Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

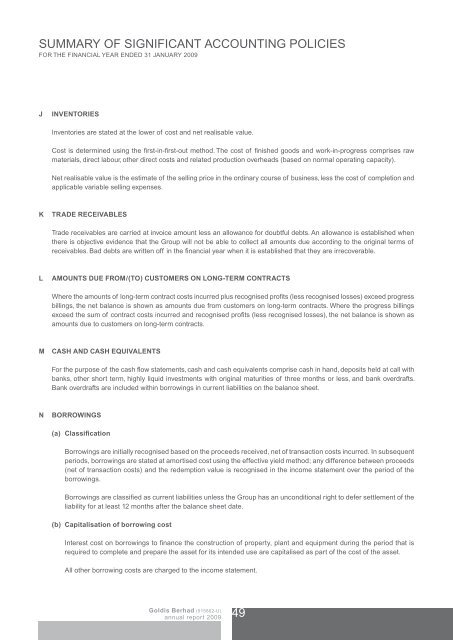

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

FOR THE FINANCIAL YEAR ENDED 31 JANUARY <strong>2009</strong><br />

J<br />

INVENTORIES<br />

Inventories are stated at the lower of cost and net realisable value.<br />

Cost is determined using the first-in-first-out method. The cost of finished goods and work-in-progress comprises raw<br />

materials, direct labour, other direct costs and related production overheads (based on normal operating capacity).<br />

Net realisable value is the estimate of the selling price in the ordinary course of business, less the cost of completion and<br />

applicable variable selling expenses.<br />

K<br />

TRADE RECEIVABLES<br />

Trade receivables are carried at invoice amount less an allowance for doubtful debts. An allowance is established when<br />

there is objective evidence that the Group will not be able to collect all amounts due according to the original terms of<br />

receivables. Bad debts are written off in the financial year when it is established that they are irrecoverable.<br />

L<br />

AMOUNTS DUE FROM/(TO) CUSTOMERS ON LONG-TERM CONTRACTS<br />

Where the amounts of long-term contract costs incurred plus recognised profits (less recognised losses) exceed progress<br />

billings, the net balance is shown as amounts due from customers on long-term contracts. Where the progress billings<br />

exceed the sum of contract costs incurred and recognised profits (less recognised losses), the net balance is shown as<br />

amounts due to customers on long-term contracts.<br />

M<br />

CASH AND CASH EQUIVALENTS<br />

For the purpose of the cash flow statements, cash and cash equivalents comprise cash in hand, deposits held at call with<br />

banks, other short term, highly liquid investments with original maturities of three months or less, and bank overdrafts.<br />

Bank overdrafts are included within borrowings in current liabilities on the balance sheet.<br />

N<br />

BORROWINGS<br />

(a) Classification<br />

Borrowings are initially recognised based on the proceeds received, net of transaction costs incurred. In subsequent<br />

periods, borrowings are stated at amortised cost using the effective yield method; any difference between proceeds<br />

(net of transaction costs) and the redemption value is recognised in the income statement over the period of the<br />

borrowings.<br />

Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement of the<br />

liability for at least 12 months after the balance sheet date.<br />

(b) Capitalisation of borrowing cost<br />

Interest cost on borrowings to finance the construction of property, plant and equipment during the period that is<br />

required to complete and prepare the asset for its intended use are capitalised as part of the cost of the asset.<br />

All other borrowing costs are charged to the income statement.<br />

<strong>Goldis</strong> <strong>Berhad</strong> (515802-U)<br />

annual report <strong>2009</strong><br />

49