7 Claims and Payment - Premera Blue Cross

7 Claims and Payment - Premera Blue Cross

7 Claims and Payment - Premera Blue Cross

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

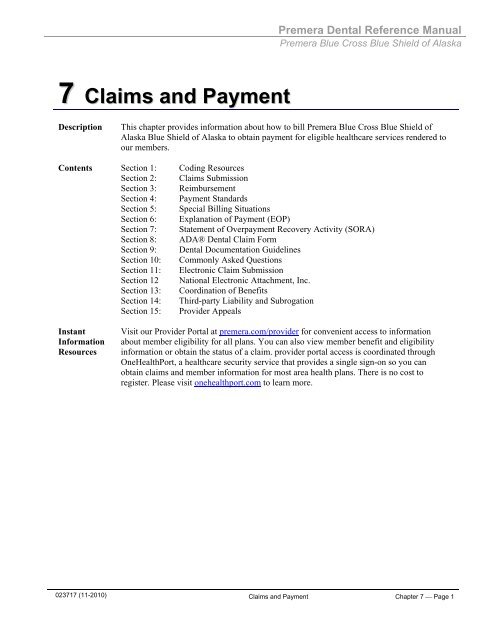

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

7 <strong>Claims</strong> <strong>and</strong> <strong>Payment</strong><br />

Description<br />

This chapter provides information about how to bill <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of<br />

Alaska <strong>Blue</strong> Shield of Alaska to obtain payment for eligible healthcare services rendered to<br />

our members.<br />

Contents Section 1: Coding Resources<br />

Section 2: <strong>Claims</strong> Submission<br />

Section 3: Reimbursement<br />

Section 4: <strong>Payment</strong> St<strong>and</strong>ards<br />

Section 5: Special Billing Situations<br />

Section 6: Explanation of <strong>Payment</strong> (EOP)<br />

Section 7: Statement of Overpayment Recovery Activity (SORA)<br />

Section 8: ADA® Dental Claim Form<br />

Section 9: Dental Documentation Guidelines<br />

Section 10: Commonly Asked Questions<br />

Section 11: Electronic Claim Submission<br />

Section 12 National Electronic Attachment, Inc.<br />

Section 13: Coordination of Benefits<br />

Section 14: Third-party Liability <strong>and</strong> Subrogation<br />

Section 15: Provider Appeals<br />

Instant<br />

Information<br />

Resources<br />

Visit our Provider Portal at premera.com/provider for convenient access to information<br />

about member eligibility for all plans. You can also view member benefit <strong>and</strong> eligibility<br />

information or obtain the status of a claim. provider portal access is coordinated through<br />

OneHealthPort, a healthcare security service that provides a single sign-on so you can<br />

obtain claims <strong>and</strong> member information for most area health plans. There is no cost to<br />

register. Please visit onehealthport.com to learn more.<br />

023717 (11-2010) <strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 1

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 1: Coding Resources<br />

Coding<br />

Types <strong>and</strong><br />

Sources<br />

Current Dental Terminology (CDT) is a reference manual published every two years by the<br />

American Dental Association (ADA®). The CDT provides a listing of dental procedure<br />

codes, nomenclature <strong>and</strong> descriptors to help identify <strong>and</strong> report dental treatment performed by<br />

dentists. The CDT provides current <strong>and</strong> uniform dental terminology that provides an effective<br />

means for accurate nationwide communication among dentists, patients <strong>and</strong> third parties.<br />

You can order a CDT book by calling 800-947-4746<br />

Coding<br />

We use HIPAA as the benchmark for accepting st<strong>and</strong>ard codes.<br />

Note: Since <strong>Premera</strong> cannot provide coding advice, we recommend that you maintain current<br />

copies of coding reference books in your office, or current versions of coding software.<br />

Deleted<br />

Codes<br />

We reimburse current effective procedure codes in the CPT book published by the American<br />

Medical Association in the year the service was rendered.<br />

If you submit a claim with a deleted code, it will be processed <strong>and</strong> the line item will indicate<br />

the corresponding denial code. Then, correct the claim to reflect the appropriate code <strong>and</strong><br />

resubmit the claim as described in “Returned <strong>Claims</strong>”. Denied claims will be considered a<br />

provider write-off until the corrected claim is processed.<br />

Anti-fraud<br />

<strong>Premera</strong> abides by federal <strong>and</strong> state regulations concerning fraud, as well as our contract<br />

obligations to members <strong>and</strong> providers. Our mission is to provide peace of mind to our<br />

members about their healthcare coverage. To support our mission, we have a Special<br />

Investigations Unit (SIU) to prevent fraud <strong>and</strong> abuse.<br />

If you suspect fraud please call the Anti-Fraud Hotline at 800-848-0244.<br />

Important: We perform r<strong>and</strong>om audits to ensure services are billed appropriately. As part of<br />

the audit process, we may request dental records supporting use of these codes.<br />

Note: If billing under the medical benefit <strong>and</strong> need additional coding resources please refer to<br />

the American Medical Association (AMA) at 800-621-8335 or visit ama-assn.org.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 2

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 2: <strong>Claims</strong> Submission<br />

Member ID<br />

Number<br />

Provider<br />

Identification<br />

National Provider<br />

Identifier (NPI)<br />

When submitting claims, please transfer the member’s ID number exactly as it is printed<br />

on the ID card, including the leading three-character alpha prefix. The ID number must<br />

be used when submitting claims to identify the patient; <strong>Premera</strong> does not use the<br />

member’s social security number<br />

When completing the ADA® Dental Claim Form, please enter the following:<br />

Applicable Social Security number (SSN) or Tax Identification number (TIN)<br />

National Provider Identifier number (NPI)<br />

Treating dentist<br />

Billing dentist or dental entity<br />

The Department of Health <strong>and</strong> Human Services issued regulations about the NPI, which<br />

affect healthcare providers, payors (i.e., health plans), <strong>and</strong> healthcare clearinghouses. As<br />

part of HIPAA’s Administration Simplification provision, the NPI is a m<strong>and</strong>ate requiring<br />

the adoption of a st<strong>and</strong>ard unique identifier for each covered healthcare provider (those<br />

that transmit healthcare information in an electronic form in connection with HIPAA<br />

st<strong>and</strong>ard claim transactions).<br />

The NPI replaces all proprietary (payor-issued) provider identifiers, including Medicare<br />

ID numbers (UPINs). It does not replace your tax ID number (TIN) or DEA number. TIN<br />

remains as a required element for claims. Electronic claims without a TIN are rejected as<br />

incomplete.<br />

If you have questions about NPI <strong>and</strong> electronic claims, email EDI@premera.com, or<br />

contact an EDI representative at 800-435-2715.<br />

Electronic <strong>Claims</strong> To speed claims turnaround, we urge you to submit electronically (see Section 11:<br />

Electronic <strong>Claims</strong> Submission for more information). If you submit claims electronically,<br />

refer to your electronic billing manual for specific formatting for electronic claims.<br />

Timely<br />

<strong>Claims</strong><br />

Submission<br />

You can submit claims daily, weekly, or monthly. The earlier you submit claims, the<br />

earlier we process them. Ideally, we’d like you to submit claims within 60 calendar days<br />

of the covered services, but no later than 365 calendar days. Please refer to your contract<br />

for further claims submission information.<br />

For most plans, claims received more than 12 months after the date of service will be<br />

denied with NO member responsibility.<br />

Paper<br />

<strong>Claims</strong><br />

If you are unable to submit claims electronically, you can submit paper claims on ADA®<br />

Dental Claim Forms. To speed claims processing, <strong>Premera</strong> uses document imaging <strong>and</strong><br />

optical character recognition (OCR) equipment to “read” your claims.<br />

To ensure that OCR “reads” your paper claims accurately, here are some tips to help you:<br />

Submit using the most current ADA® claim form<br />

Submit appropriate supporting documentation when required<br />

Provide the members ID number in box 15 <strong>and</strong> box 8 if applicable (do not provide<br />

the member’s Social Security number)<br />

Type or print out ADA® claim forms in black ink (OCR equipment cannot read<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 3

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

<br />

<br />

<br />

<br />

h<strong>and</strong>written claims forms)<br />

Confirm print is dark. Change toner cartridge or ribbon when needed<br />

Be sure information lines up correctly within the respective fields. (OCR equipment<br />

cannot accurately read data that overlaps another field/box.)<br />

Do not highlight. (Highlighted information appears “blacked out” when read by OCR<br />

equipment)<br />

Avoid using white correction fluid<br />

X-Ray Films <strong>and</strong><br />

Photos<br />

X-ray films or photos will not be returned to the dental office unless specifically<br />

requested at the time of submission.<br />

If you are requesting their return, please indicate the patient’s name, account number or<br />

other identifier on the envelope or mounting.<br />

We will not be responsible for lost x-rays or photos. The dental office should maintain<br />

the original copy of the x-ray films or photo in the patient record.<br />

For more information on submitting x-rays or photos electronically please visit the<br />

FastAttachTM web site at fast-attach.com.<br />

Returned<br />

<strong>Claims</strong><br />

Corrected<br />

<strong>Claims</strong><br />

<strong>Claims</strong> with incomplete, unclear, or incorrect information (e.g. procedure code, date of<br />

service, etc.) will be returned. Returned claims must be resubmitted with correct<br />

information. Please resubmit with correct information to process claim for payment.<br />

Correcting previously process claims is necessary when the original claim was submitted<br />

with incorrect information. To facilitate prompt payment for a resubmitted claim,<br />

remember to:<br />

Submit a new, corrected claim<br />

Attach a completed “Correct Claim –Cover Sheet”<br />

<br />

<br />

Indicate this is a corrected bill<br />

Include additional information such as a narrative, chart notes or claim remarks to<br />

document the change, if applicable<br />

To obtain a “Corrected Claim –Cover Sheet” access the Forms section of<br />

premera.com/provider. Printable versions of the form are available.<br />

Send the corrected claim to:<br />

Dental Review<br />

P.O. Box 91059<br />

Seattle, WA 98111-9159<br />

<strong>Claims</strong><br />

Status<br />

You can obtain the status of a claim:<br />

1. Online: A convenient method to check the status of a claim is to visit<br />

premera.com/provider. Information is available 24 hours a day, seven days a week.<br />

Each dentist receives a PIN to log on to our secure Provider Portal (see Chapter 2,<br />

Online Services).<br />

2. Customer Service: If you don’t have Internet access, contact Customer Service using<br />

the phone number that can be found on back of member’s ID card.<br />

3. Interactive Voice Response Unit (IVR): Available 24 hours a day, seven days a week.<br />

IVR provides claims information (see Chapter 6, Member Eligibility <strong>and</strong><br />

Coverage).<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 4

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 3: Reimbursement<br />

<strong>Payment</strong><br />

Questions<br />

If you have questions regarding claims processing, contact our Customer Service<br />

department at the phone number on the Explanation of <strong>Payment</strong> (EOP) or by using the<br />

phone number on the back of the member’s ID card. You also can submit a copy of the<br />

EOP, circle the claim in question, <strong>and</strong> provide the inquiry reason. If <strong>Premera</strong> processed the<br />

original claim incorrectly, you do not need to resubmit the claim. <strong>Premera</strong> will adjust the<br />

claim correctly, <strong>and</strong> you will receive a corrected EOP.<br />

Important: Before discussing member claim information, the Customer Service<br />

representative must verify the identity of the caller.<br />

<strong>Claims</strong><br />

Adjudication<br />

System<br />

<strong>Premera</strong> uses automated processing systems to adjudicate claims. When processing claims,<br />

the system:<br />

Checks for eligibility of the member listed on a claim<br />

Checks for completeness of the claim<br />

Confirms the accuracy of the information<br />

Compares the services provided on the claim to the benefits in the subscriber’s contract<br />

Identifies the priority of the services consistent with <strong>Premera</strong>’s payment policies<br />

Determines the payment amount<br />

Important: Final payment is subject to <strong>Premera</strong>'s fee schedule <strong>and</strong> payment policies, a<br />

member's eligibility, coverage <strong>and</strong> benefit limits at the time of service <strong>and</strong> claims<br />

adjudication edits.<br />

Overpayments<br />

Calypso, a <strong>Premera</strong> affiliate, processes refunds <strong>and</strong> overpayment requests. When Calypso<br />

identifies an overpayment, they mail an “Overpayment Notification” letter with a request<br />

for the overpaid amount.<br />

Sometimes an office returns a check to <strong>Premera</strong> that represents multiple claims because a<br />

portion (see “Threshold” below) of the payment may be incorrect. In these cases, please do<br />

not return the check to us. Instead, deposit the check, circle the claim in question on the<br />

Explanation of <strong>Payment</strong> (EOP) <strong>and</strong> include a short explanation as to why there was an<br />

overpayment. After these steps are completed, you can choose one of the following options<br />

to resolve the overpayment:<br />

1. Mail the overpayment amount to <strong>Premera</strong>’s finance department (address on check)<br />

along with a completed Refund Request form, or<br />

2. Mail a completed Overpayment Notification form <strong>and</strong> mark the box requesting a<br />

voucher deduction to recover the overpayment on future claim payments. (Refer to<br />

Section 8 for information regarding the Statement of Overpayment Recovery Activity.)<br />

Calypso will apply the refund to the claim as soon as the refund is received. If you require<br />

a written refund request before mailing the overpayment, contact Customer Service <strong>and</strong><br />

they will forward your request to Calypso, or call Calypso directly at 800-364-2991.<br />

Threshold: We do not request refunds for overpayments less than $25, but you may submit<br />

these voluntarily (<strong>Blue</strong>Card will request refunds regardless of the dollar amount).<br />

Note: The Overpayment Notification Form: is located on premera.com/provider in the<br />

Library under Forms. Call Calypso at 800-364-2991 if you have a question about an<br />

overpayment or refund request.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 5

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 4: <strong>Payment</strong> St<strong>and</strong>ards<br />

Prompt Pay<br />

St<strong>and</strong>ards<br />

Billing<br />

Instructions<br />

Your claims are submitted for payment as soon as we receive them. We also apply the following<br />

“Prompt Pay” st<strong>and</strong>ards set by Washington’s Office of the Insurance Commission (OIC) to our<br />

claims adjudication process:<br />

Pay or deny 95% of a provider’s monthly “clean” claims within 30 days of receipt; <strong>and</strong><br />

Pay or deny 95% of a provider’s monthly volume of all claims within 60 days of receipt.<br />

Important: If the above st<strong>and</strong>ards are met, the regulation does not require interest to be paid on<br />

those individual claims paid outside of the 95% threshold.<br />

To help us pay your claims promptly, follow the ADA® Dental Claim Form completion<br />

instructions. In box 15 <strong>and</strong> box 8 (if applicable) enter the member’s ID number exactly as it is<br />

printed on the ID card, including the leading three-character alpha prefix. The ID number must be<br />

used when submitting claims to identify the patient; <strong>Premera</strong> does not use the member’s social<br />

security number. Comprehensive ADA® Dental Claim Form instructions can be found in the most<br />

current CDT.<br />

A claim is classified as unclean if it does not meet the minimum billing st<strong>and</strong>ards <strong>and</strong><br />

requirements. If a claim is submitted with missing information in a required box, or has an invalid<br />

field entry, it will likely result in a rejected or returned claim.<br />

Important: The subscriber identifier is a unique alpha-numeric number assigned by <strong>Premera</strong>. To<br />

protect the privacy of our members, Social Security numbers are not used.<br />

Clean<br />

Claim<br />

Definition<br />

Clean<br />

Claim<br />

Exclusions<br />

Applying<br />

Interest<br />

Interest<br />

Vouchers<br />

Interest<br />

Threshold<br />

A clean claim is one that has no defect or impropriety, including lack of any required substantiating<br />

documentation that prevents timely payment of the claim. This includes any missing required<br />

substantiating documentation or particular circumstances requiring special treatment.<br />

<strong>Claims</strong> may also be delayed during processing if:<br />

They are suspended due to the group or individual’s non-payment of premium or dues<br />

They have Coordination of Benefits (COB) when <strong>Premera</strong> is the secondary carrier on the claim<br />

They require completion <strong>and</strong> mailing of an Incident Questionnaire for possible accident<br />

investigation or a Workers Compensation injury (claims in subrogation)<br />

They include request of medical records for review<br />

If we fail to satisfy either of the above st<strong>and</strong>ards, commencing on the 61 st day, we will pay interest<br />

at a 12% annual rate on the unpaid or un-denied clean claim. Interest will not be calculated on<br />

unclean claims regardless of how long it takes to process them.<br />

Prompt Pay interest is currently calculated monthly for the previous month’s paid claims.<br />

<strong>Payment</strong>s are issued under a separate voucher <strong>and</strong> mailed to the address on the original claim.<br />

Included with the interest voucher is a summary report detailing the claims <strong>and</strong> the corresponding<br />

interest payments applied for that time period.<br />

There is a minimum threshold of $25 for monthly interest payments on delayed clean claims. An<br />

interest check is issued only for months in which the accumulated interest is equal to or greater than<br />

the minimum threshold of $25.<br />

Interest less than $25 will continue to accrue until it reaches that threshold or until December of<br />

each year. To help your office complete year-end accounting, each December a check will be<br />

issued for the accrued interest we owe you, even if the amount is below the threshold.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 6

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Prompt<br />

Pay Unit<br />

Contact the Prompt Pay Unit (see below) for inquiries regarding the following:<br />

Voucher related interest payments<br />

Application of interest payments<br />

Amount of interest paid<br />

Lack of interest payment<br />

Call the Prompt Pay Unit at 800-932-2883 for interest-related questions.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 7

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 5: Special Billing Situations<br />

Anesthesia<br />

Providers<br />

When requesting reimbursement for general anesthesia under the medical benefit, follow<br />

CPT guidelines <strong>and</strong> submit your charges on a medical claim form (the most common<br />

code is 00170). Anesthesia for medical should be reported on one line item with total<br />

minutes in the units field. If more than one anesthesia line is billed for the same date of<br />

service, only the first anesthesia services is allowed <strong>and</strong> all others will be denied.<br />

When requesting reimbursement for anesthesia under the dental benefits plan submit<br />

your charges following the CDT guidelines (see instructions under Billing Instructions).<br />

Treating/Self<br />

<strong>and</strong> Family<br />

Members<br />

<strong>Premera</strong> follows many Medicare guidelines. Similar to Medicare, we do not reimburse<br />

for professional services or supplies that are usually provided free because of the<br />

relationship to the patient.<br />

As a reminder, physicians, providers or suppliers who are <strong>Premera</strong> members, are not<br />

reimbursed by us for professional services for any of the following when services are:<br />

Performed on themselves, or<br />

Rendered to family members residing in the home, or<br />

Provided to individuals related to them by blood, marriage, or adoption.<br />

Locum<br />

Tenens<br />

A locum tenens dentist does not need to be credentialed because he/she is considered a<br />

temporary provider. A locum tenens physician bills under the name of the absent,<br />

contracted dentist.<br />

Exception: if a locum tenens dentist provides services for more than 90 days, he/she<br />

must be credentialed.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 8

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 6: Explanation of <strong>Payment</strong><br />

Explanation<br />

of <strong>Payment</strong><br />

Dentists receive an Explanation of <strong>Payment</strong> (EOP), which describes <strong>Premera</strong>’s<br />

determination of the payment for services.<br />

Here is an example of an EOP. See the following page for an explanation of EOP fields<br />

<strong>and</strong> a description of codes <strong>and</strong> messages.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 9

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

EOP Explanation<br />

Field Name<br />

Description<br />

A PATIENT NAME Patient/member’s name.<br />

SUBSCRIBER # &<br />

PT SUFFIX<br />

Subscriber’s number <strong>and</strong> patient suffix number (including alpha prefix) assigned<br />

by plan.<br />

PATIENT ACCOUNT # Number assigned by the clinic for patient. (If no account number is assigned, the<br />

words “No Patient Account #” are noted.)<br />

SUBSCRIBER NAME Name of the subscriber.<br />

CLAIM #<br />

Number assigned to the claim when received by plan.<br />

PROVIDER OF SERVICE Provider who rendered the service. Professional example: Martha Smith is the<br />

provider of service.<br />

B SERVICE DATES The dates-of-service (to <strong>and</strong> from -- also referred to as beginning <strong>and</strong> ending<br />

dates) at a line item level.<br />

C CODE/MODIFIER The procedure code shown in box 29 of the ADA® Dental Claim Form.<br />

D UNITS BILLED/ALLOWED Units billed not applicable to dental claims forms.<br />

E APC/APG/DRG/ROOM<br />

TYPE<br />

Applicable to facility claims only.<br />

F BILLED CHARGES Charges billed by dentist at a line item level.<br />

G ALLOWED AMOUNT Amount allowed for service at a line item level.<br />

H PROVIDER ADJUSTMENT “Provider write-off” amount.<br />

I<br />

OTHER INSURANCE<br />

ADJUSTMENT<br />

Amount paid by other carrier(s).<br />

J PATIENT LIABILITY Total patient liability: Amount owed by patient. Patient liability is deductible <strong>and</strong><br />

copay/coinsurance/ineligible rolled up.<br />

Fee Adjust (A) = Member responsibility per subscriber contract.<br />

COB SAV APP (B) = Amount applied from member’s COB saving account.<br />

Coinsurance (C) = A predetermined amount designated by the subscriber’s<br />

plan. Applies after the patient meets his/her deductible.<br />

Deductible (D) = A predetermined amount designated by the subscriber’s<br />

plan, must be satisfied by member before benefits apply.<br />

Funding Acct (F) = A Health Reimbursement Account(HRA) or Healthcare<br />

Funding Account (HFA)<br />

Ineligibles (I) = Services that the member does not have a benefit<br />

predetermined by the plan.<br />

Copay (P) = Amount member is responsible to pay at time of service (e.g.,<br />

$15 office visit copay for medical).<br />

K PAYABLE AMOUNT Amount payable by plan.<br />

L REASON REMARK Adjudication explanation code(s) at a line item level <strong>and</strong> claim level (if<br />

applicable).<br />

M CLAIM TOTAL Printed at the end of each claim, the line items are summed <strong>and</strong> an asterisk<br />

indicates the claim total line.<br />

N PAID TO “Paid to” refers to the payee code (where the check was sent/issued) <strong>and</strong> is listed<br />

only in the claim total or subtotal line (e.g., G = Provider Group).<br />

O LESS PAID TO CODES<br />

LISTED AS “S” OR “C”<br />

The sum of the claim total “Payable Amounts” which have a “Paid To” code of S<br />

or C.<br />

P TOTAL PAYABLE AMOUNT Indicates the amount of the check<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 10

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 7: Statement of Overpayment Recovery Activity<br />

Statement of<br />

Overpayment<br />

Recoveries<br />

A SORA is a statement that will be printed <strong>and</strong> included with an Explanation of <strong>Payment</strong><br />

(EOP) when an overpayment recovery activity has been processed within a payment cycle.<br />

The SORA is generated when one of the following occurs during a payment cycle:<br />

An amount is deducted from your check.<br />

An overpayment was recorded during the payment cycle.<br />

There is a balance due to <strong>Premera</strong> at the end of the payment cycle.<br />

Money was posted to your account during the payment cycle.<br />

When there is any other activity on your account during the payment cycle.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 11

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

SORA Explanation<br />

Field Name<br />

A Patient Name Patient (member) name.<br />

Subscriber # & PT Suffix<br />

Patient Account #<br />

Subscriber Name<br />

Claim Number<br />

Claim Date Span<br />

Provider of Service<br />

Description<br />

Subscriber’s number <strong>and</strong> patient suffix number (including alpha prefix)<br />

assigned by <strong>Premera</strong>.<br />

Patient number assigned by the provider/clinic/hospital. (If no account number<br />

is assigned, the words “No Patient Account #” are noted.)<br />

Subscriber’s name.<br />

Claim number associated with the overpayment.<br />

Date span of the claim. (The span will be the first through the last date of<br />

service on the claim.)<br />

Provider who rendered the service.<br />

B <strong>Payment</strong> Reference ID This number specifies the current <strong>and</strong>/or prior payment vouchers applied<br />

towards the overpayment. (Each SORA has its own payment reference ID<br />

which is located in the upper right-h<strong>and</strong> corner.)<br />

C <strong>Payment</strong> Cycle Date Date of payment shown in the system that relates to the <strong>Payment</strong> Reference ID.<br />

D Prior <strong>Payment</strong> Cycle Original overpayment amount from prior statements (prints until balance is<br />

zero).<br />

E This <strong>Payment</strong> Cycle Overpayment amount that applied to this payment cycle.<br />

F <strong>Payment</strong> From Provider Amount(s) the provider voluntarily paid toward the overpayment balance.<br />

G Prior <strong>Payment</strong> Cycle Amount recovered from prior payment cycles.<br />

H This <strong>Payment</strong> Cycle Amount recovered from current payment cycle.<br />

I<br />

Outst<strong>and</strong>ing Over-<br />

<strong>Payment</strong><br />

Balance of overpayments not recovered.<br />

J Overpayment Totals Total amount for each column in the statement.<br />

K<br />

Total Recovered This<br />

<strong>Payment</strong> Cycle<br />

Total overpayments recovered in the current payment cycle.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 12

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 8: ADA® Dental Claim Form<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 13

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 14

Section 9: Dental Documentation Guidelines<br />

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Use a valid ADA® code for the date of service submitted. An invalid code can cause a delay in processing.<br />

CDT<br />

2009 -<br />

2010<br />

Description<br />

Documentation Requested<br />

D1525<br />

D2510 -<br />

D2794<br />

D2960 -<br />

D2962<br />

Inlays, onlays, crowns, veneers Preoperative x-rays<br />

Narrative detailing existing restorations <strong>and</strong><br />

areas of new decay <strong>and</strong>/or defects<br />

<br />

D2799 Provisional crown Preoperative x-ray<br />

<br />

D0140 Limited oral evaluation – problem<br />

Chart notes or narrative if dental emergency<br />

focused<br />

D0160 Detailed & extensive oral evaluation – Chart notes or narrative<br />

problem focused<br />

D0250 Extraoral – first film Type of extraoral x-ray performed<br />

D0260 Extraoral – each additional film Type of extraoral x-ray performed<br />

D0290 Posterior-anterior or lateral skull <strong>and</strong> Diagnosis<br />

facial bone survey film<br />

Chart notes <strong>and</strong>/or narrative<br />

D0322 Tomographic survey Diagnosis<br />

Chart notes <strong>and</strong>/or narrative<br />

D0340 Cephalometric Film Diagnosis<br />

Chart notes <strong>and</strong>/or narrative<br />

D0415- Oral pathology laboratory Lab/pathology report <strong>and</strong> chart notes<br />

D0418<br />

D0460 Pulp vitality tests Teeth number(s) of tooth or teeth tested<br />

D0472 - Oral pathology laboratory Lab/pathology report <strong>and</strong> chart notes<br />

D0502<br />

D1510- Space maintainers Narrative explaining reason for space maintainer<br />

D2910-<br />

D2920<br />

D2950,<br />

D2952,<br />

D2954<br />

D2971<br />

If applicable, need date of prior placement<br />

Chart notes <strong>and</strong>/or narrative<br />

Length of time the provisional crown will be<br />

used<br />

Recement inlay, onlay, post/core, crown Initial placement date<br />

Tooth buildup Preoperative x-rays<br />

Narrative detailing existing restorations <strong>and</strong><br />

areas of new decay <strong>and</strong>/or defects<br />

If prior inlay, onlay, crown, or veneer, need date<br />

Additional procedures to construct new<br />

crown under existing partial denture<br />

framework<br />

<br />

of prior placement<br />

Chart notes <strong>and</strong>/or narrative<br />

D2980 Crown repair, by report Chart notes <strong>and</strong>/or narrative<br />

Initial placement date<br />

D3220 Therapeutic pulpotomy Chart notes <strong>and</strong>/or narrative<br />

D3331 -<br />

D3333<br />

Treatment of root canal obstruction,<br />

incomplete endodontic therapy, internal<br />

root repair<br />

<br />

<br />

Preoperative x-ray<br />

Chart notes <strong>and</strong> narrative<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 15

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

CDT<br />

2009 - Description<br />

Documentation Requested<br />

2010<br />

D3346 - Retreatment of previous root canal<br />

Date of initial root canal therapy<br />

D3348 therapy<br />

If re-treatment done less than 12 months from<br />

initial root canal therapy, need preoperative x-<br />

rays <strong>and</strong> chart notes <strong>and</strong>/or narrative<br />

D4210 - Gingivectomy or gingivoplasty Periodontal charting<br />

D4211<br />

periapical x-rays if billed with crown<br />

lengthening<br />

indicate specific tooth or teeth in quad performed<br />

D4230 - Anatomical crown exposure Periapical x-rays<br />

D4231<br />

Periodontal charting<br />

indicate specific tooth or teeth in quad performed<br />

D4240 Gingival flap procedure Periodontal charting<br />

D4249 Clinical crown lengthening – hard tissue Periapical x-rays <strong>and</strong> periodontal charting<br />

D4260 - Osseous surgery Periodontal charting<br />

D4261<br />

Indicate specific tooth or teeth in quad<br />

performed<br />

D4263 - Bone replacement graft Preoperative x-rays <strong>and</strong> periodontal charting<br />

D4264<br />

D4265 Biologic materials Preoperative x-rays <strong>and</strong> periodontal charting<br />

D4266 - Guided tissue regeneration Periapical x-rays <strong>and</strong> periodontal charting<br />

D4267<br />

D4271 - Tissue grafts Periodontal charting<br />

D4273<br />

D4355<br />

Full mouth debridement to enable<br />

comprehensive evaluation <strong>and</strong> diagnosis<br />

Justification such as chart notes or narrative<br />

detailing the last time since last cleaning <strong>and</strong>/or<br />

periodontal services.<br />

D4381 Localized delivery of antimicrobial<br />

agents via a controlled release vehicle<br />

Name of material used (Arestin, Actisite,<br />

Atridox, Periochip)<br />

into diseased crevicular tissue, per tooth, Periodontal charting<br />

by report<br />

Tooth number(s)<br />

Narrative detailing patient’s active periodontal<br />

history<br />

D4910 Periodontal maintenance Narrative detailing patient’s active periodontal<br />

D5110 -<br />

D5281<br />

D5410 -<br />

D5761<br />

D5810 -<br />

D5821<br />

D6010 -<br />

D6050<br />

D6056 -<br />

D6077<br />

history<br />

Periodontal charting<br />

Complete <strong>and</strong> partial dentures Age of prior denture (if any)<br />

<br />

Adjust, repair, replace, rebase, reline Initial placement date<br />

Impression(prep) <strong>and</strong> delivery(seat) dates<br />

denture<br />

Interim complete or partial denture Length of time interim denture will be used<br />

Surgical placement of dental implant Preoperative x-rays, chart notes, <strong>and</strong> periodontal<br />

charting<br />

Prognosis of implant<br />

Full treatment plan for patient<br />

Implant supported crown, fixed or<br />

X-rays <strong>and</strong> chart notes<br />

removable denture, <strong>and</strong> fixed partial List of all missing teeth<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 16

CDT<br />

2009 -<br />

2010<br />

Description<br />

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Documentation Requested<br />

D6194 denture List of all existing bridgework <strong>and</strong> dentures<br />

D6205 - Fixed partial dentures (bridge) Preoperative x-rays, prep <strong>and</strong> seat dates<br />

D6794<br />

List of all missing teeth in both arches<br />

List of all existing bridgework <strong>and</strong>/or dentures in<br />

both arches<br />

If prior bridge or denture, need date of prior<br />

placement<br />

D6793 Provisional retainer crown Length of time provisional retainer crown will be<br />

D6970 -<br />

D6973<br />

used<br />

Core buildup, post <strong>and</strong> core Preoperative x-rays<br />

Narrative detailing existing restorations <strong>and</strong><br />

areas of new decay <strong>and</strong>/or defects<br />

If prior fixed partial denture, need date of prior<br />

placement<br />

D7230 - Surgical extractions Pre-operative x-rays <strong>and</strong> chart notes/op report<br />

D7241<br />

D7260 - Oroantral fistula or sinus perforation Pre-operative x-rays<br />

D7261 closure<br />

Narrative or surgical operative report<br />

D7285 -<br />

D7288<br />

Biopsy of oral tissue, brush biopsy,<br />

exfoliative cytological sample collection<br />

Pre-operative x-rays or lab/pathology report <strong>and</strong><br />

chart notes<br />

D7410 -<br />

D7461<br />

Removal of tumors, cysts, <strong>and</strong> neoplasms Pre-operative x-rays or lab/pathology report <strong>and</strong><br />

chart notes<br />

D7610 - Treatment of fractures If dental accident provide:<br />

D7780<br />

Pre-post op x-rays of teeth involved <strong>and</strong> office<br />

records/chart notes<br />

Date of accident <strong>and</strong> any third party information<br />

Condition of teeth prior to the accident<br />

D7810 - Reduction of dislocation <strong>and</strong><br />

Diagnosis<br />

D7877 management of other temporom<strong>and</strong>ibular Chart notes <strong>and</strong> narrative<br />

joint dysfunctions<br />

Description of service or equivalent medical<br />

code<br />

D7880 Occlusal orthotic device, by report Name <strong>and</strong> type of appliance including materials<br />

used in processing<br />

Diagnosis <strong>and</strong> narrative of the patients symptoms<br />

Treatment plan<br />

D7950 Osseous, osteoperiosteal, or cartilage Narrative <strong>and</strong> chart notes<br />

graft<br />

Preoperative x-rays<br />

D7951 Sinus augmentation with bone or bone Preoperative x-rays <strong>and</strong> complete treatment plan<br />

substitutes<br />

D8000 - Orthodontia Date the orthodontia appliance was placed<br />

D8999<br />

Total cost of orthodontia treatment<br />

D9110<br />

Palliative (emergency) treatment of<br />

dental pain<br />

<br />

<br />

<br />

<br />

B<strong>and</strong>ing fee <strong>and</strong> initial down-payment<br />

Monthly adjustment fee (can bill monthly,<br />

quarterly etc.)<br />

Expected length of treatment in months.<br />

Chart notes, office records, or detailed narrative<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 17

CDT<br />

2009 -<br />

2010<br />

D9210<br />

D9610 -<br />

D9612<br />

D9630<br />

Description<br />

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Documentation Requested<br />

Local anesthesia not in conjunction with Chart notes <strong>and</strong>/or narrative<br />

operative or surgical procedures<br />

Therapeutic parenteral drugs Narrative explaining what drug was administered<br />

Other drugs <strong>and</strong>/or medicaments, by<br />

report<br />

Description or narrative of drugs <strong>and</strong>/or<br />

medicaments<br />

Whether prescription is required<br />

D9910 -<br />

D9911<br />

Application of desensitizing medicament Narrative indicating if applied in office or given<br />

for take home use;<br />

If applied in office, need tooth numbers<br />

D9940 Occlusal guard Diagnosis or narrative<br />

D9951 Occlusal adjustment – limited Tooth or teeth number performed<br />

D9952 Occlusal adjustment - complete Periodontal charting showing the mobilities <strong>and</strong><br />

occlusal findings<br />

<br />

<br />

Narrative stating treatment rationale <strong>and</strong><br />

objectives<br />

Full mouth x-ray if bony defects present<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 18

Section 10: Commonly Asked Questions<br />

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Question:<br />

Why do you<br />

recommend submitting<br />

a Dental Predetermination<br />

What is a Benefit<br />

Advisory<br />

Why do you sometimes<br />

allow an alternative<br />

treatment benefit<br />

Do you allow<br />

composite fillings on<br />

posterior teeth<br />

Is cosmetic dentistry<br />

covered<br />

When do I bill medical<br />

verses dental<br />

Answer:<br />

A Dental Pre-determination is a resource that can be used to determine available<br />

dental benefits provided under the member’s dental plan before the services are<br />

started. This allows both the dentist <strong>and</strong> the member to make informed decisions<br />

<strong>and</strong> prepare any necessary financial arrangement for services reduced or not<br />

covered.<br />

A Benefit Advisory is a resource not necessarily related to a tooth <strong>and</strong> gum, but to<br />

the oral or maxillofacial structure. Examples of when to submit a benefit advisory<br />

are: TMJ/MPD syndrome, orthognathic surgery, oral airway appliance to treat<br />

obstructive sleep apnea, dental accident <strong>and</strong> outpatient facility <strong>and</strong> anesthesia<br />

services when used to deliver dental care. After submitting a request for a Benefit<br />

Advisory, the provider <strong>and</strong> the member will receive a letter advising if there is<br />

coverage for the proposed service(s).<br />

The majority of the dental plans we offer have an alternative treatment benefit. The<br />

alternative treatment benefit can help reduce insurance premiums. When a dental<br />

condition can be treated in more than one way, plans that have the alternative<br />

treatment benefit will cover the most cost-effective service, procedure, or supply,<br />

which, in our judgment, are consistent with acceptable st<strong>and</strong>ards of dental practice.<br />

If the patient chooses the more costly treatment, the patient will be responsible for<br />

the additional charges beyond those for the less costly alternative treatment.<br />

The majority of the dental plans we offer consider posterior composite fillings<br />

rendered on 2 nd or 3 rd molars cosmetic <strong>and</strong> will be reduced to the corresponding<br />

amalgam allowance.<br />

Second <strong>and</strong> third molars refer to:<br />

Permanent teeth, 1-2, 15-18, 31-32<br />

Primary teeth A, J, K, T<br />

No. It is important to remember that our dental plans do not cover cosmetic<br />

dentistry <strong>and</strong> any treatment, which, in our judgment, is considered not dentally<br />

necessary.<br />

For some procedures, the line between medical <strong>and</strong> dental is not always clear, as<br />

with tumors or cysts that are found in the oral cavity of the mouth. <strong>Premera</strong> will<br />

review the claim submitted to determine if the service is payable under the medical<br />

or dental plan. If the tumor or cyst is tooth or gum related it is often payable under<br />

the dental plan. If a procedure is related to the lip, tongue, or cheek, it often will be<br />

payable under the medical plan. Sending an operative or pathology report is<br />

helpful when we review these types of claims for benefits.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 19

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Question:<br />

Is Outpatient<br />

Facility/Anesthesia for<br />

Dental Services<br />

covered<br />

Answer:<br />

Please contact our Customer Service Department to inquire if your patient’s<br />

medical plan includes benefits for outpatient facility <strong>and</strong> anesthesia services when<br />

used to deliver dental care. If the patient has medical benefits for outpatient facility<br />

<strong>and</strong> anesthesia services when used to deliver medical care <strong>and</strong> meets the medical<br />

necessity criteria then these services would be covered. A benefit advisory is<br />

recommended.<br />

Criteria includes:<br />

The patient has a medical condition that the patient’s physician determines<br />

would place the patient at undue risk if the dental procedure were performed in<br />

a dental office<br />

The patient has a physical or mental h<strong>and</strong>icap <strong>and</strong> cannot be managed with<br />

local anesthesia<br />

The patient is a child who, after other means of patient management (including<br />

pre-medication) have been tried, cannot be treated in the usual office setting<br />

Note: No medical benefits are provided for the related dentist’s professional<br />

services.<br />

Is Orthognathic<br />

Surgery a covered<br />

benefit<br />

Is TMJ services<br />

covered<br />

Are Oral Appliance<br />

<strong>and</strong> Oral Appliance<br />

Therapy for<br />

Obstructive Sleep<br />

Apnea (OSA) a<br />

covered benefit<br />

When should I submit<br />

the claim when<br />

<strong>Premera</strong> is the<br />

secondary insurance<br />

plan (Coordination of<br />

Benefits)<br />

A member has dual<br />

coverage with<br />

<strong>Premera</strong>. Can you<br />

coordinate benefits<br />

without me sending it<br />

to you twice<br />

For specific details regarding benefits for facility <strong>and</strong> anesthesia services when<br />

used to deliver dental care you can access our Corporate Medical Policies at<br />

premera.com/provider<br />

Please contact our Customer Service Department to inquire if your patient’s plan<br />

includes Orthognathic surgery benefits. Regardless of the origin of the condition<br />

that makes the procedure necessary, orthognathic surgery is payable only if the<br />

plan has Orthognathic surgery benefits under the medical plan. A benefit advisory<br />

is recommended.<br />

Please contact our customer service department to inquire if your patient’s plan<br />

includes TMJ benefits under medical or dental. A benefit advisory is<br />

recommended.<br />

An Oral Appliance <strong>and</strong> the Oral Appliance Therapy can be reviewed for available<br />

medical plan benefits; however, we require documentation of a sleep study, cardiorespiratory<br />

study, or polysomnograpy to verify medical necessity <strong>and</strong> the diagnosis<br />

of obstructive sleep apnea. The oral appliance <strong>and</strong> oral appliance therapy is not<br />

covered to treat snoring problems alone. A benefit advisory is recommended.<br />

When submitting a dental claim that includes other insurance, we recommend you<br />

submit the claim first to the primary insurance plan. Then send a copy of the other<br />

insurance plan’s explanation of benefits along with your claim to us. This allows<br />

us to make sure that we coordinate benefits promptly <strong>and</strong> accurately.<br />

Yes, our system auto-generates the secondary claim as long as the members other<br />

insurance information is up to date.<br />

To expedite the processing of your claim, include the primary <strong>and</strong> secondary<br />

identifying information in the Other Coverage section on the claim form, just as if<br />

the member was covered by two different insurance companies.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 20

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Question:<br />

Can we bill Dental<br />

Accident claims under<br />

the medical plan<br />

Is Orthodontia covered<br />

under the patient’s<br />

dental plan<br />

Answer:<br />

Dental Accident benefits are often payable under the medical plan; however, some<br />

of our plans pay dental accident benefits under the dental plan or have limited<br />

benefits available. Please contact our customer service department to inquire if<br />

your patient’s plan includes dental accident benefits. A benefit advisory is<br />

recommended if the plan has accident benefits available.<br />

Plans may have specific contract language regarding dental accidents. The<br />

following is general <strong>Premera</strong> payment policy that states that dental services that are<br />

rendered, as a result of an accident are not a covered benefit except when the<br />

services are:<br />

<br />

<br />

<br />

<br />

<br />

Necessitated as a direct result of the accidental injury<br />

Are performed within the scope of the provider’s license<br />

Have not been required due to damage from biting or chewing<br />

Are performed within twelve months (twelve months is st<strong>and</strong>ard, however may<br />

be different depending on the specific members’ contract) of the accident<br />

causing the injury <strong>and</strong><br />

Are rendered on natural teeth that were free from decay <strong>and</strong> otherwise<br />

functionally sound at the time of the injury<br />

Extensions can be reviewed <strong>and</strong> allowed beyond the contract’s twelve-month<br />

limitation. We will review a request for an extension of accident benefits provided<br />

we receive a letter from you within twelve-months of the accident date.<br />

Dental plans may include a separate orthodontia benefit. An orthodontia benefit<br />

may include a lifetime orthodontia deductible, a specific orthodontia b<strong>and</strong>ing<br />

maximum, <strong>and</strong> a lifetime orthodontia maximum for all orthodontia treatment.<br />

Please contact our customer service department to inquire if your patient’s plan<br />

includes orthodontia benefits.<br />

To expedite the processing of your orthodontia claim, it is important to include the<br />

following information:<br />

<br />

<br />

<br />

<br />

<br />

Date the orthodontia appliance was placed<br />

Total cost of orthodontia treatment<br />

B<strong>and</strong>ing fee or initial down-payment<br />

Monthly adjustment fee<br />

Expected length of treatment in months<br />

You can choose to bill orthodontia adjustments monthly or quarterly. A predetermination<br />

for orthodontia services is recommended, however not required.<br />

Note: A pre-determination will advise you of the member’s available lifetime<br />

maximum. To obtain information about specific limitations, please call our<br />

Customer Service Department.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 21

Section 11: Electronic Claim Submission<br />

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Advantages<br />

Electronic<br />

<strong>Claims</strong><br />

Submission<br />

Submit claims electronically for:<br />

Faster claims payment turnaround<br />

Less time spent on claims preparation<br />

Validation to ensure that are HIPAA-compliant<br />

Detailed claim acceptance <strong>and</strong> rejection reporting<br />

A professional staff available to assist with Electronic Data Interchange (EDI) matters<br />

Our electronic claims process separates <strong>and</strong> routes only valid claims for processing,<br />

non-valid claims are reported back to the provider with rejection details. There is no charge<br />

to providers who submit electronic claims directly to <strong>Premera</strong>.<br />

If you submit your claims electronically, you may receive electronic remittance for the<br />

following:<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong><br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

LifeWise Health Plans of Oregon <strong>and</strong> Washington<br />

Remittance is available online <strong>and</strong> this feature can be implemented at your request. Your<br />

office staff can then post this remittance manually or electronically (if your software has<br />

electronic posting capability). For additional information, contact an Electronic Data<br />

Interchange (EDI) representative.<br />

Getting<br />

Started<br />

To help you move from paper to electronic claims, follow these steps:<br />

1. If you already have a computer system, notify your software vendor of your desire to<br />

convert to electronic claims. You may need special software to send your dental claims<br />

electronically. Please note, the approved format for electronic dental claims is the ANSI<br />

X12 837 Dental format.<br />

2. Call an Electronic Data Interchange (EDI) Team specialist at <strong>Premera</strong> for information on<br />

sending dental claims electronically. They will send you the following documents:<br />

Enrollment Packet<br />

Payer Billing Requirements<br />

Testing instructions<br />

3. Plan to submit test claims electronically. An EDI specialist will review the test claims<br />

with you or your vendor. Continue to submit paper claims until you are told to stop.<br />

Electronic test claims are reviewed for accuracy, but are not processed for payment.<br />

4. EDI will notify you when you have successfully completed the test phase, at which time<br />

you will be advised when you can begin sending your claims electronically in<br />

production. Once you have been approved for production, you can discontinue<br />

submitting paper claims.<br />

If you have questions or need further assistance, e-mail edi@premera.com, or contact an EDI<br />

specialist in your region at 800-435-2715.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 22

Section 12: National Electronic Attachment, Inc.<br />

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

National<br />

Electronic<br />

Attachment<br />

Inc.<br />

Benefits of<br />

FastAttach<br />

<br />

Provider offices can transmit x-rays, periodontal charts, photographs, Explanation of Benefits<br />

(EOB’s), narratives, <strong>and</strong> other attachments via FastAttach to <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong><br />

Shield of Alaska to view in support of electronic claims.<br />

Receive the following benefits when you submit via FastAttach:<br />

Inexpensive <strong>and</strong> easy to use<br />

Eliminates lost or damaged attachments<br />

Eliminates film duplication<br />

Reduces follow-up time on claims submitted with attachments<br />

Speeds dental claim <strong>and</strong> pre-determination processing<br />

Provides unlimited customer service support <strong>and</strong> training<br />

Provides HIPAA-compliant transmission service<br />

For more information call: 800-782-5150, ext. 2 or for a video presentation, visit<br />

welcometonea.com.<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 23

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 13: Coordination of Benefits<br />

About<br />

COB<br />

Billing<br />

Information<br />

How<br />

<strong>Payment</strong>s Are<br />

Made<br />

Coordination of Benefits (COB) is a non-duplication of benefits provision included in both<br />

member <strong>and</strong> physician <strong>and</strong> provider contracts. When two or more health plans cover a<br />

member, COB protects against double or over-payment. When <strong>Premera</strong> processes a claim, it<br />

coordinates benefits if the member has other primary coverage from another carrier,<br />

<strong>Premera</strong> health plan, service plan, or government third-party payor.<br />

We abide by COB established guidelines set forth by the State of Washington Office of the<br />

Insurance Commissioner (OIC). These guidelines have specific rules to determine which<br />

insurance plan pays first (primary carrier) <strong>and</strong> which pays second (secondary carrier).<br />

Briefly, these rules are as follows:<br />

1. A member is primary on the plan in which he/she is the subscriber versus the plan in<br />

which he/she is a dependent.<br />

When a member is the subscriber on more than one plan, when both plans have a<br />

COB provision, the plan with the earliest effective date pays first (primary).<br />

2. When a dependent is double-covered under married parents’ health plans, the primary<br />

plan is the coverage of the parent with his/her birthday earlier in the year, regardless of<br />

their actual age. This st<strong>and</strong>ard is called the “Birthday Rule.”<br />

3. When dependent children are double-covered by divorced parents, coverage depends on<br />

any court decrees. Generally, if the court decrees financial responsibility for the child’s<br />

healthcare to one parent, that parent’s health plan always pays first. If there are no court<br />

decrees, the plan of the parent with custody is primary.<br />

Note: Some group contracts are not subject to OIC regulations <strong>and</strong> may have unique COB<br />

rules that could change the order of liability.<br />

Primary submission: Show all insurance information on the claim, <strong>and</strong> then submit the<br />

claim to the primary plan first.<br />

Secondary submission: When submitting secondary claims to <strong>Premera</strong>, submit the primary<br />

EOB with the itemized bill.<br />

When applicable, we will suspend payment until we determine which carrier is primary <strong>and</strong><br />

which is secondary. We may send a questionnaire to the member regarding possible<br />

duplicate coverage. We need the member to promptly complete <strong>and</strong> return this<br />

questionnaire to process claims in a timely manner. When <strong>Premera</strong> is the primary carrier,<br />

we calculate <strong>and</strong> pay benefits routinely.<br />

It is important to file a claim with all insurance companies to which the member subscribes.<br />

To ensure prompt <strong>and</strong> accurate payment when <strong>Premera</strong> is the secondary carrier, we<br />

encourage you to send the secondary claims with the primary explanation of benefits (EOB)<br />

as soon as you receive it. However, it is the member’s responsibility to submit a copy of the<br />

explanation of payment from their other carrier to us.<br />

If we do not receive the EOB, <strong>and</strong> are unable to obtain the primary payment information by<br />

phone, the claim will be denied with a request for a copy of the primary EOB before<br />

processing can be completed.<br />

Questions<br />

If you have questions about COB, contact our Customer Service department (phone number<br />

on the back of the member’s ID card).<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 24

Section 14: Third-party Liability <strong>and</strong> Subrogation<br />

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Subrogation<br />

Injury<br />

Accident<br />

<strong>Claims</strong><br />

Subrogation permits the plan to recover payments when the negligence or wrongdoing of<br />

another causes a member personal illness or injury. A subrogation provision is included in<br />

both member <strong>and</strong> physician/provider contracts. In third-party cases, this provision permits<br />

the plan to recover the medical bill costs on behalf of the member.<br />

The member’s benefit program contains special provisions for benefits when an injury or<br />

condition is:<br />

1. Caused by another party (e.g., slip <strong>and</strong> fall, medical malpractice, etc.)<br />

2. Covered under the provisions of motor vehicle medical policy, personal injury<br />

protection (PIP), medical payments (Medpay)<br />

3. Uninsured (UIM) <strong>and</strong>/or underinsured (UM) motorist or other similar coverage (e.g.,<br />

homeowners, commercial medical premises)<br />

4. Covered by Workers’ Compensation.<br />

An onset date should be recorded on all accident related claims. The claim(s) will suspend<br />

<strong>and</strong> a processor will review to determine whether to send an Incident Questionnaire (IQ) to<br />

the member. If the member does not return the IQ within the specified time frame, we will<br />

deny the claim(s). Once the IQ is returned, all claims are reviewed <strong>and</strong> processed<br />

accordingly. If no specific accident occurred or the condition is not work related the<br />

member may contact Customer Service <strong>and</strong> give a description of how the incident<br />

occurred. In most cases the information can be updated <strong>and</strong> the claim(s) released for<br />

processing.<br />

Note: The member can locate the Customer Service number on the reverse side of their<br />

<strong>Premera</strong> ID card.<br />

The IQ is available on the provider home page of premera.com/provider in the Library<br />

section under Forms. A provider has the option to print <strong>and</strong> assist the member in<br />

completing the form, but it’s important to review the instructions included with the form<br />

because the patient must complete the form <strong>and</strong> then sign it.<br />

The member or provider can submit the completed IQ using one of the following methods:<br />

Fax: 425-918-5355, or 425-918-5878<br />

Mail:<br />

Subrogation Department<br />

MS 227<br />

P.O. Box 327<br />

Seattle, WA 98111-327<br />

We will send the member an IQ if the claim is potentially accident-related. When the<br />

member completes <strong>and</strong> returns the IQ form to the Subrogation Case Management<br />

department, a representative will screen it to determine if another party is primary. This<br />

review is necessary to determine whether the claim should be covered by that party (e.g.,<br />

PIP, Medpay or similar coverage – homeowners or a commercial medical premise policy).<br />

Benefits are not available through <strong>Premera</strong> until the first-party carrier has exhausted,<br />

denied, or stopped paying due to its policy limits. Once we have received a payment ledger<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 25

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

from the first-party carrier showing where they paid out their limits, we will process all<br />

related claims accordingly <strong>and</strong> under the terms of our subscriber’s contract. If the IQ states<br />

that there is no first-party coverage available, but there is a third-party liability available,<br />

we will process all related claims until all parties are ready to negotiate a settlement for<br />

possible reimbursement.<br />

Workers’<br />

Compensation<br />

Workers’ Compensation will pay when the member’s employer is liable to pay medical<br />

bills resulting from illness or injury arising out of, or in, the scope of employment. All<br />

<strong>Premera</strong> contracts exclude coverage for care covered under the Workers’ Compensation<br />

Act.<br />

<strong>Claims</strong> submitted with a diagnosis that indicates possible Workers’ Compensation injuries<br />

are investigated. We send the member a questionnaire requesting information to determine<br />

if benefits are available. If we do not receive a response within the specified period, the<br />

claim is denied pending further information. If the information received indicates an onthe-job<br />

illness or injury, both the member <strong>and</strong> physician/provider will receive a denial that<br />

states the <strong>Premera</strong> contract excludes work-related conditions.<br />

Closed Workers’ Comp <strong>Claims</strong>: The member has seven years from the date of first<br />

closure to reopen their claim if needed, <strong>and</strong> can do so multiple times.<br />

Denied Workers’ Comp <strong>Claims</strong>: Subrogation will review all Workers’ Comp denials; if<br />

the denial is valid, Subro will update to process claims based on members contract benefits<br />

If an invalid denial is received, Subro will contact the members to advise them.<br />

Examples of invalid denials:<br />

Timely filing<br />

No authorization<br />

Workers’ comp carrier did not receive information requested to make their decision<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 26

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Section 15: Provider Appeals<br />

Complaint<br />

<strong>and</strong> Appeal<br />

Process<br />

Dentists have the right to appeal certain <strong>Premera</strong> actions. Our provider appeals process<br />

ensures that we address a complaint or an appeal in a fair <strong>and</strong> timely manner. Our process<br />

meets or exceeds the requirements set by the Alaska Division of Insurance.<br />

The provider appeal process applies to dental providers contracted with <strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong><br />

<strong>Blue</strong> Shield of Alaska.<br />

Important: An office has the option to start the claims issue resolution process at the<br />

complaint or Level I Appeal stage; however, either stage must take place within 365 days of<br />

the <strong>Premera</strong> action that prompted the dispute.<br />

Complaint<br />

Occurs when an office communicates an issue (verbally or in writing) to a <strong>Premera</strong> associate<br />

regarding a <strong>Premera</strong> action. An office has 365 calendar days to submit a complaint following<br />

the <strong>Premera</strong> action that prompted the complaint.<br />

If we receive the complaint before the 365-day deadline, it is reviewed <strong>and</strong> a decision is issued<br />

within 30 calendar days via telephone or letter. You also receive information about how to<br />

submit a Level I Appeal should you disagree with the decision.<br />

A complaint can be made verbally or in writing to Customer Service. You can reach Customer<br />

Service by calling 800-722-4714, option 2. The plan mailing addresses are located in<br />

Chapter 1, Section 2 in Contact Information.<br />

Level I<br />

Appeal<br />

A Level I Appeal is used to:<br />

Dispute a <strong>Premera</strong> action, or<br />

Appeal a decision on a previously submitted complaint.<br />

Note: If you already filed a complaint <strong>and</strong> are appealing its outcome, the Level I Appeal must<br />

be submitted within the same 365-day time period of the <strong>Premera</strong> action that prompted the<br />

dispute. Only appeals received within this time period will be accepted for review.<br />

Modifications we make to your contract or to our policy or procedures are not subject to<br />

appeal unless we made it in violation of your contract or the law.<br />

Level I<br />

Appeal,<br />

continued<br />

A Level I Appeal is used for both billing <strong>and</strong> non-billing issues. A billing issue is classified as<br />

a provider appeal because the issue directly impacts your write-off or payment amount. A<br />

non-billing issue is classified as a member appeal because the financial liability is that of the<br />

member, not the provider (please refer to Chapter 6, Section 4; Member Appeals). Here are<br />

examples:<br />

Billing Example<br />

Non-Billing Example<br />

Bundling or Inclusive Procedures<br />

Service not a benefit of subscriber’s contract<br />

A Level I Appeal must be submitted with complete supporting documentation that includes<br />

all of the following:<br />

A detailed description of the disputed issue<br />

Your position on the disputed issue<br />

All evidence offered by you in support of your position including medical/dental records<br />

A description of the resolution you are requesting<br />

<strong>Claims</strong> <strong>and</strong> <strong>Payment</strong> Chapter 7 Page 27

<strong>Premera</strong> Dental Reference Manual<br />

<strong>Premera</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>Blue</strong> Shield of Alaska<br />

Incomplete appeal submissions are returned to the sender. The time period does not start until<br />

we receive a complete appeal. Once the submission is complete, <strong>and</strong> if the issue is:<br />

Billing related we review the request <strong>and</strong> issue a decision within 30 days along with<br />

your right to submit a Level II Appeal, if you are not satisfied with the outcome.<br />

Non-billing related we review the request <strong>and</strong> issue a decision within 60 calendar days.<br />

o Only a member can request a Level II Appeal for a non-billing issue, unless the<br />

member has completed a release to allow the provider to act as their Representative.<br />

Level II<br />

Appeal<br />

Mediation<br />

Must be submitted within 15 calendar days of the Level I decision <strong>and</strong> can only pertain to a<br />

billing issue. If the appeal is timely <strong>and</strong> complete, the appeal is reviewed. We notify you in<br />

writing if the Level II Appeal is not timely. Once we accept your Level II Appeal, we respond<br />

within 15 days in writing. We also provide information regarding mediation should you<br />

disagree with the decision.<br />

You have 30 calendar days to submit a mediation request after receiving the Level I decision<br />

on a non-billing dispute, or a Level II decision on a billing dispute. We notify you in writing if<br />

the request for mediation is not timely.<br />

If your request for mediation is within the time limits, both parties must agree upon a<br />

mediator. The mediator consults with the parties, determines a process, <strong>and</strong> schedules the<br />

mediation. If we cannot resolve the matter through non-binding mediation, either one of us<br />

may institute an action in any Superior Court of competent jurisdiction.<br />

The mediator’s fees are shared equally between the parties. All other related costs incurred by<br />

the parties shall be the responsibility of whoever incurred the cost.<br />

Submitting<br />

an Appeal<br />

To submit either a Level I, Level II or Mediation Appeal, send complete documentation to:<br />

Physician <strong>and</strong> Provider Appeals<br />

P.O. Box 91102<br />

Seattle, WA 98111-9202<br />

Appeal<br />

Submission<br />

Diagram<br />