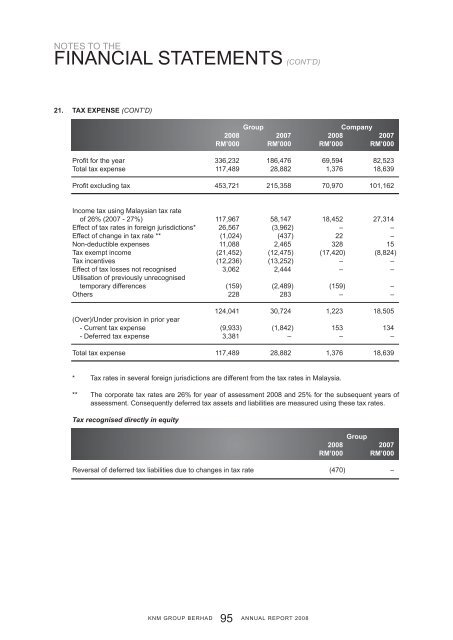

21. Tax expense (cont’d)<br />

Group<br />

Company<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007<br />

RM’000 RM’000 RM’000 RM’000<br />

Profit for the year 336,232 186,476 69,594 82,523<br />

Total tax expense 117,489 28,882 1,376 18,639<br />

Profit excluding tax 453,721 215,358 70,970 101,162<br />

Income tax using Malaysian tax rate<br />

of 26% (2007 - 27%) 117,967 58,147 18,452 27,314<br />

Effect of tax rates in foreign jurisdictions* 26,567 (3,962) – –<br />

Effect of change in tax rate ** (1,024) (437) 22 –<br />

Non-deductible expenses 11,088 2,465 328 15<br />

Tax exempt income (21,452) (12,475) (17,420) (8,824)<br />

Tax incentives (12,236) (13,252) – –<br />

Effect of tax losses not recognised 3,062 2,444 – –<br />

Utilisation of previously unrecognised<br />

temporary differences (159) (2,489) (159) –<br />

Others 228 283 – –<br />

124,041 30,724 1,223 18,505<br />

(Over)/Under provision in prior year<br />

- Current tax expense (9,933) (1,842) 153 134<br />

- Deferred tax expense 3,381 – – –<br />

Total tax expense 117,489 28,882 1,376 18,639<br />

* Tax rates in several foreign jurisdictions are different from the tax rates in Malaysia.<br />

** The corporate tax rates are 26% for year of assessment <strong>2008</strong> and 25% for the subsequent years of<br />

assessment. Consequently deferred tax assets and liabilities are measured using these tax rates.<br />

Tax recognised directly in equity<br />

Group<br />

<strong>2008</strong> 2007<br />

RM’000 RM’000<br />

Reversal of deferred tax liabilities due to changes in tax rate (470) –<br />

<strong>KNM</strong> GROUP BERHAD<br />

95<br />

<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2008</strong>