Living in a materiaL worLd - Minnesota Precision Manufacturing ...

Living in a materiaL worLd - Minnesota Precision Manufacturing ...

Living in a materiaL worLd - Minnesota Precision Manufacturing ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COVer | RAW MATERIALS<br />

did demand. It proved to be a very bad<br />

year for the company.<br />

After bottom<strong>in</strong>g out last July, Chicago<br />

Tube & Iron f<strong>in</strong>ally is see<strong>in</strong>g a modest<br />

<strong>in</strong>crease <strong>in</strong> demand, although it is down<br />

considerably from early 2008. Larry<br />

Soehrman, vice president of materials<br />

management, said the company is<br />

beg<strong>in</strong>n<strong>in</strong>g to keep a little more material<br />

on hand, anticipat<strong>in</strong>g demand to pick up<br />

<strong>in</strong> the second half of the year. However,<br />

he th<strong>in</strong>ks lead times are a bigger problem<br />

than supply right now.<br />

“One of the biggest problems is<br />

that most of the mills and distributors<br />

are work<strong>in</strong>g at less than full capacity,”<br />

he said. “So if there’s a slight uptick <strong>in</strong><br />

demand, it shows up fairly quickly. That’s<br />

why we’re see<strong>in</strong>g lead times <strong>in</strong>crease a<br />

bit. It’s not because there’s a problem<br />

with supply; it’s because there aren’t as<br />

many people work<strong>in</strong>g.”<br />

His advice to manufacturers is to<br />

plan ahead.<br />

“If you have any unusual items that<br />

are critical to a customer base, you’re<br />

better off gett<strong>in</strong>g those on order sooner<br />

rather than later; because, if there is a<br />

ramp up, it will be difficult for suppliers<br />

to react as quickly as they did before,<br />

because they’re runn<strong>in</strong>g on shorter hours<br />

and shorter staff,” Soehrman said.<br />

The Future of the Market<br />

Free said he can’t predict when<br />

prices will level out aga<strong>in</strong>, but he<br />

expects them to rema<strong>in</strong> highly volatile<br />

this year as the economy gets <strong>in</strong>to fits<br />

and starts with recovery.<br />

Surcharges, he believes, have become<br />

a permanent feature <strong>in</strong> the market for<br />

raw materials used <strong>in</strong> manufactur<strong>in</strong>g,<br />

and shops that offer fixed prices for their<br />

products do so at their own peril.<br />

He and other analysts will be keep<strong>in</strong>g<br />

a close eye on the hous<strong>in</strong>g and auto<br />

<strong>in</strong>dustries. Houses require large amounts<br />

of steel, and contractors drive light trucks,<br />

which also require large amounts of steel.<br />

These two <strong>in</strong>dustries are a major part of<br />

the metal ecosystem and have a significant<br />

effect on supply, demand and price.<br />

Natural disasters are another powerful<br />

<strong>in</strong>fluence on the price of metals. One<br />

day after an earthquake struck Chile, for<br />

example, copper prices went up 2 percent.<br />

Chile is the world’s largest producer<br />

of copper and, although the m<strong>in</strong>es<br />

themselves weren’t damaged, electricity<br />

was <strong>in</strong>terrupted.<br />

So how do you <strong>in</strong>telligently manage<br />

risk when the price of your raw<br />

material—which may be half your part<br />

costs—doubles?<br />

“You don’t give firm prices for a year,<br />

that’s for sure,” Free said.<br />

“The advice I would give<br />

manufacturers,” he concluded, “is that it’s<br />

probably more important to know where<br />

you can f<strong>in</strong>d material than what you<br />

ultimately will pay for it. I’m not say<strong>in</strong>g<br />

give away your product, but price for<br />

immediate delivery trumps low price for<br />

2 months out from now.”<br />

It’s a material world, <strong>in</strong>deed. PM<br />

Melissa DeBilzan is a contribut<strong>in</strong>g writer<br />

for Intr<strong>in</strong>xec Management, Inc. She can be<br />

reached at melissa@mpma.com.<br />

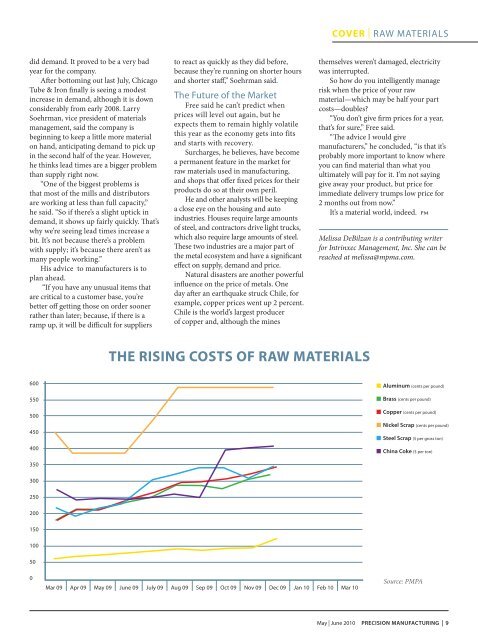

THE RISING COSTS OF RAW MATERIALS<br />

600<br />

550<br />

500<br />

450<br />

400<br />

Alum<strong>in</strong>um (cents per pound)<br />

Brass (cents per pound)<br />

Copper (cents per pound)<br />

Nickel Scrap (cents per pound)<br />

Steel Scrap ($ per gross ton)<br />

Ch<strong>in</strong>a Coke ($ per ton)<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Mar 09 Apr 09 May 09 June 09 July 09 Aug 09 Sep 09 Oct 09 Nov 09 Dec 09 Jan 10 Feb 10 Mar 10<br />

Source: PMPA<br />

May | June 2010 PRECISION MANUFACTURING | 9