Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

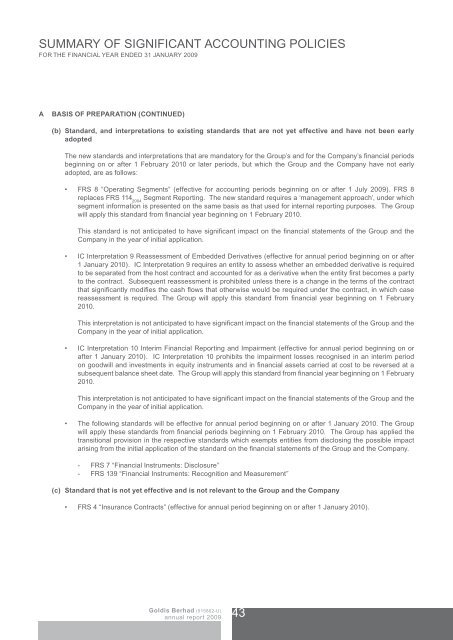

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

FOR THE FINANCIAL YEAR ENDED 31 JANUARY <strong>2009</strong><br />

A<br />

BASIS OF PREPARATION (CONTINUED)<br />

(b) Standard, and interpretations to existing standards that are not yet effective and have not been early<br />

adopted<br />

the new standards and interpretations that are mandatory for the Group’s and for the Company’s financial periods<br />

beginning on or after 1 February 2010 or later periods, but which the Group and the Company have not early<br />

adopted, are as follows:<br />

• FRS 8 “Operating Segments” (effective for accounting periods beginning on or after 1 July <strong>2009</strong>). FRS 8<br />

replaces FRS 114 2004<br />

Segment <strong>Report</strong>ing. The new standard requires a ‘management approach’, under which<br />

segment information is presented on the same basis as that used for internal reporting purposes. The Group<br />

will apply this standard from financial year beginning on 1 February 2010.<br />

This standard is not anticipated to have significant impact on the financial statements of the Group and the<br />

Company in the year of initial application.<br />

• IC Interpretation 9 Reassessment of Embedded Derivatives (effective for annual period beginning on or after<br />

1 January 2010). IC Interpretation 9 requires an entity to assess whether an embedded derivative is required<br />

to be separated from the host contract and accounted for as a derivative when the entity first becomes a party<br />

to the contract. Subsequent reassessment is prohibited unless there is a change in the terms of the contract<br />

that significantly modifies the cash flows that otherwise would be required under the contract, in which case<br />

reassessment is required. The Group will apply this standard from financial year beginning on 1 February<br />

2010.<br />

This interpretation is not anticipated to have significant impact on the financial statements of the Group and the<br />

Company in the year of initial application.<br />

• IC Interpretation 10 Interim Financial <strong>Report</strong>ing and Impairment (effective for annual period beginning on or<br />

after 1 January 2010). IC Interpretation 10 prohibits the impairment losses recognised in an interim period<br />

on goodwill and investments in equity instruments and in financial assets carried at cost to be reversed at a<br />

subsequent balance sheet date. The Group will apply this standard from financial year beginning on 1 February<br />

2010.<br />

This interpretation is not anticipated to have significant impact on the financial statements of the Group and the<br />

Company in the year of initial application.<br />

• The following standards will be effective for annual period beginning on or after 1 January 2010. The Group<br />

will apply these standards from financial periods beginning on 1 February 2010. The Group has applied the<br />

transitional provision in the respective standards which exempts entities from disclosing the possible impact<br />

arising from the initial application of the standard on the financial statements of the Group and the Company.<br />

- FRS 7 “Financial Instruments: Disclosure”<br />

- FRS 139 “Financial Instruments: Recognition and Measurement”<br />

(c) Standard that is not yet effective and is not relevant to the Group and the Company<br />

• FRS 4 “Insurance Contracts” (effective for annual period beginning on or after 1 January 2010).<br />

<strong>Goldis</strong> <strong>Berhad</strong> (515802-U)<br />

annual report <strong>2009</strong><br />

43