You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

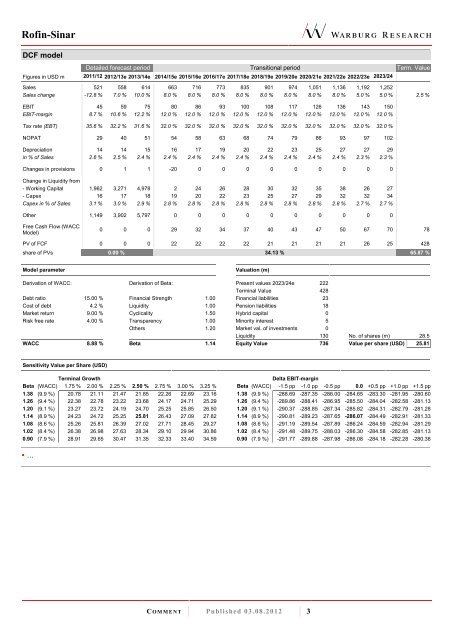

<strong>Rofin</strong>-Sinar<br />

DCF model<br />

Detailed forecast period Transitional period Term. Value<br />

Figures in USD m 2011/12 2012/13e 2013/14e 2014/15e 2015/16e 2016/17e 2017/18e 2018/19e 2019/20e 2020/21e 2021/22e 2022/23e 2023/24<br />

Sales<br />

e<br />

521 558 614 663 716 773 835 901 974 1,051 1,136 1,192<br />

e<br />

1,252<br />

Sales change -12.8 % 7.0 % 10.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 8.0 % 5.0 % 5.0 % 2.5 %<br />

EBIT 45 59 75 80 86 93 100 108 117 126 136 143 150<br />

EBIT-margin 8.7 % 10.6 % 12.2 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 % 12.0 %<br />

Tax rate (EBT) 35.6 % 32.2 % 31.6 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 % 32.0 %<br />

NOPAT 29 40 51 54 58 63 68 74 79 86 93 97 102<br />

Depreciation 14 14 15 16 17 19 20 22 23 25 27 27 29<br />

in % of Sales 2.6 % 2.5 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.4 % 2.3 % 2.3 %<br />

Changes in provisions 0 1 1 -20 0 0 0 0 0 0 0 0 0<br />

Change in Liquidity from<br />

- Working Capital 1,962 3,271 4,978 2 24 26 28 30 32 35 38 26 27<br />

- Capex 16 17 18 19 20 22 23 25 27 29 32 32 34<br />

Capex in % of Sales 3.1 % 3.0 % 2.9 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.8 % 2.7 % 2.7 %<br />

Other 1,149 3,902 5,797 0 0 0 0 0 0 0 0 0 0<br />

Free Cash Flow (WACC<br />

Model)<br />

0 0 0 29 32 34 37 40 43 47 50 67 70 78<br />

PV of FCF 0 0 0 22 22 22 22 21 21 21 21 26 25 428<br />

share of PVs 0.00 % 34.13 % 65.87 %<br />

Model parameter Valuation (m)<br />

Derivation of WACC: Derivation of Beta: Present values 2023/24e 222<br />

Terminal Value 428<br />

Debt ratio 15.00 % Financial Strength 1.00 Financial liabilities 23<br />

Cost of debt 4.2 % Liquidity 1.00 Pension liabilities 18<br />

Market return 9.00 % Cyclicality 1.50 Hybrid capital 0<br />

Risk free rate 4.00 % Transparency 1.00 Minority interest 5<br />

Others 1.20 Market val. of investments 0<br />

Liquidity 130 No. of shares (m) 28.5<br />

WACC 8.88 % Beta 1.14 Equity Value 736 Value per share (USD) 25.81<br />

Sensitivity Value per Share (USD)<br />

Terminal Growth Delta EBIT-margin<br />

Beta (WACC) 1.75 % 2.00 % 2.25 % 2.50 % 2.75 % 3.00 % 3.25 % Beta (WACC) -1.5 pp -1.0 pp -0.5 pp 0.0 +0.5 pp +1.0 pp +1.5 pp<br />

1.38 (9.9 %) 20.78 21.11 21.47 21.85 22.26 22.69 23.16 1.38 (9.9 %) -288.69 -287.35 -286.00 -284.65 -283.30 -281.95 -280.60<br />

1.26 (9.4 %) 22.38 22.78 23.22 23.68 24.17 24.71 25.29 1.26 (9.4 %) -289.86 -288.41 -286.95 -285.50 -284.04 -282.58 -281.13<br />

1.20 (9.1 %) 23.27 23.72 24.19 24.70 25.25 25.85 26.50 1.20 (9.1 %) -290.37 -288.85 -287.34 -285.82 -284.31 -282.79 -281.28<br />

1.14 (8.9 %) 24.23 24.72 25.25 25.81 26.43 27.09 27.82 1.14 (8.9 %) -290.81 -289.23 -287.65 -286.07 -284.49 -282.91 -281.33<br />

1.08 (8.6 %) 25.26 25.81 26.39 27.02 27.71 28.45 29.27 1.08 (8.6 %) -291.19 -289.54 -287.89 -286.24 -284.59 -282.94 -281.29<br />

1.02 (8.4 %) 26.38 26.98 27.63 28.34 29.10 29.94 30.86 1.02 (8.4 %) -291.48 -289.75 -288.03 -286.30 -284.58 -282.85 -281.13<br />

0.90 (7.9 %) 28.91 29.65 30.47 31.35 32.33 33.40 34.59 0.90 (7.9 %) -291.77 -289.88 -287.98 -286.08 -284.18 -282.28 -280.38<br />

� …<br />

C O M M E N T Published 03.08.2012 3