ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

ANNUAL REPORT 2008 - KNM Steel Sdn Bhd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CORPORATE GOVERNANCE<br />

STATEMENT (CONT’D)<br />

ADDITIONAL COMPLIANCE INFORMATION<br />

The following additional information is provided in compliance with the Listing Requirements:-<br />

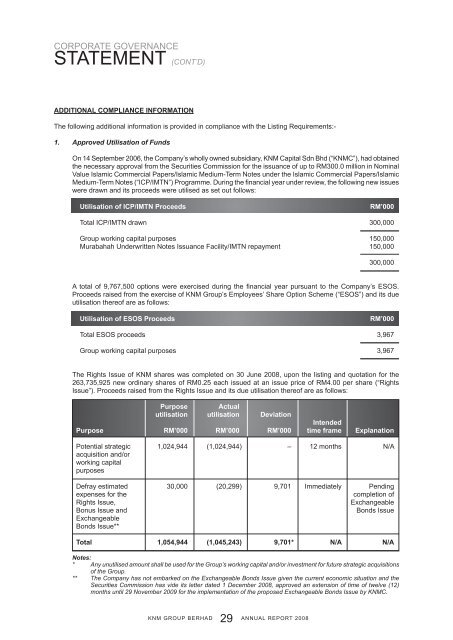

1. Approved Utilisation of Funds<br />

On 14 September 2006, the Company’s wholly owned subsidiary, <strong>KNM</strong> Capital <strong>Sdn</strong> <strong>Bhd</strong> (“<strong>KNM</strong>C”), had obtained<br />

the necessary approval from the Securities Commission for the issuance of up to RM300.0 million in Nominal<br />

Value Islamic Commercial Papers/Islamic Medium-Term Notes under the Islamic Commercial Papers/Islamic<br />

Medium-Term Notes (“ICP/IMTN”) Programme. During the financial year under review, the following new issues<br />

were drawn and its proceeds were utilised as set out follows:<br />

Utilisation of ICP/IMTN Proceeds<br />

RM’000<br />

Total ICP/IMTN drawn 300,000<br />

Group working capital purposes 150,000<br />

Murabahah Underwritten Notes Issuance Facility/IMTN repayment 150,000<br />

300,000<br />

A total of 9,767,500 options were exercised during the financial year pursuant to the Company’s ESOS.<br />

Proceeds raised from the exercise of <strong>KNM</strong> Group’s Employees’ Share Option Scheme (“ESOS”) and its due<br />

utilisation thereof are as follows:<br />

Utilisation of ESOS Proceeds<br />

RM’000<br />

Total ESOS proceeds 3,967<br />

Group working capital purposes 3,967<br />

The Rights Issue of <strong>KNM</strong> shares was completed on 30 June <strong>2008</strong>, upon the listing and quotation for the<br />

263,735,925 new ordinary shares of RM0.25 each issued at an issue price of RM4.00 per share (“Rights<br />

Issue”). Proceeds raised from the Rights Issue and its due utilisation thereof are as follows:<br />

Purpose Actual<br />

utilisation utilisation Deviation<br />

Intended<br />

Purpose RM’000 RM’000 RM’000 time frame Explanation<br />

Potential strategic 1,024,944 (1,024,944) – 12 months N/A<br />

acquisition and/or<br />

working capital<br />

purposes<br />

Defray estimated 30,000 (20,299) 9,701 Immediately Pending<br />

expenses for the<br />

completion of<br />

Rights Issue,<br />

Exchangeable<br />

Bonus Issue and<br />

Bonds Issue<br />

Exchangeable<br />

Bonds Issue**<br />

Total 1,054,944 (1,045,243) 9,701* N/A N/A<br />

Notes:<br />

* Any unutilised amount shall be used for the Group’s working capital and/or investment for future strategic acquisitions<br />

of the Group.<br />

** The Company has not embarked on the Exchangeable Bonds Issue given the current economic situation and the<br />

Securities Commission has vide its letter dated 1 December <strong>2008</strong>, approved an extension of time of twelve (12)<br />

months until 29 November 2009 for the implementation of the proposed Exchangeable Bonds Issue by <strong>KNM</strong>C.<br />

<strong>KNM</strong> GROUP BERHAD<br />

29<br />

<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2008</strong>