Faculty Association - Capital Region BOCES

Faculty Association - Capital Region BOCES

Faculty Association - Capital Region BOCES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

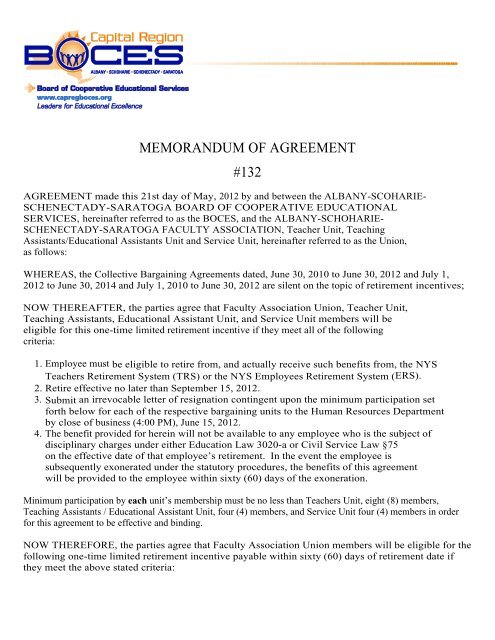

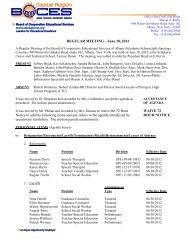

MEMORANDUM OF AGREEMENT<br />

#132<br />

AGREEMENT made this 21st day of May, 2012 by and between the ALBANY-SCOHARIE-<br />

SCHENECTADY-SARATOGA BOARD OF COOPERATIVE EDUCATIONAL<br />

SERVICES, hereinafter referred to as the <strong>BOCES</strong>, and the ALBANY-SCHOHARIE-<br />

SCHENECTADY-SARATOGA FACULTY ASSOCIATION, Teacher Unit, Teaching<br />

Assistants/Educational Assistants Unit and Service Unit, hereinafter referred to as the Union,<br />

as follows:<br />

WHEREAS, the Collective Bargaining Agreements dated, June 30, 2010 to June 30, 2012 and July 1,<br />

2012 to June 30, 2014 and July 1, 2010 to June 30, 2012 are silent on the topic of retirement incentives;<br />

NOW THEREAFTER, the parties agree that <strong>Faculty</strong> <strong>Association</strong> Union, Teacher Unit,<br />

Teaching Assistants, Educational Assistant Unit, and Service Unit members will be<br />

eligible for this one-time limited retirement incentive if they meet all of the following<br />

criteria:<br />

1. Employee must be eligible to retire from, and actually receive such benefits from, the NYS<br />

Teachers Retirement System (TRS) or the NYS Employees Retirement System (ERS).<br />

2. Retire effective no later than September 15, 2012.<br />

3. Submit an irrevocable letter of resignation contingent upon the minimum participation set<br />

forth below for each of the respective bargaining units to the Human Resources Department<br />

by close of business (4:00 PM), June 15, 2012.<br />

4. The benefit provided for herein will not be available to any employee who is the subject of<br />

disciplinary charges under either Education Law 3020-a or Civil Service Law §75<br />

on the effective date of that employee’s retirement. In the event the employee is<br />

subsequently exonerated under the statutory procedures, the benefits of this agreement<br />

will be provided to the employee within sixty (60) days of the exoneration.<br />

Minimum participation by each unit’s membership must be no less than Teachers Unit, eight (8) members,<br />

Teaching Assistants / Educational Assistant Unit, four (4) members, and Service Unit four (4) members in order<br />

for this agreement to be effective and binding.<br />

NOW THEREFORE, the parties agree that <strong>Faculty</strong> <strong>Association</strong> Union members will be eligible for the<br />

following one-time limited retirement incentive payable within sixty (60) days of retirement date if<br />

they meet the above stated criteria:

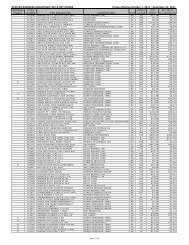

Retirement Incentive Payout:<br />

Teachers:<br />

Employee’s Current Salary minus 2011-2012 Step 3, column IV hiring rate divided by 2. If an<br />

employee is less than 1.0 FTE the retirement incentive will be prorated accordingly.<br />

Example: Employee A currently is a 1.0 FTE step 24, column IV earning $93,000. Current step 3,<br />

column IV salary is $46,238. The incentive for this employee would be $23,381.<br />

($93,000 - $46,238 = $45,762 / 2 = $23,381)<br />

Teaching Assistants / Educational Assistants:<br />

Employee’s Current Salary minus 2011-2012 Step 1 hiring rate divided by 2. If an employee is less<br />

than 1.0 FTE the retirement incentive will be prorated accordingly.<br />

Example: Employee A currently is a 1.0 FTE Step 15 earning $18.89 per hour working 6 hours per<br />

day 185 days per year. Current Step 1 hourly rate is $11.94. The incentive for this employee<br />

would be $3,857.25. $20,967.90 ($18.89 x 6 x 185) - $13,253.40 ($11.94 x 6 x 185) /2 =<br />

$3,857.25.<br />

Service Unit:<br />

Employee’s Current Salary minus minimum hiring rate (2011-12) for grade of position divided by<br />

2. If an employee is less than 1.0 FTE or 10 month vs. 12 month, the retirement incentive will be<br />

prorated accordingly.<br />

Example: Employee A currently is a 1.0 FTE Grade X earning $42,000. Current Grade X<br />

minimum hiring rate is $34,175. The incentive for this employee would be $3,912.50. ($42,000 -<br />

$34,175 = $7,825 / 2 = $3,912.50.<br />

Employer Non-Elective Contribution to 403(b) Plan<br />

Employer Non-Elective Contribution- Retirement Incentive The Employer agrees to make an<br />

Employer Non-Elective Contribution to the 403(b) account of each covered employee entitled to a<br />

retirement incentive in accordance with the Board of Education Resolution dated May 21, 2012<br />

creating such incentive. Such contribution will be in an amount equal to and in place of the retirement<br />

incentive outlined in said Memorandum of Agreement, subject to the maximum contribution permitted<br />

under §415(c)(l) of the Internal Revenue Code of 1986, as amended, for the year in which the employee<br />

severs employment.<br />

No Cash Option No employee may receive cash in lieu of or as an alternative to any of the<br />

Employer's Non-Elective Contribution(s) described herein.<br />

Contribution Limitations in any applicable year, the maximum Employer Contribution shall not<br />

cause an employee's 403(b) account to exceed the applicable contribution limit under §415(c)(1) of<br />

the code, as adjusted for cost-of-living increases. For Employer Non-Elective contributions made<br />

post-employment to former employees' 403 (b) account, the Contribution Limit shall be based on

the employee's compensation, as determined under §403(b)(3) of the Code.<br />

In the event that the calculation of the Employer Non-Elective Contribution exceeds the<br />

applicable contribution limit, the Employer shall first make an Employer Non-Elective<br />

Contribution up to the Contribution Limit of the Internal Revenue Code and then pay any excess<br />

amount as compensation directly to the Employee. In no instance shall the Employee have any<br />

rights to, including ability to receive, any excess amount as compensation unless and until<br />

compensation limit of the Internal Revenue Service Code are fully met through payment of the<br />

Employer's Non-Elective Contribution; and<br />

403(b) Accounts Employer Non-Elective Contributions shall be deposited into the 403(b) account<br />

selected by the employee to receive employer contributions provided such account will accept<br />

Employer Non-Elective contributions.<br />

Tier 1* Adjustments Tier I* members with membership dates prior to June 17, 1971, Employer<br />

Non-Elective Contributions hereunder will be reported as non-regular Contributions hereunder will<br />

be reported as non-regular compensation to the New York State Teachers Retirement System.<br />

*Applicable to NYSTRS Tier I Members<br />

This Memorandum of Agreement (MOA) shall be subject to Internal Revenue Service regulations<br />

and rulings. Should any portion be declared contrary to law, then such portion shall not be deemed<br />

valid and subsisting, but all other portions shall continue in full force and effect. As to the<br />

portions declared contrary to law, the <strong>BOCES</strong> and the PAO Union shall promptly meet and alter<br />

those portions in order to provide the same or similar benefit(s) which conform, as closest to possible,<br />

to the original intent of the parties.<br />

Both the Employer and Employee are responsible for providing both Elective and Employer Non-<br />

Elective Contributions and the amount of the participant's Includible Compensation,<br />

For Employer:<br />

By:<br />

Dated:<br />

For the <strong>Association</strong><br />

By:<br />

Date: