2013-2017_-_Private_Sector_Development_Strategy

2013-2017_-_Private_Sector_Development_Strategy

2013-2017_-_Private_Sector_Development_Strategy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Africa’s rapid population growth also places enormous<br />

strains on existing, and often outdated and poorly<br />

maintained economic and social infrastructure. In fact,<br />

in many countries, infrastructure limitations constrain<br />

productivity at least as much other institutional<br />

challenges as weak governance, complex regulation,<br />

and lack of access to financial services. This is especially<br />

true in the power and logistics industries as well as<br />

physical infrastructure for the delivery of healthcare and<br />

basic education.<br />

In addition to the lack of physical connection between<br />

countries, there is also very limited integration of regional<br />

markets for infrastructure services, particularly, in power,<br />

energy, telecommunications, transport, water and<br />

sanitation. This is in part due to weak regional economic<br />

communities that are not structured to make necessary<br />

regional investments. More significantly, governments<br />

have also not worked enough with the private sector and<br />

others to develop and upgrade regional infrastructure<br />

(particularly in communications and transport); improve<br />

policies for industries that fit the productive capabilities<br />

of countries in Africa (for example, in agriculture and food<br />

security); and fully implement protocols of the Regional<br />

Economic Communities that governments have signed.<br />

In addition, significant obstacles remain to the<br />

mobilization of private financing and investment in<br />

infrastructure.<br />

The costs of overhauling Africa’s infrastructure needs<br />

are estimated at about US$100 billion a year over the<br />

next decade. 17 Two-thirds of that is required for entirely<br />

new infrastructure, and the rest for the maintenance of<br />

existing infrastructure. Only about US$25 billion a year<br />

is currently being spent on capital expenditure, leaving<br />

a substantial shortfall. New and innovative financing will<br />

be needed to address this gap. 18<br />

Going Forward – Operational Priorities<br />

Support to Africa’s infrastructure – the essence of this pillar<br />

– is at the core of the Bank’s work and is an area where it<br />

has a comparative advantage. The Bank Group’s <strong>Strategy</strong><br />

<strong>2013</strong>-2022 envisages scaling up infrastructure investments<br />

substantially via both its sovereign and non-sovereign<br />

windows, and particularly in the areas of transport, energy,<br />

water and sanitation, all of which have been identified by<br />

African companies and governments as posing the biggest<br />

challenges for the continent’s transformation.<br />

Under this pillar, the Bank will support RMCs mainly in<br />

their infrastructure development priorities as expressed<br />

in their long-term development strategies and, at the<br />

regional level, as expressed in the African Union/New<br />

Partnership for Africa (NEPAD) Program for Infrastructure<br />

<strong>Development</strong> in Africa (PIDA). Bank interventions will help<br />

RMCs increase their productivity and competitiveness,<br />

deepen physical, economic and social integration, and<br />

create greater opportunities for promoting inclusion and<br />

contributing to sustainable economic transformation.<br />

Specifically, it will:<br />

• Support new infrastructure or rehabilitation<br />

initiatives aimed primarily at improving long-term<br />

and comprehensive reforms and investments across<br />

transport and logistics chains, reducing travel time<br />

17 World Bank. 2005. The African Infrastructure Country Diagnostic. World Bank.<br />

Washington DC.<br />

18 African <strong>Development</strong> Bank 2011, ‘Closing Africa’s Infra-structure Gap: Innovative<br />

Financing and Risk’, AfDB Economic Brief.<br />

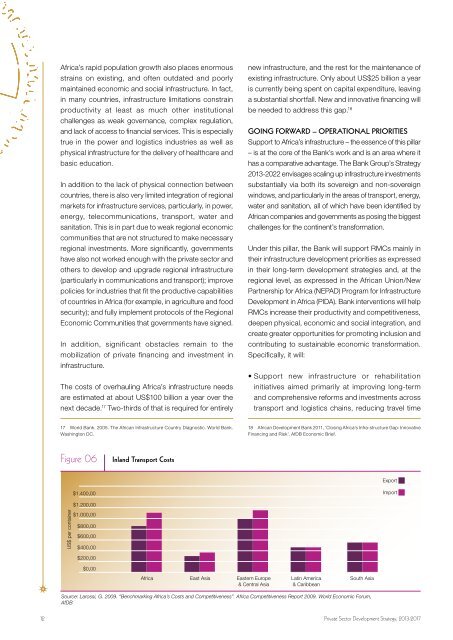

Figure 06<br />

Inland Transport Costs<br />

Export<br />

$1.400,00<br />

Import<br />

$1.200,00<br />

US$ per container<br />

$1.000,00<br />

$800,00<br />

$600,00<br />

$400,00<br />

$200,00<br />

$0,00<br />

Africa East Asia Eastern Europe<br />

& Central Asia<br />

Latin America<br />

& Caribbean<br />

South Asia<br />

Source: Larossi, G. 2009. “Benchmarking Africa’s Costs and Competitiveness”. Africa Competitiveness Report 2009. World Economic Forum,<br />

AfDB<br />

12 <strong>Private</strong> <strong>Sector</strong> <strong>Development</strong> <strong>Strategy</strong>, <strong>2013</strong>-<strong>2017</strong>