INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

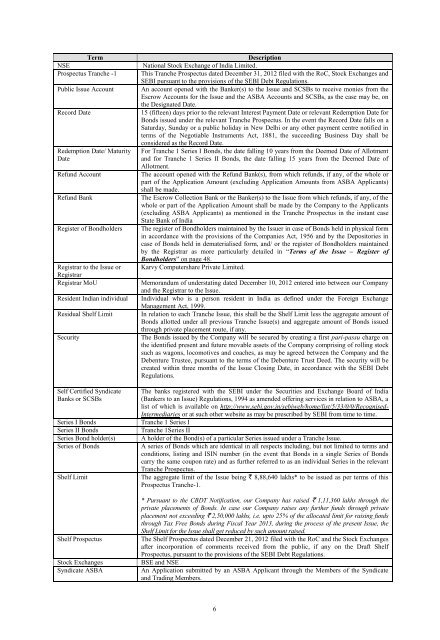

TermNSEProspectus Tranche -1Public Issue AccountRecord DateRedemption Date/ MaturityDateRefund AccountRefund BankRegister of BondholdersRegistrar to the Issue orRegistrarRegistrar MoUResident Indian individualResidual Shelf LimitSecuritySelf Certified SyndicateBanks or SCSBsSeries I BondsSeries II BondsSeries Bond holder(s)Series of BondsShelf LimitShelf ProspectusStock ExchangesSyndicate ASBADescriptionNational Stock Exchange of India Limited.This Tranche Prospectus dated December 31, 2012 filed with the RoC, Stock Exchanges andSEBI pursuant to the provisions of the SEBI Debt Regulations.An account opened with the Banker(s) to the Issue and SCSBs to receive monies from theEscrow Accounts for the Issue and the ASBA Accounts and SCSBs, as the case may be, onthe Designated Date.15 (fifteen) days prior to the relevant Interest Payment Date or relevant Redemption Date forBonds issued under the relevant Tranche Prospectus. In the event the Record Date falls on aSaturday, Sunday or a public holiday in New Delhi or any other payment centre notified interms of the Negotiable Instruments Act, 1881, the succeeding Business Day shall beconsidered as the Record Date.For Tranche 1 Series I Bonds, the date falling 10 years from the Deemed Date of Allotmentand for Tranche 1 Series II Bonds, the date falling 15 years from the Deemed Date ofAllotment.The account opened with the Refund Bank(s), from which refunds, if any, of the whole orpart of the Application Amount (excluding Application Amounts from ASBA Applicants)shall be made.The Escrow Collection Bank or the Banker(s) to the Issue from which refunds, if any, of thewhole or part of the Application Amount shall be made by the Company to the Applicants(excluding ASBA Applicants) as mentioned in the Tranche Prospectus in the instant caseState Bank of IndiaThe register of Bondholders maintained by the Issuer in case of Bonds held in physical formin accordance with the provisions of the Companies Act, 1956 and by the Depositories incase of Bonds held in dematerialised form, and/ or the register of Bondholders maintainedby the Registrar as more particularly detailed in “Terms of the Issue – Register ofBondholders” on page 48.Karvy Computershare Private Limited.Memorandum of understating dated December 10, 2012 entered into between our Companyand the Registrar to the Issue.Individual who is a person resident in India as defined under the Foreign ExchangeManagement Act, 1999.In relation to each Tranche Issue, this shall be the Shelf Limit less the aggregate amount ofBonds allotted under all previous Tranche Issue(s) and aggregate amount of Bonds issuedthrough private placement route, if any.The Bonds issued by the Company will be secured by creating a first pari-passu charge onthe identified present and future movable assets of the Company comprising of rolling stocksuch as wagons, locomotives and coaches, as may be agreed between the Company and theDebenture Trustee, pursuant to the terms of the Debenture Trust Deed. The security will becreated within three months of the Issue Closing Date, in accordance with the SEBI DebtRegulations.The banks registered with the SEBI under the Securities and Exchange Board of India(Bankers to an Issue) Regulations, 1994 as amended offering services in relation to ASBA, alist of which is available on http://www.sebi.gov.in/sebiweb/home/list/5/33/0/0/Recognised-Intermediaries or at such other website as may be prescribed by SEBI from time to time.Tranche 1 Series ITranche 1Series IIA holder of the Bond(s) of a particular Series issued under a Tranche Issue.A series of Bonds which are identical in all respects including, but not limited to terms andconditions, listing and ISIN number (in the event that Bonds in a single Series of Bondscarry the same coupon rate) and as further referred to as an individual Series in the relevantTranche Prospectus.The aggregate limit of the Issue being ` 8,88,640 lakhs* to be issued as per terms of thisProspectus Tranche-1.* Pursuant to the CBDT Notification, our Company has raised ` 1,11,360 lakhs through theprivate placements of Bonds. In case our Company raises any further funds through privateplacement not exceeding ` 2,50,000 lakhs, i.e. upto 25% of the allocated limit for raising fundsthrough Tax Free Bonds during Fiscal Year 2013, during the process of the present Issue, theShelf Limit for the Issue shall get reduced by such amount raised.The Shelf Prospectus dated December 21, 2012 filed with the RoC and the Stock Exchangesafter incorporation of comments received from the public, if any on the Draft ShelfProspectus, pursuant to the provisions of the SEBI Debt Regulations.BSE and NSEAn Application submitted by an ASBA Applicant through the Members of the Syndicateand Trading Members.6