2013-2017_-_Private_Sector_Development_Strategy

2013-2017_-_Private_Sector_Development_Strategy

2013-2017_-_Private_Sector_Development_Strategy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

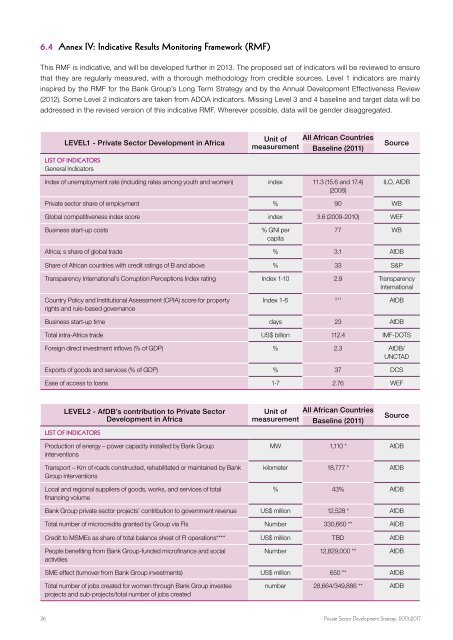

6.4 Annex IV: Indicative Results Monitoring Framework (RMF)<br />

This RMF is indicative, and will be developed further in <strong>2013</strong>. The proposed set of indicators will be reviewed to ensure<br />

that they are regularly measured, with a thorough methodology from credible sources. Level 1 indicators are mainly<br />

inspired by the RMF for the Bank Group’s Long Term <strong>Strategy</strong> and by the Annual <strong>Development</strong> Effectiveness Review<br />

(2012). Some Level 2 indicators are taken from ADOA indicators. Missing Level 3 and 4 baseline and target data will be<br />

addressed in the revised version of this indicative RMF. Wherever possible, data will be gender disaggregated.<br />

LEVEL1 - <strong>Private</strong> <strong>Sector</strong> <strong>Development</strong> in Africa<br />

List of indicators<br />

General Indicators<br />

Unit of<br />

measurement<br />

All African Countries<br />

Baseline (2011)<br />

Source<br />

Index of unemployment rate (including rates among youth and women) index 11.3 (15.6 and 17.4)<br />

(2008)<br />

ILO, AfDB<br />

<strong>Private</strong> sector share of employment % 90 WB<br />

Global competitiveness index score index 3.6 (2009-2010) WEF<br />

Business start-up costs<br />

% GNI per<br />

capita<br />

77 WB<br />

Africa; s share of global trade % 3.1 AfDB<br />

Share of African countries with credit ratings of B and above % 33 S&P<br />

Transparency International’s Corruption Perceptions Index rating Index 1-10 2.9 Transparency<br />

International<br />

Country Policy and Institutional Assessment (CPIA) score for property<br />

rights and rule-based governance<br />

Index 1-6<br />

3.11<br />

AfDB<br />

Business start-up time days 23 AfDB<br />

Total intra-Africa trade US$ billion 112.4 IMF-DOTS<br />

Foreign direct investment inflows (% of GDP) % 2.3 AfDB/<br />

UNCTAD<br />

Exports of goods and services (% of GDP) % 37 DCS<br />

Ease of access to loans 1-7 2.76 WEF<br />

LEVEL2 - AfDB’s contribution to <strong>Private</strong> <strong>Sector</strong><br />

<strong>Development</strong> in Africa<br />

List of indicators<br />

Unit of<br />

measurement<br />

All African Countries<br />

Baseline (2011)<br />

Source<br />

Production of energy – power capacity installed by Bank Group<br />

interventions<br />

Transport – Km of roads constructed, rehabilitated or maintained by Bank<br />

Group interventions<br />

Local and regional suppliers of goods, works, and services of total<br />

financing volume<br />

MW 1,110 * AfDB<br />

kilometer 18,777 * AfDB<br />

% 43% AfDB<br />

Bank Group private sector projects’ contribution to government revenue US$ million 12,528 * AfDB<br />

Total number of microcredits granted by Group via FIs Number 330,660 ** AfDB<br />

Credit to MSMEs as share of total balance sheet of FI operations**** US$ million TBD AfDB<br />

People benefiting from Bank Group-funded microfinance and social<br />

activities<br />

Number 12,829,000 ** AfDB<br />

SME effect (turnover from Bank Group investments) US$ million 650 ** AfDB<br />

Total number of jobs created for women through Bank Group investee<br />

projects and sub-projects/total number of jobs created<br />

number 28,664/349,886 ** AfDB<br />

36 <strong>Private</strong> <strong>Sector</strong> <strong>Development</strong> <strong>Strategy</strong>, <strong>2013</strong>-<strong>2017</strong>