Hatching For The Future - teo seng capital berhad

Hatching For The Future - teo seng capital berhad

Hatching For The Future - teo seng capital berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Teo Seng Capital Berhad<br />

Notes To <strong>The</strong> Financial Statements<br />

<strong>For</strong> <strong>The</strong> Financial Year Ended 31 March 2012<br />

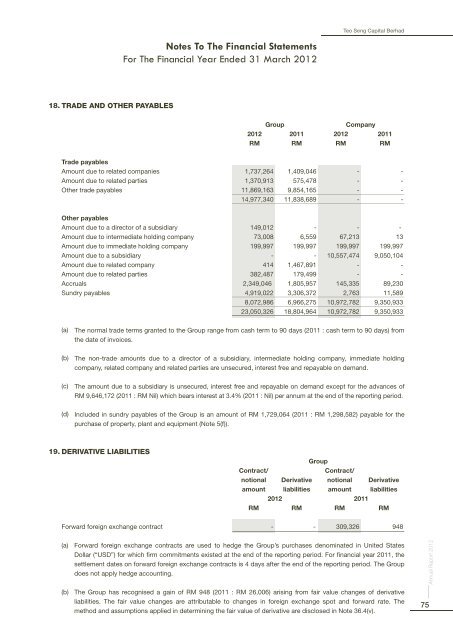

18. TRADE AND OTHER PAYABLES<br />

Group<br />

Company<br />

2012 2011 2012 2011<br />

RM RM RM RM<br />

Trade payables<br />

Amount due to related companies 1,737,264 1,409,046 - -<br />

Amount due to related parties 1,370,913 575,478 - -<br />

Other trade payables 11,869,163 9,854,165 - -<br />

14,977,340 11,838,689 - -<br />

Other payables<br />

Amount due to a director of a subsidiary 149,012 - - -<br />

Amount due to intermediate holding company 73,008 6,559 67,213 13<br />

Amount due to immediate holding company 199,997 199,997 199,997 199,997<br />

Amount due to a subsidiary - - 10,557,474 9,050,104<br />

Amount due to related company 414 1,467,891 - -<br />

Amount due to related parties 382,487 179,499 - -<br />

Accruals 2,349,046 1,805,957 145,335 89,230<br />

Sundry payables 4,919,022 3,306,372 2,763 11,589<br />

8,072,986 6,966,275 10,972,782 9,350,933<br />

23,050,326 18,804,964 10,972,782 9,350,933<br />

(a)<br />

<strong>The</strong> normal trade terms granted to the Group range from cash term to 90 days (2011 : cash term to 90 days) from<br />

the date of invoices.<br />

(b)<br />

<strong>The</strong> non-trade amounts due to a director of a subsidiary, intermediate holding company, immediate holding<br />

company, related company and related parties are unsecured, interest free and repayable on demand.<br />

(c)<br />

<strong>The</strong> amount due to a subsidiary is unsecured, interest free and repayable on demand except for the advances of<br />

RM 9,646,172 (2011 : RM Nil) which bears interest at 3.4% (2011 : Nil) per annum at the end of the reporting period.<br />

(d)<br />

Included in sundry payables of the Group is an amount of RM 1,729,064 (2011 : RM 1,298,582) payable for the<br />

purchase of property, plant and equipment (Note 5(f)).<br />

19. DERIVATIVE LIABILITIES<br />

Group<br />

Contract/<br />

Contract/<br />

notional Derivative notional Derivative<br />

amount liabilities amount liabilities<br />

2012 2011<br />

RM RM RM RM<br />

<strong>For</strong>ward foreign exchange contract - - 309,326 948<br />

(a)<br />

(b)<br />

<strong>For</strong>ward foreign exchange contracts are used to hedge the Group’s purchases denominated in United States<br />

Dollar (“USD”) for which firm commitments existed at the end of the reporting period. <strong>For</strong> financial year 2011, the<br />

settlement dates on forward foreign exchange contracts is 4 days after the end of the reporting period. <strong>The</strong> Group<br />

does not apply hedge accounting.<br />

<strong>The</strong> Group has recognised a gain of RM 948 (2011 : RM 26,006) arising from fair value changes of derivative<br />

liabilities. <strong>The</strong> fair value changes are attributable to changes in foreign exchange spot and forward rate. <strong>The</strong><br />

method and assumptions applied in determining the fair value of derivative are disclosed in Note 36.4(v).<br />

Annual Report 2012<br />

75