INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

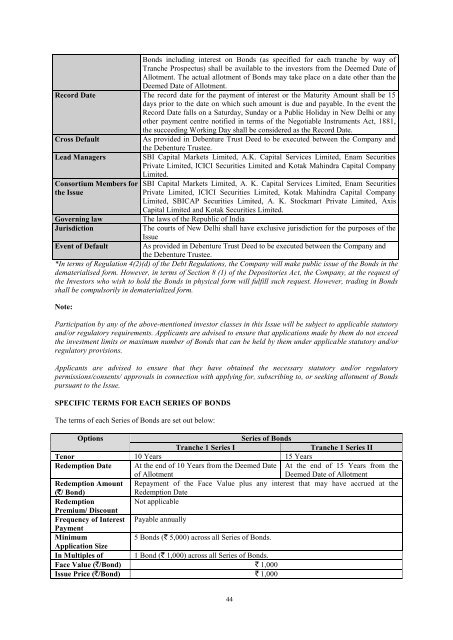

Bonds including interest on Bonds (as specified for each tranche by way ofTranche Prospectus) shall be available to the investors from the Deemed Date ofAllotment. The actual allotment of Bonds may take place on a date other than theDeemed Date of Allotment.Record Date The record date for the payment of interest or the Maturity Amount shall be 15days prior to the date on which such amount is due and payable. In the event theRecord Date falls on a Saturday, Sunday or a Public Holiday in New Delhi or anyother payment centre notified in terms of the Negotiable Instruments Act, 1881,the succeeding Working Day shall be considered as the Record Date.Cross DefaultAs provided in Debenture Trust Deed to be executed between the Company andthe Debenture Trustee.Lead Managers SBI Capital Markets Limited, A.K. Capital Services Limited, Enam SecuritiesPrivate Limited, ICICI Securities Limited and Kotak Mahindra Capital CompanyLimited.Consortium Members forthe IssueGoverning lawJurisdictionEvent of DefaultSBI Capital Markets Limited, A. K. Capital Services Limited, Enam SecuritiesPrivate Limited, ICICI Securities Limited, Kotak Mahindra Capital CompanyLimited, SBICAP Securities Limited, A. K. Stockmart Private Limited, AxisCapital Limited and Kotak Securities Limited.The laws of the Republic of IndiaThe courts of New Delhi shall have exclusive jurisdiction for the purposes of theIssueAs provided in Debenture Trust Deed to be executed between the Company andthe Debenture Trustee.*In terms of Regulation 4(2)(d) of the Debt Regulations, the Company will make public issue of the Bonds in thedematerialised form. However, in terms of Section 8 (1) of the Depositories Act, the Company, at the request ofthe Investors who wish to hold the Bonds in physical form will fulfill such request. However, trading in Bondsshall be compulsorily in dematerialized form.Note:Participation by any of the above-mentioned investor classes in this Issue will be subject to applicable statutoryand/or regulatory requirements. Applicants are advised to ensure that applications made by them do not exceedthe investment limits or maximum number of Bonds that can be held by them under applicable statutory and/orregulatory provisions.Applicants are advised to ensure that they have obtained the necessary statutory and/or regulatorypermissions/consents/ approvals in connection with applying for, subscribing to, or seeking allotment of Bondspursuant to the Issue.SPECIFIC TERMS FOR EACH SERIES OF BONDSThe terms of each Series of Bonds are set out below:OptionsSeries of BondsTranche 1 Series ITranche 1 Series IITenor 10 Years 15 YearsRedemption Date At the end of 10 Years from the Deemed Dateof AllotmentAt the end of 15 Years from theDeemed Date of AllotmentRedemption Amount(`/ Bond)Repayment of the Face Value plus any interest that may have accrued at theRedemption DateRedemptionNot applicablePremium/ DiscountFrequency of Interest Payable annuallyPaymentMinimum5 Bonds (` 5,000) across all Series of Bonds.Application SizeIn Multiples of 1 Bond (` 1,000) across all Series of Bonds.Face Value (`/Bond) ` 1,000Issue Price (`/Bond) ` 1,00044