2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

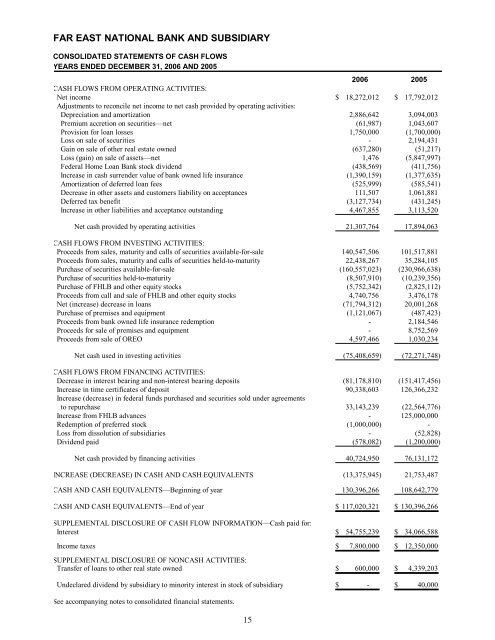

FAR EAST NATIONAL BANK AND SUBSIDIARYCONSOLIDATED STATEMENTS OF CASH FLOWSYEARS ENDED DECEMBER 31, <strong>2006</strong> AND 2005<strong>2006</strong> 2005CASH FLOWS FROM OPERATING ACTIVITIES:Net income $ 18,272,012 $ 17,792,012Adjustments to reconcile net income to net cash provided by operating activities:Depreciation and amortization 2,886,642 3,094,003Premium accretion on securities—net (61,987) 1,043,607Provision for loan losses 1,750,000 (1,700,000)Loss on sale of securities - 2,194,431Gain on sale of other real estate owned (637,280) (51,217)Loss (gain) on sale of assets—net 1,476 (5,847,997)Federal Home Loan <strong>Bank</strong> stock dividend (438,569) (411,756)Increase in cash surrender value of bank owned life insurance (1,390,159) (1,377,635)Amortization of deferred loan fees (525,999) (585,541)Decrease in other assets and customers liability on acceptances 111,507 1,061,881Deferred tax benefit (3,127,734) (431,245)Increase in other liabilities and acceptance outstanding 4,467,855 3,113,520Net cash provided by operating activities 21,307,764 17,894,063CASH FLOWS FROM INVESTING ACTIVITIES:Proceeds from sales, maturity and calls of securities available-for-sale 140,547,506 101,517,881Proceeds from sales, maturity and calls of securities held-to-maturity 22,438,267 35,284,105Purchase of securities available-for-sale (160,557,023) (230,966,638)Purchase of securities held-to-maturity (8,507,910) (10,239,356)Purchase of FHLB and other equity stocks (5,752,342) (2,825,112)Proceeds from call and sale of FHLB and other equity stocks 4,740,756 3,476,178Net (increase) decrease in loans (71,794,312) 20,001,268Purchase of premises and equipment (1,121,067) (487,423)Proceeds from bank owned life insurance redemption - 2,184,546Proceeds for sale of premises and equipment - 8,752,569Proceeds from sale of OREO 4,597,466 1,030,234Net cash used in investing activities (75,408,659) (72,271,748)CASH FLOWS FROM FINANCING ACTIVITIES:Decrease in interest bearing and non-interest bearing deposits (81,178,810) (151,417,456)Increase in time certificates of deposit 90,338,603 126,366,232Increase (decrease) in federal funds purchased and securities sold under agreementsto repurchase 33,143,239 (22,564,776)Increase from FHLB advances - 125,000,000Redemption of preferred stock (1,000,000) -Loss from dissolution of subsidiaries - (52,828)Dividend paid (578,082) (1,200,000)Net cash provided by financing activities 40,724,950 76,131,172INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (13,375,945) 21,753,487CASH AND CASH EQUIVALENTS—Beginning of year 130,396,266 108,642,779CASH AND CASH EQUIVALENTS—End of year $ 117,020,321 $ 130,396,266SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION—Cash paid for:Interest $ 54,755,239 $ 34,066,588Income taxes $ 7,800,000 $ 12,350,000SUPPLEMENTAL DISCLOSURE OF NONCASH ACTIVITIES:Transfer of loans to other real state owned $ 600,000 $ 4,339,203Undeclared dividend by subsidiary to minority interest in stock of subsidiary $ - $ 40,000See accompanying notes to consolidated financial statements.15