Hatching For The Future - teo seng capital berhad

Hatching For The Future - teo seng capital berhad

Hatching For The Future - teo seng capital berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

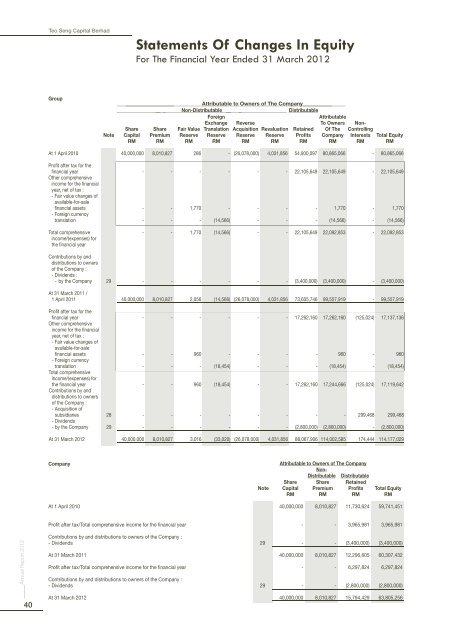

Teo Seng Capital Berhad<br />

Statements Of Changes In Equity<br />

<strong>For</strong> <strong>The</strong> Financial Year Ended 31 March 2012<br />

Group<br />

__________________<br />

Attributable to Owners of <strong>The</strong> Company___________<br />

__ _ Non-Distributable __ _<br />

Distributable<br />

<strong>For</strong>eign<br />

Attributable<br />

Exchange Reverse To Owners Non-<br />

Share Share Fair Value Translation Acquisition Revaluation Retained Of <strong>The</strong> Controlling<br />

Note Capital Premium Reserve Reserve Reserve Reserve Profits Company Interests Total Equity<br />

RM RM RM RM RM RM RM RM RM RM<br />

At 1 April 2010 40,000,000 8,010,827 286 - (26,078,000) 4,031,856 54,900,097 80,865,066 - 80,865,066<br />

Profit after tax for the<br />

financial year - - - - - - 22,105,649 22,105,649 - 22,105,649<br />

Other comprehensive<br />

income for the financial<br />

year, net of tax :<br />

- Fair value changes of<br />

available-for-sale<br />

financial assets - - 1,770 - - - - 1,770 - 1,770<br />

- <strong>For</strong>eign currency<br />

translation - - - (14,566) - - - (14,566) - (14,566)<br />

Total comprehensive - - 1,770 (14,566) - - 22,105,649 22,092,853 - 22,092,853<br />

income/(expenses) for<br />

the financial year<br />

Contributions by and<br />

distributions to owners<br />

of the Company :<br />

- Dividends :<br />

- by the Company 29 - - - - - - (3,400,000) (3,400,000) - (3,400,000)<br />

At 31 March 2011 /<br />

1 April 2011 40,000,000 8,010,827 2,056 (14,566) (26,078,000) 4,031,856 73,605,746 99,557,919 - 99,557,919<br />

Profit after tax for the<br />

financial year - - - - - - 17,262,160 17,262,160 (125,024) 17,137,136<br />

Other comprehensive<br />

income for the financial<br />

year, net of tax :<br />

- Fair value changes of<br />

available-for-sale<br />

financial assets - - 960 - - - - 960 - 960<br />

- <strong>For</strong>eign currency<br />

translation - - - (18,454) - - - (18,454) - (18,454)<br />

Total comprehensive<br />

income/(expenses) for<br />

the financial year - - 960 (18,454) - - 17,262,160 17,244,666 (125,024) 17,119,642<br />

Contributions by and<br />

distributions to owners<br />

of the Company :<br />

- Acquisition of<br />

subsidiaries 28 - - - - - - - - 299,468 299,468<br />

- Dividends<br />

- by the Company 29 - - - - - - (2,800,000) (2,800,000) - (2,800,000)<br />

At 31 March 2012 40,000,000 8,010,827 3,016 (33,020) (26,078,000) 4,031,856 88,067,906 114,002,585 174,444 114,177,029<br />

Company<br />

Attributable to Owners of <strong>The</strong> Company<br />

Non-<br />

Distributable Distributable<br />

Share Share Retained<br />

Note Capital Premium Profits Total Equity<br />

RM RM RM RM<br />

At 1 April 2010 40,000,000 8,010,827 11,730,624 59,741,451<br />

Profit after tax/Total comprehensive income for the financial year - - 3,965,981 3,965,981<br />

Annual Report 2012<br />

40<br />

Contributions by and distributions to owners of the Company :<br />

- Dividends 29 - - (3,400,000) (3,400,000)<br />

At 31 March 2011 40,000,000 8,010,827 12,296,605 60,307,432<br />

Profit after tax/Total comprehensive income for the financial year - - 6,297,824 6,297,824<br />

Contributions by and distributions to owners of the Company :<br />

- Dividends 29 - - (2,800,000) (2,800,000)<br />

At 31 March 2012 40,000,000 8,010,827 15,794,429 63,805,256