2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

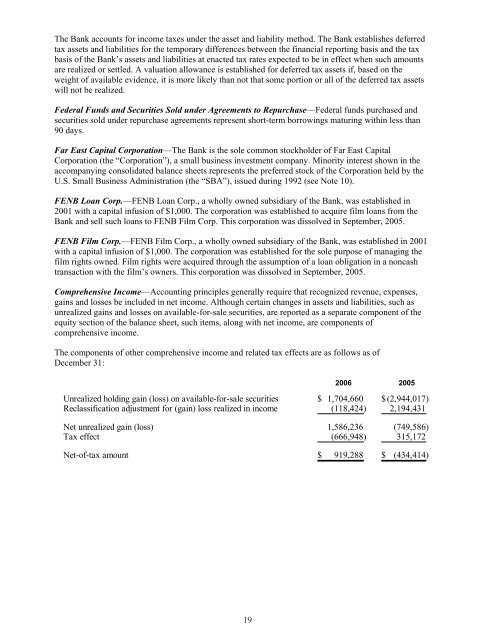

The <strong>Bank</strong> accounts for income taxes under the asset and liability method. The <strong>Bank</strong> establishes deferredtax assets and liabilities for the temporary differences between the financial reporting basis and the taxbasis of the <strong>Bank</strong>’s assets and liabilities at enacted tax rates expected to be in effect when such amountsare realized or settled. A valuation allowance is established for deferred tax assets if, based on theweight of available evidence, it is more likely than not that some portion or all of the deferred tax assetswill not be realized.Federal Funds and Securities Sold under Agreements to Repurchase—Federal funds purchased andsecurities sold under repurchase agreements represent short-term borrowings maturing within less than90 days.<strong>Far</strong> <strong>East</strong> Capital Corporation—The <strong>Bank</strong> is the sole common stockholder of <strong>Far</strong> <strong>East</strong> CapitalCorporation (the “Corporation”), a small business investment company. Minority interest shown in theaccompanying consolidated balance sheets represents the preferred stock of the Corporation held by theU.S. Small Business Administration (the “SBA”), issued during 1992 (see Note 10).FENB Loan Corp.—FENB Loan Corp., a wholly owned subsidiary of the <strong>Bank</strong>, was established in2001 with a capital infusion of $1,000. The corporation was established to acquire film loans from the<strong>Bank</strong> and sell such loans to FENB Film Corp. This corporation was dissolved in September, 2005.FENB Film Corp.—FENB Film Corp., a wholly owned subsidiary of the <strong>Bank</strong>, was established in 2001with a capital infusion of $1,000. The corporation was established for the sole purpose of managing thefilm rights owned. Film rights were acquired through the assumption of a loan obligation in a noncashtransaction with the film’s owners. This corporation was dissolved in September, 2005.Comprehensive Income—Accounting principles generally require that recognized revenue, expenses,gains and losses be included in net income. Although certain changes in assets and liabilities, such asunrealized gains and losses on available-for-sale securities, are reported as a separate component of theequity section of the balance sheet, such items, along with net income, are components ofcomprehensive income.The components of other comprehensive income and related tax effects are as follows as ofDecember 31:<strong>2006</strong> 2005Unrealized holding gain (loss) on available-for-sale securities $ 1,704,660 $ (2,944,017)Reclassification adjustment for (gain) loss realized in income (118,424) 2,194,431Net unrealized gain (loss) 1,586,236 (749,586)Tax effect (666,948) 315,172Net-of-tax amount $ 919,288 $ (434,414)19