Enhancing dairy sector export competitiveness - International Trade ...

Enhancing dairy sector export competitiveness - International Trade ...

Enhancing dairy sector export competitiveness - International Trade ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

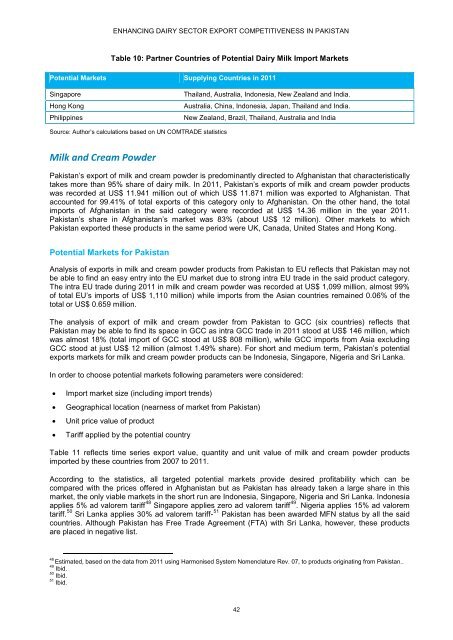

ENHANCING DAIRY SECTOR EXPORT COMPETITIVENESS IN PAKISTANTable 10: Partner Countries of Potential Dairy Milk Import MarketsPotential Markets Supplying Countries in 2011SingaporeHong KongPhilippinesThailand, Australia, Indonesia, New Zealand and India.Australia, China, Indonesia, Japan, Thailand and India.New Zealand, Brazil, Thailand, Australia and IndiaSource: Author’s calculations based on UN COMTRADE statisticsMilk and Cream PowderPakistan’s <strong>export</strong> of milk and cream powder is predominantly directed to Afghanistan that characteristicallytakes more than 95% share of <strong>dairy</strong> milk. In 2011, Pakistan’s <strong>export</strong>s of milk and cream powder productswas recorded at US$ 11.941 million out of which US$ 11.871 million was <strong>export</strong>ed to Afghanistan. Thataccounted for 99.41% of total <strong>export</strong>s of this category only to Afghanistan. On the other hand, the totalimports of Afghanistan in the said category were recorded at US$ 14.36 million in the year 2011.Pakistan’s share in Afghanistan’s market was 83% (about US$ 12 million). Other markets to whichPakistan <strong>export</strong>ed these products in the same period were UK, Canada, United States and Hong Kong.Potential Markets for PakistanAnalysis of <strong>export</strong>s in milk and cream powder products from Pakistan to EU reflects that Pakistan may notbe able to find an easy entry into the EU market due to strong intra EU trade in the said product category.The intra EU trade during 2011 in milk and cream powder was recorded at US$ 1,099 million, almost 99%of total EU’s imports of US$ 1,110 million) while imports from the Asian countries remained 0.06% of thetotal or US$ 0.659 million.The analysis of <strong>export</strong> of milk and cream powder from Pakistan to GCC (six countries) reflects thatPakistan may be able to find its space in GCC as intra GCC trade in 2011 stood at US$ 146 million, whichwas almost 18% (total import of GCC stood at US$ 808 million), while GCC imports from Asia excludingGCC stood at just US$ 12 million (almost 1.49% share). For short and medium term, Pakistan’s potential<strong>export</strong>s markets for milk and cream powder products can be Indonesia, Singapore, Nigeria and Sri Lanka.In order to choose potential markets following parameters were considered:• Import market size (including import trends)• Geographical location (nearness of market from Pakistan)• Unit price value of product• Tariff applied by the potential countryTable 11 reflects time series <strong>export</strong> value, quantity and unit value of milk and cream powder productsimported by these countries from 2007 to 2011.According to the statistics, all targeted potential markets provide desired profitability which can becompared with the prices offered in Afghanistan but as Pakistan has already taken a large share in thismarket, the only viable markets in the short run are Indonesia, Singapore, Nigeria and Sri Lanka. Indonesiaapplies 5% ad valorem tariff 48 Singapore applies zero ad valorem tariff 49 . Nigeria applies 15% ad valoremtariff. 50 Sri Lanka applies 30% ad valorem tariff- 51 Pakistan has been awarded MFN status by all the saidcountries. Although Pakistan has Free <strong>Trade</strong> Agreement (FTA) with Sri Lanka, however, these productsare placed in negative list.48Estimated, based on the data from 2011 using Harmonised System Nomenclature Rev. 07, to products originating from Pakistan..49 Ibid.50 Ibid.51 Ibid.42