Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

Goldis Berhad Annual Report 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

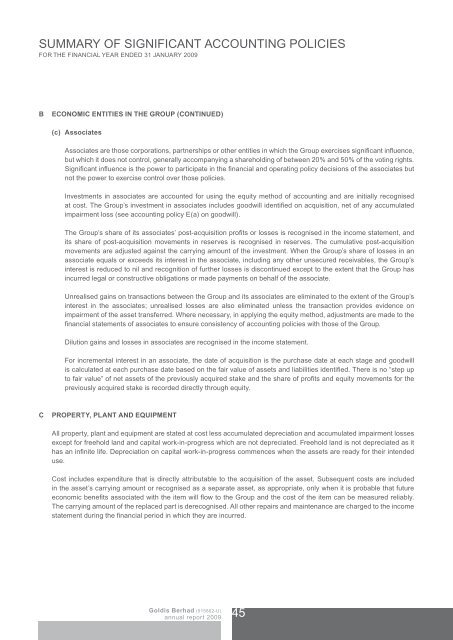

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

FOR THE FINANCIAL YEAR ENDED 31 JANUARY <strong>2009</strong><br />

B<br />

ECONOMIC ENTITIES IN THE GROUP (CONTINUED)<br />

(c) Associates<br />

Associates are those corporations, partnerships or other entities in which the Group exercises significant influence,<br />

but which it does not control, generally accompanying a shareholding of between 20% and 50% of the voting rights.<br />

Significant influence is the power to participate in the financial and operating policy decisions of the associates but<br />

not the power to exercise control over those policies.<br />

Investments in associates are accounted for using the equity method of accounting and are initially recognised<br />

at cost. The Group’s investment in associates includes goodwill identified on acquisition, net of any accumulated<br />

impairment loss (see accounting policy E(a) on goodwill).<br />

The Group’s share of its associates’ post-acquisition profits or losses is recognised in the income statement, and<br />

its share of post-acquisition movements in reserves is recognised in reserves. The cumulative post-acquisition<br />

movements are adjusted against the carrying amount of the investment. When the Group’s share of losses in an<br />

associate equals or exceeds its interest in the associate, including any other unsecured receivables, the Group’s<br />

interest is reduced to nil and recognition of further losses is discontinued except to the extent that the Group has<br />

incurred legal or constructive obligations or made payments on behalf of the associate.<br />

Unrealised gains on transactions between the Group and its associates are eliminated to the extent of the Group’s<br />

interest in the associates; unrealised losses are also eliminated unless the transaction provides evidence on<br />

impairment of the asset transferred. Where necessary, in applying the equity method, adjustments are made to the<br />

financial statements of associates to ensure consistency of accounting policies with those of the Group.<br />

Dilution gains and losses in associates are recognised in the income statement.<br />

For incremental interest in an associate, the date of acquisition is the purchase date at each stage and goodwill<br />

is calculated at each purchase date based on the fair value of assets and liabilities identified. There is no “step up<br />

to fair value” of net assets of the previously acquired stake and the share of profits and equity movements for the<br />

previously acquired stake is recorded directly through equity.<br />

C<br />

PROPERTY, PLANT AND EQUIPMENT<br />

All property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses<br />

except for freehold land and capital work-in-progress which are not depreciated. Freehold land is not depreciated as it<br />

has an infinite life. Depreciation on capital work-in-progress commences when the assets are ready for their intended<br />

use.<br />

Cost includes expenditure that is directly attributable to the acquisition of the asset. Subsequent costs are included<br />

in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future<br />

economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably.<br />

The carrying amount of the replaced part is derecognised. All other repairs and maintenance are charged to the income<br />

statement during the financial period in which they are incurred.<br />

<strong>Goldis</strong> <strong>Berhad</strong> (515802-U)<br />

annual report <strong>2009</strong><br />

45