2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

2006 ANNUAL REPORT - Far East National Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

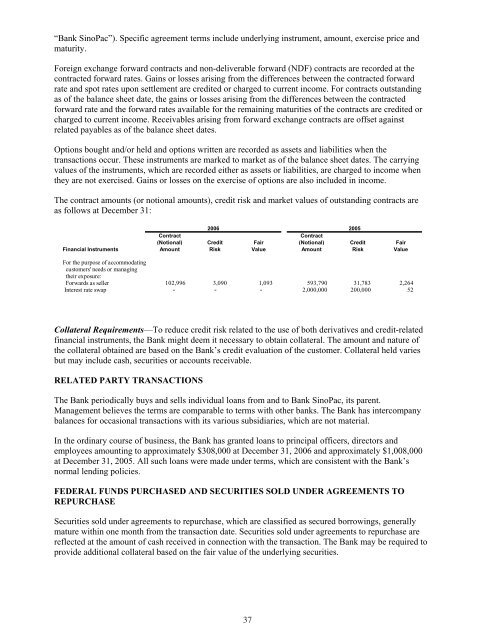

“<strong>Bank</strong> SinoPac”). Specific agreement terms include underlying instrument, amount, exercise price andmaturity.Foreign exchange forward contracts and non-deliverable forward (NDF) contracts are recorded at thecontracted forward rates. Gains or losses arising from the differences between the contracted forwardrate and spot rates upon settlement are credited or charged to current income. For contracts outstandingas of the balance sheet date, the gains or losses arising from the differences between the contractedforward rate and the forward rates available for the remaining maturities of the contracts are credited orcharged to current income. Receivables arising from forward exchange contracts are offset againstrelated payables as of the balance sheet dates.Options bought and/or held and options written are recorded as assets and liabilities when thetransactions occur. These instruments are marked to market as of the balance sheet dates. The carryingvalues of the instruments, which are recorded either as assets or liabilities, are charged to income whenthey are not exercised. Gains or losses on the exercise of options are also included in income.The contract amounts (or notional amounts), credit risk and market values of outstanding contracts areas follows at December 31:<strong>2006</strong> 2005ContractContract(Notional) Credit Fair (Notional) Credit FairFinancial Instruments Amount Risk Value Amount Risk ValueFor the purpose of accommodatingcustomers' needs or managingtheir exposure:Forwards as seller 102,996 3,090 1,093 593,790 31,783 2,264Interest rate swap - - - 2,000,000 200,000 52Collateral Requirements—To reduce credit risk related to the use of both derivatives and credit-relatedfinancial instruments, the <strong>Bank</strong> might deem it necessary to obtain collateral. The amount and nature ofthe collateral obtained are based on the <strong>Bank</strong>’s credit evaluation of the customer. Collateral held variesbut may include cash, securities or accounts receivable.RELATED PARTY TRANSACTIONSThe <strong>Bank</strong> periodically buys and sells individual loans from and to <strong>Bank</strong> SinoPac, its parent.Management believes the terms are comparable to terms with other banks. The <strong>Bank</strong> has intercompanybalances for occasional transactions with its various subsidiaries, which are not material.In the ordinary course of business, the <strong>Bank</strong> has granted loans to principal officers, directors andemployees amounting to approximately $308,000 at December 31, <strong>2006</strong> and approximately $1,008,000at December 31, 2005. All such loans were made under terms, which are consistent with the <strong>Bank</strong>’snormal lending policies.FEDERAL FUNDS PURCHASED AND SECURITIES SOLD UNDER AGREEMENTS TOREPURCHASESecurities sold under agreements to repurchase, which are classified as secured borrowings, generallymature within one month from the transaction date. Securities sold under agreements to repurchase arereflected at the amount of cash received in connection with the transaction. The <strong>Bank</strong> may be required toprovide additional collateral based on the fair value of the underlying securities.37