INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

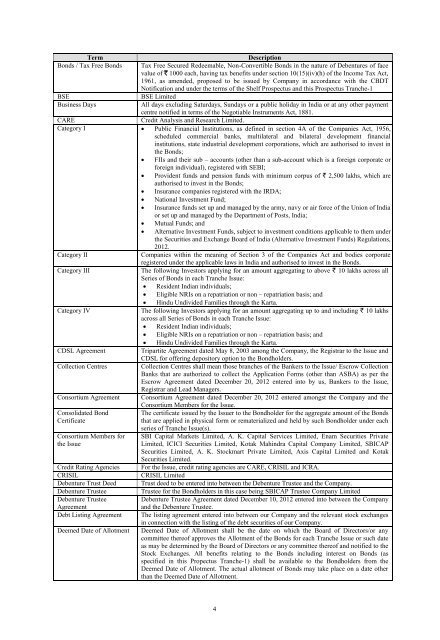

TermDescriptionBonds / Tax Free Bonds Tax Free Secured Redeemable, Non-Convertible Bonds in the nature of Debentures of facevalue of ` 1000 each, having tax benefits under section 10(15)(iv)(h) of the Income Tax Act,1961, as amended, proposed to be issued by Company in accordance with the CBDTNotification and under the terms of the Shelf Prospectus and this Prospectus Tranche-1BSEBSE LimitedBusiness DaysAll days excluding Saturdays, Sundays or a public holiday in India or at any other paymentcentre notified in terms of the Negotiable Instruments Act, 1881.CARECredit Analysis and Research Limited.Category I Public Financial Institutions, as defined in section 4A of the Companies Act, 1956,scheduled commercial banks, multilateral and bilateral development financialinstitutions, state industrial development corporations, which are authorised to invest inthe Bonds; FIIs and their sub – accounts (other than a sub-account which is a foreign corporate orforeign individual), registered with SEBI; Provident funds and pension funds with minimum corpus of ` 2,500 lakhs, which areauthorised to invest in the Bonds; Insurance companies registered with the IRDA; National Investment Fund; Insurance funds set up and managed by the army, navy or air force of the Union of Indiaor set up and managed by the Department of Posts, India;Category IICategory IIICategory IVCDSL AgreementCollection CentresConsortium AgreementConsolidated BondCertificateConsortium Members forthe IssueCredit Rating AgenciesCRISILDebenture Trust DeedDebenture TrusteeDebenture TrusteeAgreementDebt Listing AgreementDeemed Date of AllotmentMutual Funds; andAlternative Investment Funds, subject to investment conditions applicable to them underthe Securities and Exchange Board of India (Alternative Investment Funds) Regulations,2012.Companies within the meaning of Section 3 of the Companies Act and bodies corporateregistered under the applicable laws in India and authorised to invest in the Bonds.The following Investors applying for an amount aggregating to above ` 10 lakhs across allSeries of Bonds in each Tranche Issue: Resident Indian individuals; Eligible NRIs on a repatriation or non – repatriation basis; and Hindu Undivided Families through the Karta.The following Investors applying for an amount aggregating up to and including ` 10 lakhsacross all Series of Bonds in each Tranche Issue: Resident Indian individuals; Eligible NRIs on a repatriation or non – repatriation basis; and Hindu Undivided Families through the Karta.Tripartite Agreement dated May 8, 2003 among the Company, the Registrar to the Issue andCDSL for offering depository option to the Bondholders.Collection Centres shall mean those branches of the Bankers to the Issue/ Escrow CollectionBanks that are authorized to collect the Application Forms (other than ASBA) as per theEscrow Agreement dated December 20, 2012 entered into by us, Bankers to the Issue,Registrar and Lead Managers.Consortium Agreement dated December 20, 2012 entered amongst the Company and theConsortium Members for the Issue.The certificate issued by the Issuer to the Bondholder for the aggregate amount of the Bondsthat are applied in physical form or rematerialized and held by such Bondholder under eachseries of Tranche Issue(s).SBI Capital Markets Limited, A. K. Capital Services Limited, Enam Securities PrivateLimited, ICICI Securities Limited, Kotak Mahindra Capital Company Limited, SBICAPSecurities Limited, A. K. Stockmart Private Limited, Axis Capital Limited and KotakSecurities Limited.For the Issue, credit rating agencies are CARE, CRISIL and ICRA.CRISIL LimitedTrust deed to be entered into between the Debenture Trustee and the Company.Trustee for the Bondholders in this case being SBICAP Trustee Company LimitedDebenture Trustee Agreement dated December 10, 2012 entered into between the Companyand the Debenture Trustee.The listing agreement entered into between our Company and the relevant stock exchangesin connection with the listing of the debt securities of our Company.Deemed Date of Allotment shall be the date on which the Board of Directors/or anycommittee thereof approves the Allotment of the Bonds for each Tranche Issue or such dateas may be determined by the Board of Directors or any committee thereof and notified to theStock Exchanges. All benefits relating to the Bonds including interest on Bonds (asspecified in this Propectus Tranche-1) shall be available to the Bondholders from theDeemed Date of Allotment. The actual allotment of Bonds may take place on a date otherthan the Deemed Date of Allotment.4