Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

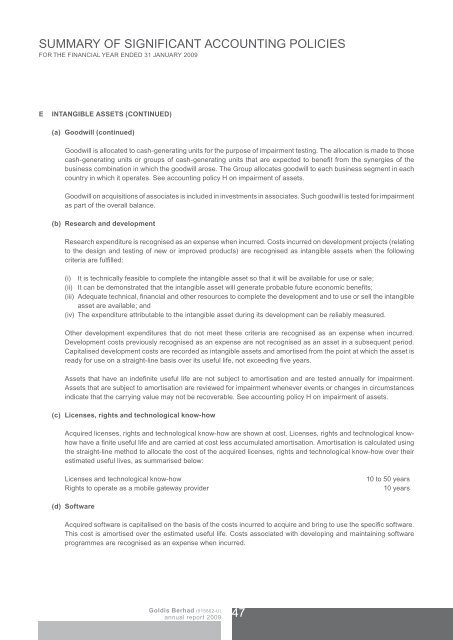

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

FOR THE FINANCIAL YEAR ENDED 31 JANUARY <strong>2009</strong><br />

E<br />

INTANGIBLE ASSETS (CONTINUED)<br />

(a) Goodwill (continued)<br />

Goodwill is allocated to cash-generating units for the purpose of impairment testing. The allocation is made to those<br />

cash-generating units or groups of cash-generating units that are expected to benefit from the synergies of the<br />

business combination in which the goodwill arose. The Group allocates goodwill to each business segment in each<br />

country in which it operates. See accounting policy H on impairment of assets.<br />

Goodwill on acquisitions of associates is included in investments in associates. Such goodwill is tested for impairment<br />

as part of the overall balance.<br />

(b) Research and development<br />

Research expenditure is recognised as an expense when incurred. Costs incurred on development projects (relating<br />

to the design and testing of new or improved products) are recognised as intangible assets when the following<br />

criteria are fulfilled:<br />

(i) It is technically feasible to complete the intangible asset so that it will be available for use or sale;<br />

(ii) It can be demonstrated that the intangible asset will generate probable future economic benefits;<br />

(iii) Adequate technical, financial and other resources to complete the development and to use or sell the intangible<br />

asset are available; and<br />

(iv) The expenditure attributable to the intangible asset during its development can be reliably measured.<br />

other development expenditures that do not meet these criteria are recognised as an expense when incurred.<br />

Development costs previously recognised as an expense are not recognised as an asset in a subsequent period.<br />

Capitalised development costs are recorded as intangible assets and amortised from the point at which the asset is<br />

ready for use on a straight-line basis over its useful life, not exceeding five years.<br />

Assets that have an indefinite useful life are not subject to amortisation and are tested annually for impairment.<br />

Assets that are subject to amortisation are reviewed for impairment whenever events or changes in circumstances<br />

indicate that the carrying value may not be recoverable. See accounting policy H on impairment of assets.<br />

(c) Licenses, rights and technological know-how<br />

Acquired licenses, rights and technological know-how are shown at cost. Licenses, rights and technological knowhow<br />

have a finite useful life and are carried at cost less accumulated amortisation. Amortisation is calculated using<br />

the straight-line method to allocate the cost of the acquired licenses, rights and technological know-how over their<br />

estimated useful lives, as summarised below:<br />

Licenses and technological know-how<br />

Rights to operate as a mobile gateway provider<br />

10 to 50 years<br />

10 years<br />

(d) Software<br />

Acquired software is capitalised on the basis of the costs incurred to acquire and bring to use the specific software.<br />

This cost is amortised over the estimated useful life. Costs associated with developing and maintaining software<br />

programmes are recognised as an expense when incurred.<br />

<strong>Goldis</strong> <strong>Berhad</strong> (515802-U)<br />

annual report <strong>2009</strong><br />

47