2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

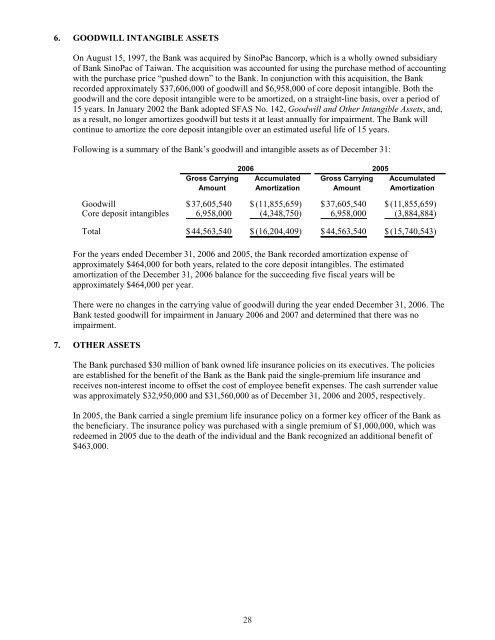

6. GOODWILL INTANGIBLE ASSETSOn August 15, 1997, the <strong>Bank</strong> was acquired by SinoPac Bancorp, which is a wholly owned subsidiaryof <strong>Bank</strong> SinoPac of Taiwan. The acquisition was accounted for using the purchase method of accountingwith the purchase price “pushed down” to the <strong>Bank</strong>. In conjunction with this acquisition, the <strong>Bank</strong>recorded approximately $37,606,000 of goodwill and $6,958,000 of core deposit intangible. Both thegoodwill and the core deposit intangible were to be amortized, on a straight-line basis, over a period of15 years. In January 2002 the <strong>Bank</strong> adopted SFAS No. 142, Goodwill and Other Intangible Assets, and,as a result, no longer amortizes goodwill but tests it at least annually for impairment. The <strong>Bank</strong> willcontinue to amortize the core deposit intangible over an estimated useful life of 15 years.Following is a summary of the <strong>Bank</strong>’s goodwill and intangible assets as of December 31:<strong>2006</strong> 2005Gross Carrying Accumulated Gross Carrying AccumulatedAmount Amortization Amount AmortizationGoodwill $ 37,605,540 $ (11,855,659) $ 37,605,540 $ (11,855,659)Core deposit intangibles 6,958,000 (4,348,750) 6,958,000 (3,884,884)Total $ 44,563,540 $ (16,204,409) $ 44,563,540 $ (15,740,543)For the years ended December 31, <strong>2006</strong> and 2005, the <strong>Bank</strong> recorded amortization expense ofapproximately $464,000 for both years, related to the core deposit intangibles. The estimatedamortization of the December 31, <strong>2006</strong> balance for the succeeding five fiscal years will beapproximately $464,000 per year.There were no changes in the carrying value of goodwill during the year ended December 31, <strong>2006</strong>. The<strong>Bank</strong> tested goodwill for impairment in January <strong>2006</strong> and 2007 and determined that there was noimpairment.7. OTHER ASSETSThe <strong>Bank</strong> purchased $30 million of bank owned life insurance policies on its executives. The policiesare established for the benefit of the <strong>Bank</strong> as the <strong>Bank</strong> paid the single-premium life insurance andreceives non-interest income to offset the cost of employee benefit expenses. The cash surrender valuewas approximately $32,950,000 and $31,560,000 as of December 31, <strong>2006</strong> and 2005, respectively.In 2005, the <strong>Bank</strong> carried a single premium life insurance policy on a former key officer of the <strong>Bank</strong> asthe beneficiary. The insurance policy was purchased with a single premium of $1,000,000, which wasredeemed in 2005 due to the death of the individual and the <strong>Bank</strong> recognized an additional benefit of$463,000.28