You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

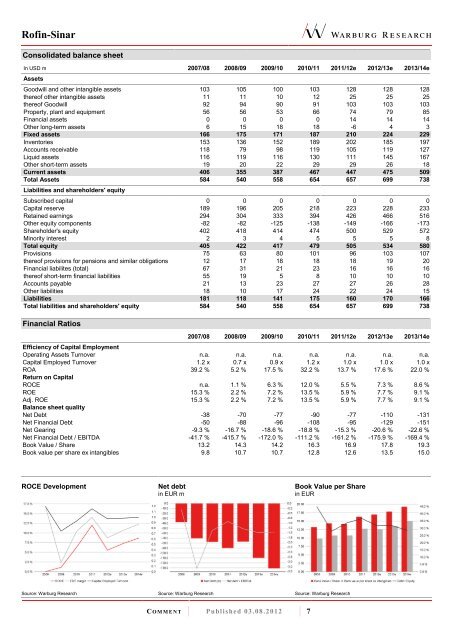

<strong>Rofin</strong>-Sinar<br />

Consolidated balance sheet<br />

In USD m 2007/08 2008/09 2009/10 2010/11 2011/12e 2012/13e 2013/14e<br />

Assets<br />

Goodwill and other intangible assets 103 105 100 103 128 128 128<br />

thereof other intangible assets 11 11 10 12 25 25 25<br />

thereof Goodwill 92 94 90 91 103 103 103<br />

Property, plant and equipment 56 56 53 66 74 79 85<br />

Financial assets 0 0 0 0 14 14 14<br />

Other long-term assets 6 15 18 18 -6 4 3<br />

Fixed assets 166 175 171 187 210 224 229<br />

Inventories 153 136 152 189 202 185 197<br />

Accounts receivable 118 79 98 119 105 119 127<br />

Liquid assets 116 119 116 130 111 145 167<br />

Other short-term assets 19 20 22 29 29 26 18<br />

Current assets 406 355 387 467 447 475 509<br />

Total Assets 584 540 558 654 657 699 738<br />

Liabilities and shareholders' equity<br />

Subscribed capital 0 0 0 0 0 0 0<br />

Capital reserve 189 196 205 218 223 228 233<br />

Retained earnings 294 304 333 394 426 466 516<br />

Other equity components -82 -82 -125 -138 -149 -166 -173<br />

Shareholder's equity 402 418 414 474 500 529 572<br />

Minority interest 2 3 4 5 5 5 8<br />

Total equity 405 422 417 479 505 534 580<br />

Provisions 75 63 80 101 96 103 107<br />

thereof provisions for pensions and similar obligations 12 17 18 18 18 19 20<br />

Financial liabilites (total) 67 31 21 23 16 16 16<br />

thereof short-term financial liabilities 55 19 5 8 10 10 10<br />

Accounts payable 21 13 23 27 27 26 28<br />

Other liabilities 18 10 17 24 22 24 15<br />

Liabilities 181 118 141 175 160 170 166<br />

Total liabilities and shareholders' equity 584 540 558 654 657 699 738<br />

Financial Ratios<br />

2007/08 2008/09 2009/10 2010/11 2011/12e 2012/13e 2013/14e<br />

Efficiency of Capital Employment<br />

Operating Assets Turnover n.a. n.a. n.a. n.a. n.a. n.a. n.a.<br />

Capital Employed Turnover 1.2 x 0.7 x 0.9 x 1.2 x 1.0 x 1.0 x 1.0 x<br />

ROA 39.2 % 5.2 % 17.5 % 32.2 % 13.7 % 17.6 % 22.0 %<br />

Return on Capital<br />

ROCE n.a. 1.1 % 6.3 % 12.0 % 5.5 % 7.3 % 8.6 %<br />

ROE 15.3 % 2.2 % 7.2 % 13.5 % 5.9 % 7.7 % 9.1 %<br />

Adj. ROE 15.3 % 2.2 % 7.2 % 13.5 % 5.9 % 7.7 % 9.1 %<br />

Balance sheet quality<br />

Net Debt -38 -70 -77 -90 -77 -110 -131<br />

Net Financial Debt -50 -88 -96 -108 -95 -129 -151<br />

Net Gearing -9.3 % -16.7 % -18.6 % -18.8 % -15.3 % -20.6 % -22.6 %<br />

Net Financial Debt / EBITDA -41.7 % -415.7 % -172.0 % -111.2 % -161.2 % -175.9 % -169.4 %<br />

Book Value / Share 13.2 14.3 14.2 16.3 16.9 17.8 19.3<br />

Book value per share ex intangibles 9.8 10.7 10.7 12.8 12.6 13.5 15.0<br />

ROCE Development<br />

Source: Warburg Research<br />

Net debt<br />

in EUR m<br />

Source: Warburg Research<br />

C O M M E N T Published 03.08.2012 7<br />

Book Value per Share<br />

in EUR<br />

Source: Warburg Research