Guam Business Resource Guide

Guam Business Resource Guide

Guam Business Resource Guide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

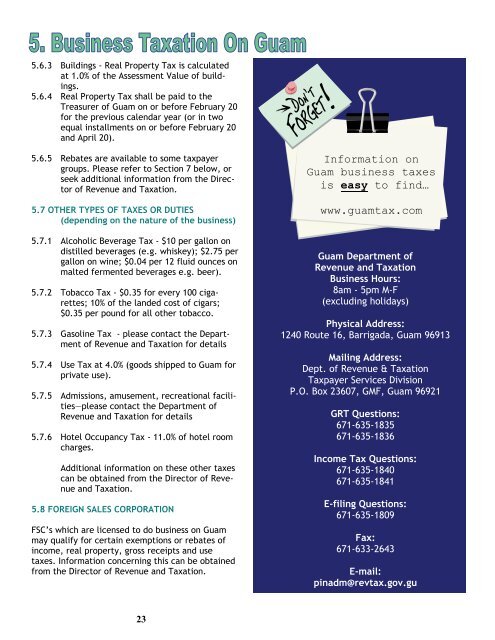

5.6.3 Buildings - Real Property Tax is calculated<br />

at 1.0% of the Assessment Value of buildings.<br />

5.6.4 Real Property Tax shall be paid to the<br />

Treasurer of <strong>Guam</strong> on or before February 20<br />

for the previous calendar year (or in two<br />

equal installments on or before February 20<br />

and April 20).<br />

5.6.5 Rebates are available to some taxpayer<br />

groups. Please refer to Section 7 below, or<br />

seek additional information from the Director<br />

of Revenue and Taxation.<br />

5.7 OTHER TYPES OF TAXES OR DUTIES<br />

(depending on the nature of the business)<br />

5.7.1 Alcoholic Beverage Tax - $10 per gallon on<br />

distilled beverages (e.g. whiskey); $2.75 per<br />

gallon on wine; $0.04 per 12 fluid ounces on<br />

malted fermented beverages e.g. beer).<br />

5.7.2 Tobacco Tax - $0.35 for every 100 cigarettes;<br />

10% of the landed cost of cigars;<br />

$0.35 per pound for all other tobacco.<br />

5.7.3 Gasoline Tax - please contact the Department<br />

of Revenue and Taxation for details<br />

5.7.4 Use Tax at 4.0% (goods shipped to <strong>Guam</strong> for<br />

private use).<br />

5.7.5 Admissions, amusement, recreational facilities—please<br />

contact the Department of<br />

Revenue and Taxation for details<br />

5.7.6 Hotel Occupancy Tax - 11.0% of hotel room<br />

charges.<br />

Additional information on these other taxes<br />

can be obtained from the Director of Revenue<br />

and Taxation.<br />

5.8 FOREIGN SALES CORPORATION<br />

FSC’s which are licensed to do business on <strong>Guam</strong><br />

may qualify for certain exemptions or rebates of<br />

income, real property, gross receipts and use<br />

taxes. Information concerning this can be obtained<br />

from the Director of Revenue and Taxation.<br />

Information on<br />

<strong>Guam</strong> business taxes<br />

is easy to find…<br />

www.guamtax.com<br />

<strong>Guam</strong> Department of<br />

Revenue and Taxation<br />

<strong>Business</strong> Hours:<br />

8am - 5pm M-F<br />

(excluding holidays)<br />

Physical Address:<br />

1240 Route 16, Barrigada, <strong>Guam</strong> 96913<br />

Mailing Address:<br />

Dept. of Revenue & Taxation<br />

Taxpayer Services Division<br />

P.O. Box 23607, GMF, <strong>Guam</strong> 96921<br />

GRT Questions:<br />

671-635-1835<br />

671-635-1836<br />

Income Tax Questions:<br />

671-635-1840<br />

671-635-1841<br />

E-filing Questions:<br />

671-635-1809<br />

Fax:<br />

671-633-2643<br />

E-mail:<br />

pinadm@revtax.gov.gu<br />

23

![Residence Hall Application Form [PDF]](https://img.yumpu.com/46340085/1/190x245/residence-hall-application-form-pdf.jpg?quality=85)

![Modern compiler design [PDF]](https://img.yumpu.com/37285279/1/190x245/modern-compiler-design-pdf.jpg?quality=85)