INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

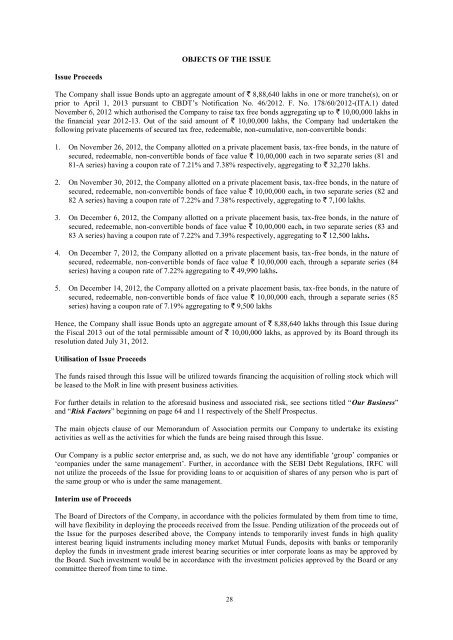

OBJECTS OF THE ISSUEIssue ProceedsThe Company shall issue Bonds upto an aggregate amount of ` 8,88,640 lakhs in one or more tranche(s), on orprior to April 1, 2013 pursuant to CBDT’s Notification No. 46/2012. F. No. 178/60/2012-(ITA.1) datedNovember 6, 2012 which authorised the Company to raise tax free bonds aggregating up to ` 10,00,000 lakhs inthe financial year 2012-13. Out of the said amount of ` 10,00,000 lakhs, the Company had undertaken thefollowing private placements of secured tax free, redeemable, non-cumulative, non-convertible bonds:1. On November 26, 2012, the Company allotted on a private placement basis, tax-free bonds, in the nature ofsecured, redeemable, non-convertible bonds of face value ` 10,00,000 each in two separate series (81 and81-A series) having a coupon rate of 7.21% and 7.38% respectively, aggregating to ` 32,270 lakhs.2. On November 30, 2012, the Company allotted on a private placement basis, tax-free bonds, in the nature ofsecured, redeemable, non-convertible bonds of face value ` 10,00,000 each, in two separate series (82 and82 A series) having a coupon rate of 7.22% and 7.38% respectively, aggregating to ` 7,100 lakhs.3. On December 6, 2012, the Company allotted on a private placement basis, tax-free bonds, in the nature ofsecured, redeemable, non-convertible bonds of face value ` 10,00,000 each, in two separate series (83 and83 A series) having a coupon rate of 7.22% and 7.39% respectively, aggregating to ` 12,500 lakhs.4. On December 7, 2012, the Company allotted on a private placement basis, tax-free bonds, in the nature ofsecured, redeemable, non-convertible bonds of face value ` 10,00,000 each, through a separate series (84series) having a coupon rate of 7.22% aggregating to ` 49,990 lakhs.5. On December 14, 2012, the Company allotted on a private placement basis, tax-free bonds, in the nature ofsecured, redeemable, non-convertible bonds of face value ` 10,00,000 each, through a separate series (85series) having a coupon rate of 7.19% aggregating to ` 9,500 lakhsHence, the Company shall issue Bonds upto an aggregate amount of ` 8,88,640 lakhs through this Issue duringthe Fiscal 2013 out of the total permissible amount of ` 10,00,000 lakhs, as approved by its Board through itsresolution dated July 31, 2012.Utilisation of Issue ProceedsThe funds raised through this Issue will be utilized towards financing the acquisition of rolling stock which willbe leased to the MoR in line with present business activities.For further details in relation to the aforesaid business and associated risk, see sections titled “Our Business”and “Risk Factors” beginning on page 64 and 11 respectively of the Shelf Prospectus.The main objects clause of our Memorandum of Association permits our Company to undertake its existingactivities as well as the activities for which the funds are being raised through this Issue.Our Company is a public sector enterprise and, as such, we do not have any identifiable ‘group’ companies or‘companies under the same management’. Further, in accordance with the SEBI Debt Regulations, IRFC willnot utilize the proceeds of the Issue for providing loans to or acquisition of shares of any person who is part ofthe same group or who is under the same management.Interim use of ProceedsThe Board of Directors of the Company, in accordance with the policies formulated by them from time to time,will have flexibility in deploying the proceeds received from the Issue. Pending utilization of the proceeds out ofthe Issue for the purposes described above, the Company intends to temporarily invest funds in high qualityinterest bearing liquid instruments including money market Mutual Funds, deposits with banks or temporarilydeploy the funds in investment grade interest bearing securities or inter corporate loans as may be approved bythe Board. Such investment would be in accordance with the investment policies approved by the Board or anycommittee thereof from time to time.28