Annual Report - Bina Puri

Annual Report - Bina Puri

Annual Report - Bina Puri

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

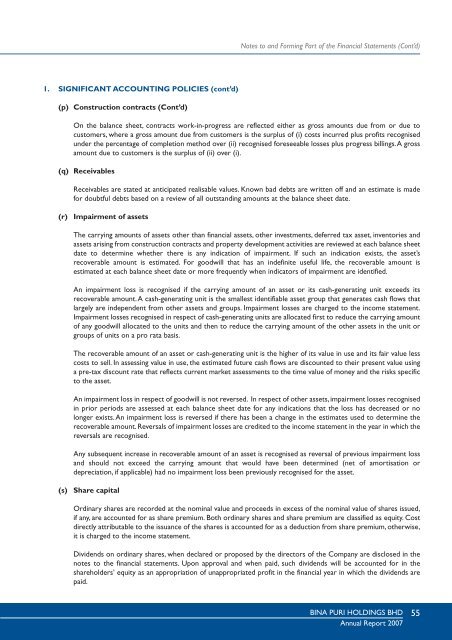

Notes to and Forming Part of the Financial Statements (Cont’d)1. SIGNIFICANT ACCOUNTING POLICIES (cont’d)(p) Construction contracts (Cont’d)On the balance sheet, contracts work-in-progress are reflected either as gross amounts due from or due tocustomers, where a gross amount due from customers is the surplus of (i) costs incurred plus profits recognisedunder the percentage of completion method over (ii) recognised foreseeable losses plus progress billings.A grossamount due to customers is the surplus of (ii) over (i).(q) ReceivablesReceivables are stated at anticipated realisable values. Known bad debts are written off and an estimate is madefor doubtful debts based on a review of all outstanding amounts at the balance sheet date.(r)Impairment of assetsThe carrying amounts of assets other than financial assets, other investments, deferred tax asset, inventories andassets arising from construction contracts and property development activities are reviewed at each balance sheetdate to determine whether there is any indication of impairment. If such an indication exists, the asset’srecoverable amount is estimated. For goodwill that has an indefinite useful life, the recoverable amount isestimated at each balance sheet date or more frequently when indicators of impairment are identified.An impairment loss is recognised if the carrying amount of an asset or its cash-generating unit exceeds itsrecoverable amount.A cash-generating unit is the smallest identifiable asset group that generates cash flows thatlargely are independent from other assets and groups. Impairment losses are charged to the income statement.Impairment losses recognised in respect of cash-generating units are allocated first to reduce the carrying amountof any goodwill allocated to the units and then to reduce the carrying amount of the other assets in the unit orgroups of units on a pro rata basis.The recoverable amount of an asset or cash-generating unit is the higher of its value in use and its fair value lesscosts to sell. In assessing value in use, the estimated future cash flows are discounted to their present value usinga pre-tax discount rate that reflects current market assessments to the time value of money and the risks specificto the asset.An impairment loss in respect of goodwill is not reversed. In respect of other assets, impairment losses recognisedin prior periods are assessed at each balance sheet date for any indications that the loss has decreased or nolonger exists.An impairment loss is reversed if there has been a change in the estimates used to determine therecoverable amount. Reversals of impairment losses are credited to the income statement in the year in which thereversals are recognised.Any subsequent increase in recoverable amount of an asset is recognised as reversal of previous impairment lossand should not exceed the carrying amount that would have been determined (net of amortisation ordepreciation, if applicable) had no impairment loss been previously recognised for the asset.(s)Share capitalOrdinary shares are recorded at the nominal value and proceeds in excess of the nominal value of shares issued,if any, are accounted for as share premium. Both ordinary shares and share premium are classified as equity. Costdirectly attributable to the issuance of the shares is accounted for as a deduction from share premium, otherwise,it is charged to the income statement.Dividends on ordinary shares, when declared or proposed by the directors of the Company are disclosed in thenotes to the financial statements. Upon approval and when paid, such dividends will be accounted for in theshareholders’ equity as an appropriation of unappropriated profit in the financial year in which the dividends arepaid.BINA PURI HOLDINGS BHD<strong>Annual</strong> <strong>Report</strong> 200755