Hatching For The Future - teo seng capital berhad

Hatching For The Future - teo seng capital berhad

Hatching For The Future - teo seng capital berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Teo Seng Capital Berhad<br />

Notes To <strong>The</strong> Financial Statements<br />

<strong>For</strong> <strong>The</strong> Financial Year Ended 31 March 2012<br />

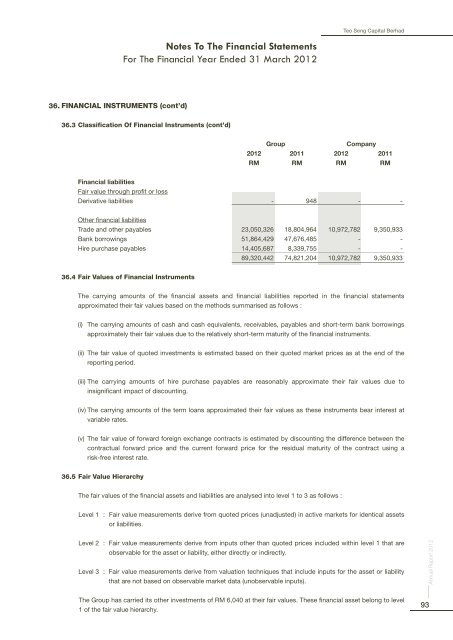

36. FINANCIAL INSTRUMENTS (cont’d)<br />

36.3 Classification Of Financial Instruments (cont’d)<br />

Group<br />

Company<br />

2012 2011 2012 2011<br />

RM RM RM RM<br />

Financial liabilities<br />

Fair value through profit or loss<br />

Derivative liabilities - 948 - -<br />

Other financial liabilities<br />

Trade and other payables 23,050,326 18,804,964 10,972,782 9,350,933<br />

Bank borrowings 51,864,429 47,676,485 - -<br />

Hire purchase payables 14,405,687 8,339,755 - -<br />

89,320,442 74,821,204 10,972,782 9,350,933<br />

36.4 Fair Values of Financial Instruments<br />

<strong>The</strong> carrying amounts of the financial assets and financial liabilities reported in the financial statements<br />

approximated their fair values based on the methods summarised as follows :<br />

(i)<br />

<strong>The</strong> carrying amounts of cash and cash equivalents, receivables, payables and short-term bank borrowings<br />

approximately their fair values due to the relatively short-term maturity of the financial instruments.<br />

(ii)<br />

<strong>The</strong> fair value of quoted investments is estimated based on their quoted market prices as at the end of the<br />

reporting period.<br />

(iii) <strong>The</strong> carrying amounts of hire purchase payables are reasonably approximate their fair values due to<br />

insignificant impact of discounting.<br />

(iv) <strong>The</strong> carrying amounts of the term loans approximated their fair values as these instruments bear interest at<br />

variable rates.<br />

(v) <strong>The</strong> fair value of forward foreign exchange contracts is estimated by discounting the difference between the<br />

contractual forward price and the current forward price for the residual maturity of the contract using a<br />

risk-free interest rate.<br />

36.5 Fair Value Hierarchy<br />

<strong>The</strong> fair values of the financial assets and liabilities are analysed into level 1 to 3 as follows :<br />

Level 1 :<br />

Fair value measurements derive from quoted prices (unadjusted) in active markets for identical assets<br />

or liabilities.<br />

Level 2 :<br />

Level 3 :<br />

Fair value measurements derive from inputs other than quoted prices included within level 1 that are<br />

observable for the asset or liability, either directly or indirectly.<br />

Fair value measurements derive from valuation techniques that include inputs for the asset or liability<br />

that are not based on observable market data (unobservable inputs).<br />

Annual Report 2012<br />

<strong>The</strong> Group has carried its other investments of RM 6,040 at their fair values. <strong>The</strong>se financial asset belong to level<br />

1 of the fair value hierarchy.<br />

93