2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

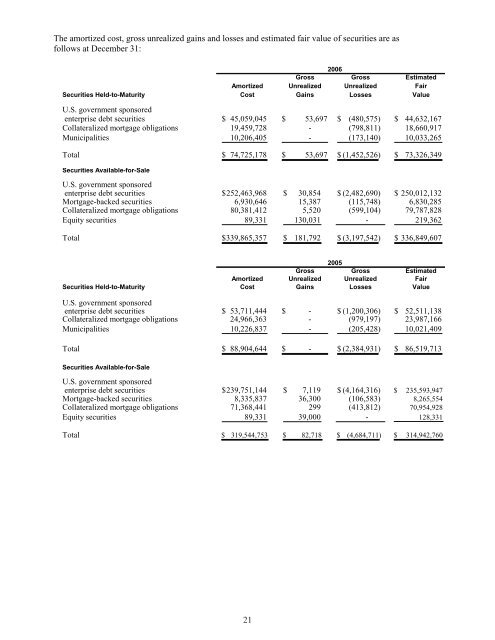

The amortized cost, gross unrealized gains and losses and estimated fair value of securities are asfollows at December 31:<strong>2006</strong>Gross Gross EstimatedAmortized Unrealized Unrealized FairSecurities Held-to-Maturity Cost Gains Losses ValueU.S. government sponsoredenterprise debt securities $ 45,059,045 $ 53,697 $ (480,575) $ 44,632,167Collateralized mortgage obligations 19,459,728 - (798,811) 18,660,917Municipalities 10,206,405 - (173,140) 10,033,265Total $ 74,725,178 $ 53,697 $ (1,452,526) $ 73,326,349Securities Available-for-SaleU.S. government sponsoredenterprise debt securities $ 252,463,968 $ 30,854 $ (2,482,690) $ 250,012,132Mortgage-backed securities 6,930,646 15,387 (115,748) 6,830,285Collateralized mortgage obligations 80,381,412 5,520 (599,104) 79,787,828Equity securities 89,331 130,031 - 219,362Total $ 339,865,357 $ 181,792 $ (3,197,542) $ 336,849,6072005Gross Gross EstimatedAmortized Unrealized Unrealized FairSecurities Held-to-Maturity Cost Gains Losses ValueU.S. government sponsoredenterprise debt securities $ 53,711,444 $ - $ (1,200,306) $ 52,511,138Collateralized mortgage obligations 24,966,363 - (979,197) 23,987,166Municipalities 10,226,837 - (205,428) 10,021,409Total $ 88,904,644 $ - $ (2,384,931) $ 86,519,713Securities Available-for-SaleU.S. government sponsoredenterprise debt securities $ 239,751,144 $ 7,119 $ (4,164,316) $ 235,593,947Mortgage-backed securities 8,335,837 36,300 (106,583) 8,265,554Collateralized mortgage obligations 71,368,441 299 (413,812) 70,954,928Equity securities 89,331 39,000 - 128,331Total $ 319,544,753 $ 82,718 $ (4,684,711) $ 314,942,76021