Enhancing dairy sector export competitiveness - International Trade ...

Enhancing dairy sector export competitiveness - International Trade ...

Enhancing dairy sector export competitiveness - International Trade ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

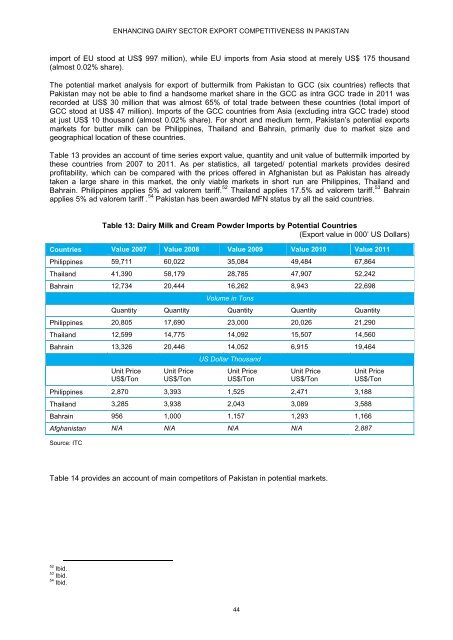

ENHANCING DAIRY SECTOR EXPORT COMPETITIVENESS IN PAKISTANimport of EU stood at US$ 997 million), while EU imports from Asia stood at merely US$ 175 thousand(almost 0.02% share).The potential market analysis for <strong>export</strong> of buttermilk from Pakistan to GCC (six countries) reflects thatPakistan may not be able to find a handsome market share in the GCC as intra GCC trade in 2011 wasrecorded at US$ 30 million that was almost 65% of total trade between these countries (total import ofGCC stood at US$ 47 million). Imports of the GCC countries from Asia (excluding intra GCC trade) stoodat just US$ 10 thousand (almost 0.02% share). For short and medium term, Pakistan’s potential <strong>export</strong>smarkets for butter milk can be Philippines, Thailand and Bahrain, primarily due to market size andgeographical location of these countries.Table 13 provides an account of time series <strong>export</strong> value, quantity and unit value of buttermilk imported bythese countries from 2007 to 2011. As per statistics, all targeted/ potential markets provides desiredprofitability, which can be compared with the prices offered in Afghanistan but as Pakistan has alreadytaken a large share in this market, the only viable markets in short run are Philippines, Thailand andBahrain. Philippines applies 5% ad valorem tariff. 52 Thailand applies 17.5% ad valorem tariff. 53 Bahrainapplies 5% ad valorem tariff . 54 Pakistan has been awarded MFN status by all the said countries.Table 13: Dairy Milk and Cream Powder Imports by Potential Countries(Export value in 000’ US Dollars)Countries Value 2007 Value 2008 Value 2009 Value 2010 Value 2011Philippines 59,711 60,022 35,084 49,484 67,864Thailand 41,390 58,179 28,785 47,907 52,242Bahrain 12,734 20,444 16,262 8,943 22,698Volume in TonsQuantity Quantity Quantity Quantity QuantityPhilippines 20,805 17,690 23,000 20,026 21,290Thailand 12,599 14,775 14,092 15,507 14,560Bahrain 13,326 20,446 14,052 6,915 19,464Unit PriceUS$/TonUnit PriceUS$/TonUS Dollar ThousandUnit PriceUS$/TonUnit PriceUS$/TonUnit PriceUS$/TonPhilippines 2,870 3,393 1,525 2,471 3,188Thailand 3,285 3,938 2,043 3,089 3,588Bahrain 956 1,000 1,157 1,293 1,166Afghanistan N/A N/A N/A N/A 2,887Source: ITCTable 14 provides an account of main competitors of Pakistan in potential markets.52 Ibid.53 Ibid.54 Ibid.44