Head of Human Resources wins HR Director of the ... - BNP Paribas

Head of Human Resources wins HR Director of the ... - BNP Paribas

Head of Human Resources wins HR Director of the ... - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Total shareholder return<br />

• Since privatisation in October 1993<br />

- Initial investment = 1 share at <strong>the</strong> IPO price<br />

(FRF 240 or EUR 36.59) on 18 October 1993.<br />

- Reinvestment <strong>of</strong> dividends and <strong>the</strong> March 1995<br />

allocation <strong>of</strong> one share for every 10 shares<br />

acquired at <strong>the</strong> time <strong>of</strong> <strong>the</strong> IPO and held for 18<br />

months.<br />

Two-for-one share-split on 20 February 2002<br />

- Closing price on 31 December 2003,<br />

valuing <strong>the</strong> initial investment at<br />

2.9106 x EUR 49.92 = EUR 145.30 (FRF 953.11)<br />

Initial capital multiplied by 3.97<br />

Total shareholder return: 14.46% per year<br />

• Over 5 years<br />

- Initial investment = 1 share at <strong>the</strong> opening price<br />

on 4 January 1999 = EUR 73.04 (FRF 479.11)<br />

- Reinvestment <strong>of</strong> dividends<br />

Two-for-one share-split on 20 February 2002<br />

- Closing price on 31 December 2003, valuing <strong>the</strong><br />

initial investment at 2.3462 x EUR 49.92 = EUR<br />

117.12 (FRF 768.26)<br />

An amount 60.4% higher than <strong>the</strong> original<br />

investment<br />

Total shareholder return: 9.92% per year<br />

B - Five-year comparison <strong>of</strong> an investment<br />

in <strong>BNP</strong> <strong>Paribas</strong> shares with <strong>the</strong> “Livret A”<br />

passbook savings account and mediumterm<br />

Treasury Notes<br />

In this calculation, we compare <strong>the</strong> creation <strong>of</strong><br />

shareholder value over <strong>the</strong> same period through<br />

investment in <strong>BNP</strong>, <strong>the</strong>n <strong>BNP</strong> <strong>Paribas</strong> shares with<br />

two risk free investments, <strong>the</strong> "Livret A" passbook<br />

savings account <strong>of</strong>fered by <strong>the</strong> French savings<br />

bank network and medium-term French<br />

government notes (OAT).<br />

• Investment <strong>of</strong> EUR 73.04 on 1 January 1999<br />

in a “Livret A” passbook account:<br />

At <strong>the</strong> investment date, <strong>the</strong> <strong>of</strong>ficial interest<br />

rate on Livret A accounts was 3%. The rate was<br />

reduced to 2.25% on 1 August 1999, <strong>the</strong>n set<br />

again at 3% on 1 July 2000, and returned to<br />

2.25% on 1 August 2003. As <strong>of</strong> 31 December<br />

2003, <strong>the</strong> account balance is EUR 83.86.<br />

The value created through an investment in<br />

<strong>BNP</strong> <strong>Paribas</strong> shares, reflecting <strong>the</strong> additional<br />

risk, amounts to 117.12-83.86 = EUR 33.26<br />

per share over five years.<br />

• Investment <strong>of</strong> EUR 73.04 on 1 January 1999<br />

in five-year French government notes:<br />

The five-year interest rate (BTAN) on that date<br />

was 3.3672%; at <strong>the</strong> end <strong>of</strong> each subsequent<br />

year, interest income is re-invested in a similar<br />

note on <strong>the</strong> following terms:<br />

- 4.7161% (BTAN) in January 2000 for 4 years;<br />

- 4.5421% (BTAN) in January 2001 for 3 years;<br />

- 3.6622% (BTAN) in January 2002 for 2 years;<br />

- 2.749% in January 2003 for 1 year (Euribor).<br />

At <strong>the</strong> end <strong>of</strong> five years, <strong>the</strong> accrued value <strong>of</strong><br />

<strong>the</strong> investment is EUR 86.43.<br />

The additional value created by choosing<br />

<strong>BNP</strong> <strong>Paribas</strong> shares as <strong>the</strong> investment vehicle<br />

is <strong>the</strong>refore 117.12-86.43 = EUR 30.69 per<br />

share over five years.<br />

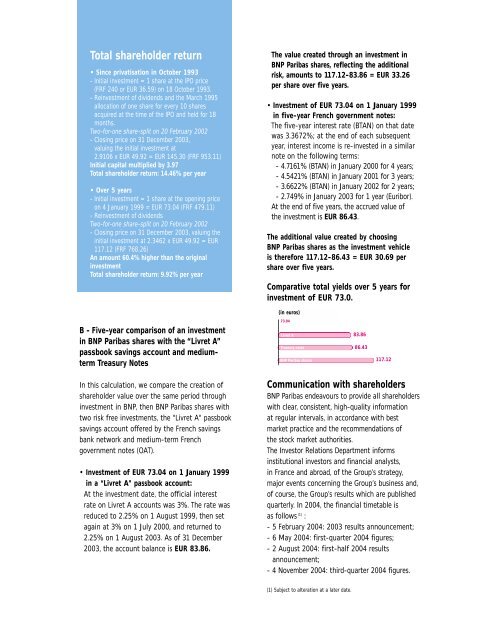

Comparative total yields over 5 years for<br />

investment <strong>of</strong> EUR 73.0.<br />

(in euros)<br />

73.04<br />

Livret A<br />

Treasury notes<br />

<strong>BNP</strong> <strong>Paribas</strong> shares<br />

83.86<br />

86.43<br />

117.12<br />

Communication with shareholders<br />

<strong>BNP</strong> <strong>Paribas</strong> endeavours to provide all shareholders<br />

with clear, consistent, high-quality information<br />

at regular intervals, in accordance with best<br />

market practice and <strong>the</strong> recommendations <strong>of</strong><br />

<strong>the</strong> stock market authorities.<br />

The Investor Relations Department informs<br />

institutional investors and financial analysts,<br />

in France and abroad, <strong>of</strong> <strong>the</strong> Group’s strategy,<br />

major events concerning <strong>the</strong> Group’s business and,<br />

<strong>of</strong> course, <strong>the</strong> Group’s results which are published<br />

quarterly. In 2004, <strong>the</strong> financial timetable is<br />

as follows (1) :<br />

- 5 February 2004: 2003 results announcement;<br />

- 6 May 2004: first-quarter 2004 figures;<br />

- 2 August 2004: first-half 2004 results<br />

announcement;<br />

- 4 November 2004: third-quarter 2004 figures.<br />

(1) Subject to alteration at a later date.