Annual Report - Bina Puri

Annual Report - Bina Puri

Annual Report - Bina Puri

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

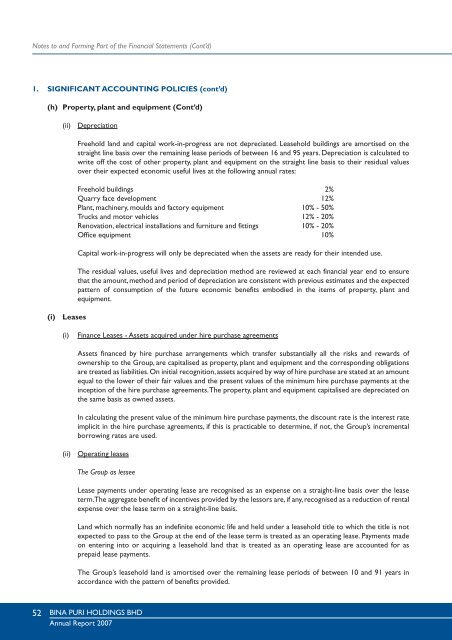

Notes to and Forming Part of the Financial Statements (Cont’d)1. SIGNIFICANT ACCOUNTING POLICIES (cont’d)(h) Property, plant and equipment (Cont’d)(ii)DepreciationFreehold land and capital work-in-progress are not depreciated. Leasehold buildings are amortised on thestraight line basis over the remaining lease periods of between 16 and 95 years. Depreciation is calculated towrite off the cost of other property, plant and equipment on the straight line basis to their residual valuesover their expected economic useful lives at the following annual rates:Freehold buildings 2%Quarry face development 12%Plant, machinery, moulds and factory equipment 10% - 50%Trucks and motor vehicles 12% - 20%Renovation, electrical installations and furniture and fittings 10% - 20%Office equipment 10%Capital work-in-progress will only be depreciated when the assets are ready for their intended use.The residual values, useful lives and depreciation method are reviewed at each financial year end to ensurethat the amount, method and period of depreciation are consistent with previous estimates and the expectedpattern of consumption of the future economic benefits embodied in the items of property, plant andequipment.(i)Leases(i)Finance Leases - Assets acquired under hire purchase agreementsAssets financed by hire purchase arrangements which transfer substantially all the risks and rewards ofownership to the Group, are capitalised as property, plant and equipment and the corresponding obligationsare treated as liabilities. On initial recognition, assets acquired by way of hire purchase are stated at an amountequal to the lower of their fair values and the present values of the minimum hire purchase payments at theinception of the hire purchase agreements.The property, plant and equipment capitalised are depreciated onthe same basis as owned assets.In calculating the present value of the minimum hire purchase payments, the discount rate is the interest rateimplicit in the hire purchase agreements, if this is practicable to determine, if not, the Group’s incrementalborrowing rates are used.(ii)Operating leasesThe Group as lesseeLease payments under operating lease are recognised as an expense on a straight-line basis over the leaseterm.The aggregate benefit of incentives provided by the lessors are, if any, recognised as a reduction of rentalexpense over the lease term on a straight-line basis.Land which normally has an indefinite economic life and held under a leasehold title to which the title is notexpected to pass to the Group at the end of the lease term is treated as an operating lease. Payments madeon entering into or acquiring a leasehold land that is treated as an operating lease are accounted for asprepaid lease payments.The Group’s leasehold land is amortised over the remaining lease periods of between 10 and 91 years inaccordance with the pattern of benefits provided.52 BINA PURI HOLDINGS BHD<strong>Annual</strong> <strong>Report</strong> 2007