2013-2017_-_Private_Sector_Development_Strategy

2013-2017_-_Private_Sector_Development_Strategy

2013-2017_-_Private_Sector_Development_Strategy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

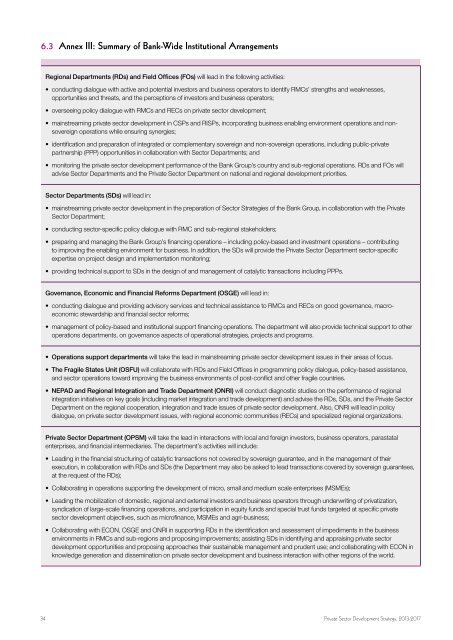

6.3 Annex III: Summary of Bank-Wide Institutional Arrangements<br />

Regional Departments (RDs) and Field Offices (FOs) will lead in the following activities:<br />

• conducting dialogue with active and potential investors and business operators to identify RMCs’ strengths and weaknesses,<br />

opportunities and threats, and the perceptions of investors and business operators;<br />

• overseeing policy dialogue with RMCs and RECs on private sector development;<br />

• mainstreaming private sector development in CSPs and RISPs, incorporating business enabling environment operations and nonsovereign<br />

operations while ensuring synergies;<br />

• identification and preparation of integrated or complementary sovereign and non-sovereign operations, including public-private<br />

partnership (PPP) opportunities in collaboration with <strong>Sector</strong> Departments; and<br />

• monitoring the private sector development performance of the Bank Group’s country and sub-regional operations. RDs and FOs will<br />

advise <strong>Sector</strong> Departments and the <strong>Private</strong> <strong>Sector</strong> Department on national and regional development priorities.<br />

<strong>Sector</strong> Departments (SDs) will lead in:<br />

• mainstreaming private sector development in the preparation of <strong>Sector</strong> Strategies of the Bank Group, in collaboration with the <strong>Private</strong><br />

<strong>Sector</strong> Department;<br />

• conducting sector-specific policy dialogue with RMC and sub-regional stakeholders;<br />

• preparing and managing the Bank Group’s financing operations – including policy-based and investment operations – contributing<br />

to improving the enabling environment for business. In addition, the SDs will provide the <strong>Private</strong> <strong>Sector</strong> Department sector-specific<br />

expertise on project design and implementation monitoring;<br />

• providing technical support to SDs in the design of and management of catalytic transactions including PPPs.<br />

Governance, Economic and Financial Reforms Department (OSGE) will lead in:<br />

• conducting dialogue and providing advisory services and technical assistance to RMCs and RECs on good governance, macroeconomic<br />

stewardship and financial sector reforms;<br />

• management of policy-based and institutional support financing operations. The department will also provide technical support to other<br />

operations departments, on governance aspects of operational strategies, projects and programs.<br />

• Operations support departments will take the lead in mainstreaming private sector development issues in their areas of focus.<br />

• The Fragile States Unit (OSFU) will collaborate with RDs and Field Offices in programming policy dialogue, policy-based assistance,<br />

and sector operations toward improving the business environments of post-conflict and other fragile countries.<br />

• NEPAD and Regional Integration and Trade Department (ONRI) will conduct diagnostic studies on the performance of regional<br />

integration initiatives on key goals (including market integration and trade development) and advise the RDs, SDs, and the <strong>Private</strong> <strong>Sector</strong><br />

Department on the regional cooperation, integration and trade issues of private sector development. Also, ONRI will lead in policy<br />

dialogue, on private sector development issues, with regional economic communities (RECs) and specialized regional organizations.<br />

<strong>Private</strong> <strong>Sector</strong> Department (OPSM) will take the lead in interactions with local and foreign investors, business operators, parastatal<br />

enterprises, and financial intermediaries. The department’s activities will include:<br />

• Leading in the financial structuring of catalytic transactions not covered by sovereign guarantee, and in the management of their<br />

execution, in collaboration with RDs and SDs (the Department may also be asked to lead transactions covered by sovereign guarantees,<br />

at the request of the RDs);<br />

• Collaborating in operations supporting the development of micro, small and medium scale enterprises (MSMEs);<br />

• Leading the mobilization of domestic, regional and external investors and business operators through underwriting of privatization,<br />

syndication of large-scale financing operations, and participation in equity funds and special trust funds targeted at specific private<br />

sector development objectives, such as microfinance, MSMEs and agri-business;<br />

• Collaborating with ECON, OSGE and ONRI in supporting RDs in the identification and assessment of impediments in the business<br />

environments in RMCs and sub-regions and proposing improvements; assisting SDs in identifying and appraising private sector<br />

development opportunities and proposing approaches their sustainable management and prudent use; and collaborating with ECON in<br />

knowledge generation and dissemination on private sector development and business interaction with other regions of the world.<br />

34 <strong>Private</strong> <strong>Sector</strong> <strong>Development</strong> <strong>Strategy</strong>, <strong>2013</strong>-<strong>2017</strong>