Faculty Association - Capital Region BOCES

Faculty Association - Capital Region BOCES

Faculty Association - Capital Region BOCES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

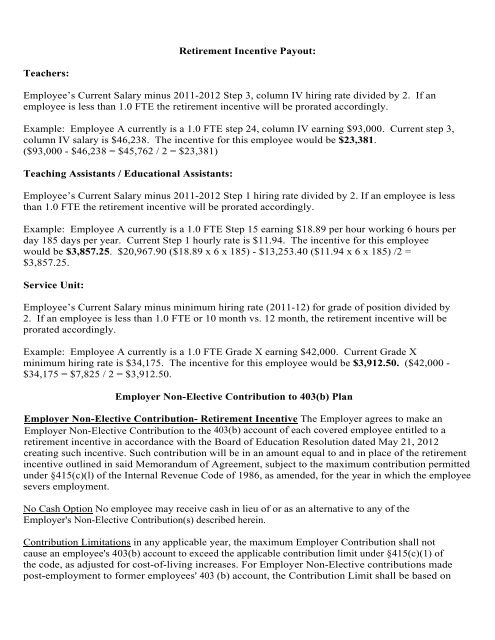

Retirement Incentive Payout:<br />

Teachers:<br />

Employee’s Current Salary minus 2011-2012 Step 3, column IV hiring rate divided by 2. If an<br />

employee is less than 1.0 FTE the retirement incentive will be prorated accordingly.<br />

Example: Employee A currently is a 1.0 FTE step 24, column IV earning $93,000. Current step 3,<br />

column IV salary is $46,238. The incentive for this employee would be $23,381.<br />

($93,000 - $46,238 = $45,762 / 2 = $23,381)<br />

Teaching Assistants / Educational Assistants:<br />

Employee’s Current Salary minus 2011-2012 Step 1 hiring rate divided by 2. If an employee is less<br />

than 1.0 FTE the retirement incentive will be prorated accordingly.<br />

Example: Employee A currently is a 1.0 FTE Step 15 earning $18.89 per hour working 6 hours per<br />

day 185 days per year. Current Step 1 hourly rate is $11.94. The incentive for this employee<br />

would be $3,857.25. $20,967.90 ($18.89 x 6 x 185) - $13,253.40 ($11.94 x 6 x 185) /2 =<br />

$3,857.25.<br />

Service Unit:<br />

Employee’s Current Salary minus minimum hiring rate (2011-12) for grade of position divided by<br />

2. If an employee is less than 1.0 FTE or 10 month vs. 12 month, the retirement incentive will be<br />

prorated accordingly.<br />

Example: Employee A currently is a 1.0 FTE Grade X earning $42,000. Current Grade X<br />

minimum hiring rate is $34,175. The incentive for this employee would be $3,912.50. ($42,000 -<br />

$34,175 = $7,825 / 2 = $3,912.50.<br />

Employer Non-Elective Contribution to 403(b) Plan<br />

Employer Non-Elective Contribution- Retirement Incentive The Employer agrees to make an<br />

Employer Non-Elective Contribution to the 403(b) account of each covered employee entitled to a<br />

retirement incentive in accordance with the Board of Education Resolution dated May 21, 2012<br />

creating such incentive. Such contribution will be in an amount equal to and in place of the retirement<br />

incentive outlined in said Memorandum of Agreement, subject to the maximum contribution permitted<br />

under §415(c)(l) of the Internal Revenue Code of 1986, as amended, for the year in which the employee<br />

severs employment.<br />

No Cash Option No employee may receive cash in lieu of or as an alternative to any of the<br />

Employer's Non-Elective Contribution(s) described herein.<br />

Contribution Limitations in any applicable year, the maximum Employer Contribution shall not<br />

cause an employee's 403(b) account to exceed the applicable contribution limit under §415(c)(1) of<br />

the code, as adjusted for cost-of-living increases. For Employer Non-Elective contributions made<br />

post-employment to former employees' 403 (b) account, the Contribution Limit shall be based on