Guam Business Resource Guide

Guam Business Resource Guide

Guam Business Resource Guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

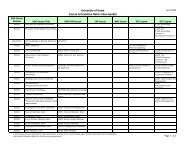

4.1.5 BUSINESS STRUCTURE CHART<br />

Features of the Major Forms of <strong>Business</strong> Ownership<br />

Source: www.bizstats.com<br />

Feature<br />

Sole<br />

Proprietorship Partnership C Corporation S Corporation<br />

Limited Liability<br />

Company<br />

Owner’s personal<br />

liability:<br />

Unlimited<br />

Unlimited for general<br />

partners.<br />

Limited for limited<br />

partners.<br />

Limited Limited Limited<br />

Number of owners:<br />

1 2 or more (at least<br />

1 general partner<br />

required)<br />

Any number Maximum of 75<br />

(with restriction<br />

on who they are)<br />

2 or more<br />

Tax Liability<br />

Single tax:<br />

Proprietor pays at<br />

individual rate<br />

Single tax:<br />

Partners pay on<br />

their proportional<br />

shares at individual<br />

rate<br />

Double tax: corporation<br />

pays tax<br />

and shareholders<br />

pay tax on dividends<br />

distributed<br />

Single tax:<br />

Owners pay on<br />

their proportional<br />

shares at individual<br />

rate<br />

Single tax:<br />

Members pay on<br />

their proportional<br />

shares at individual<br />

rate<br />

Transferability<br />

of ownership:<br />

Fully transferable<br />

through sale or<br />

transfer of company<br />

assets<br />

May require consent<br />

of all partners<br />

Fully transferable<br />

Transferable (but<br />

transfer may affect<br />

S status)<br />

Usually requires<br />

consent of all<br />

members<br />

Continuity of<br />

business:<br />

Ends on death or<br />

disability of proprietor<br />

or upon<br />

termination by<br />

proprietor<br />

Dissolves upon<br />

death, disability,<br />

or retirement of a<br />

general partner<br />

(business may continue)<br />

<strong>Business</strong> continues <strong>Business</strong> continues <strong>Business</strong> continues<br />

Comments:<br />

Low legal<br />

compliance;<br />

insurance protection<br />

can be established<br />

to offset<br />

unlimited liability<br />

Low legal<br />

compliance;<br />

insurance protection<br />

can be established<br />

to offset<br />

unlimited liability<br />

High legal<br />

compliance;<br />

need to manage to<br />

minimize profits<br />

and taxation<br />

High legal<br />

compliance<br />

High legal<br />

compliance;<br />

relatively high<br />

compliance costs<br />

18

![Residence Hall Application Form [PDF]](https://img.yumpu.com/46340085/1/190x245/residence-hall-application-form-pdf.jpg?quality=85)

![Modern compiler design [PDF]](https://img.yumpu.com/37285279/1/190x245/modern-compiler-design-pdf.jpg?quality=85)