investment statement for - Pumpkin Patch investor relations

investment statement for - Pumpkin Patch investor relations

investment statement for - Pumpkin Patch investor relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

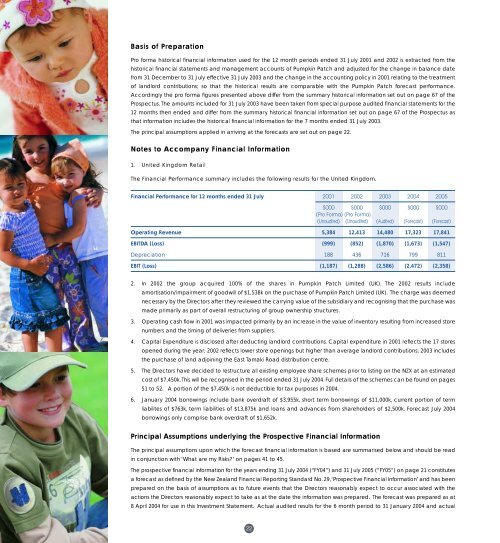

Basis of PreparationPro <strong>for</strong>ma historical financial in<strong>for</strong>mation used <strong>for</strong> the 12 month periods ended 31 July 2001 and 2002 is extracted from thehistorical financial <strong>statement</strong>s and management accounts of <strong>Pumpkin</strong> <strong>Patch</strong> and adjusted <strong>for</strong> the change in balance datefrom 31 December to 31 July effective 31 July 2003 and the change in the accounting policy in 2001 relating to the treatmentof landlord contributions; so that the historical results are comparable with the <strong>Pumpkin</strong> <strong>Patch</strong> <strong>for</strong>ecast per<strong>for</strong>mance.Accordingly the pro <strong>for</strong>ma figures presented above differ from the summary historical in<strong>for</strong>mation set out on page 67 of theProspectus. The amounts included <strong>for</strong> 31 July 2003 have been taken from special purpose audited financial <strong>statement</strong>s <strong>for</strong> the12 months then ended and differ from the summary historical financial in<strong>for</strong>mation set out on page 67 of the Prospectus asthat in<strong>for</strong>mation includes the historical financial in<strong>for</strong>mation <strong>for</strong> the 7 months ended 31 July 2003.The principal assumptions applied in arriving at the <strong>for</strong>ecasts are set out on page 22.Notes to Accompany Financial In<strong>for</strong>mation1. United Kingdom RetailThe Financial Per<strong>for</strong>mance summary includes the following results <strong>for</strong> the United Kingdom.Financial Per<strong>for</strong>mance <strong>for</strong> 12 months ended 31 July 2001 2002 2003 2004 2005$000 $000 $000 $000 $000(Pro Forma) (Pro Forma)(Unaudited) (Unaudited) (Audited) (Forecast) (Forecast)Operating Revenue 5,384 12,413 14,480 17,323 17,841EBITDA (Loss) (999) (852) (1,870) (1,673) (1,547)Depreciation 188 436 716 799 811EBIT (Loss) (1,187) (1,288) (2,586) (2,472) (2,358)2. In 2002 the group acquired 100% of the shares in <strong>Pumpkin</strong> <strong>Patch</strong> Limited (UK). The 2002 results includeamortisation/impairment of goodwill of $1,538k on the purchase of <strong>Pumpkin</strong> <strong>Patch</strong> Limited (UK). The charge was deemednecessary by the Directors after they reviewed the carrying value of the subsidiary and recognising that the purchase wasmade primarily as part of overall restructuring of group ownership structures.3. Operating cash flow in 2001 was impacted primarily by an increase in the value of inventory resulting from increased storenumbers and the timing of deliveries from suppliers.4. Capital Expenditure is disclosed after deducting landlord contributions. Capital expenditure in 2001 reflects the 17 storesopened during the year; 2002 reflects lower store openings but higher than average landlord contributions; 2003 includesthe purchase of land adjoining the East Tamaki Road distribution centre.5. The Directors have decided to restructure all existing employee share schemes prior to listing on the NZX at an estimatedcost of $7,450k.This will be recognised in the period ended 31 July 2004. Full details of the schemes can be found on pages51 to 52. A portion of the $7,450k is not deductible <strong>for</strong> tax purposes in 2004.6. January 2004 borrowings include bank overdraft of $3,955k, short term borrowings of $11,000k, current portion of termliabilites of $763k, term liabilities of $13,875k and loans and advances from shareholders of $2,500k. Forecast July 2004borrowings only comprise bank overdraft of $1,652k.Principal Assumptions underlying the Prospective Financial In<strong>for</strong>mationThe principal assumptions upon which the <strong>for</strong>ecast financial in<strong>for</strong>mation is based are summarised below and should be readin conjunction with ‘What are my Risks?’ on pages 41 to 45.The prospective financial in<strong>for</strong>mation <strong>for</strong> the years ending 31 July 2004 (“FY04”) and 31 July 2005 (“FY05”) on page 21 constitutesa <strong>for</strong>ecast as defined by the New Zealand Financial Reporting Standard No. 29,‘Prospective Financial In<strong>for</strong>mation’ and has beenprepared on the basis of assumptions as to future events that the Directors reasonably expect to occur associated with theactions the Directors reasonably expect to take as at the date the in<strong>for</strong>mation was prepared. The <strong>for</strong>ecast was prepared as at8 April 2004 <strong>for</strong> use in this Investment Statement. Actual audited results <strong>for</strong> the 6 month period to 31 January 2004 and actual22