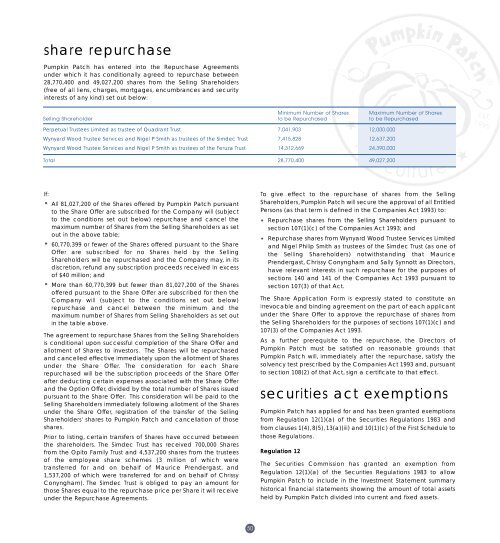

share repurchase<strong>Pumpkin</strong> <strong>Patch</strong> has entered into the Repurchase Agreementsunder which it has conditionally agreed to repurchase between28,770,400 and 49,027,200 shares from the Selling Shareholders(free of all liens, charges, mortgages, encumbrances and securityinterests of any kind) set out below:Minimum Number of Shares Maximum Number of SharesSelling Shareholder to be Repurchased to be RepurchasedPerpetual Trustees Limited as trustee of Quadrant Trust 7,041,903 12,000,000Wynyard Wood Trustee Services and Nigel P Smith as trustees of the Simdec Trust 7,415,828 12,637,200Wynyard Wood Trustee Services and Nigel P Smith as trustees of the Feruza Trust 14,312,669 24,390,000Total 28,770,400 49,027,200If:• All 81,027,200 of the Shares offered by <strong>Pumpkin</strong> <strong>Patch</strong> pursuantto the Share Offer are subscribed <strong>for</strong> the Company will (subjectto the conditions set out below) repurchase and cancel themaximum number of Shares from the Selling Shareholders as setout in the above table;• 60,770,399 or fewer of the Shares offered pursuant to the ShareOffer are subscribed <strong>for</strong> no Shares held by the SellingShareholders will be repurchased and the Company may, in itsdiscretion, refund any subscription proceeds received in excessof $40 million; and• More than 60,770,399 but fewer than 81,027,200 of the Sharesoffered pursuant to the Share Offer are subscribed <strong>for</strong> then theCompany will (subject to the conditions set out below)repurchase and cancel between the minimum and themaximum number of Shares from Selling Shareholders as set outin the table above.The agreement to repurchase Shares from the Selling Shareholdersis conditional upon successful completion of the Share Offer andallotment of Shares to <strong>investor</strong>s. The Shares will be repurchasedand cancelled effective immediately upon the allotment of Sharesunder the Share Offer. The consideration <strong>for</strong> each Sharerepurchased will be the subscription proceeds of the Share Offerafter deducting certain expenses associated with the Share Offerand the Option Offer, divided by the total number of Shares issuedpursuant to the Share Offer. This consideration will be paid to theSelling Shareholders immediately following allotment of the Sharesunder the Share Offer, registration of the transfer of the SellingShareholders' shares to <strong>Pumpkin</strong> <strong>Patch</strong> and cancellation of thoseshares.Prior to listing, certain transfers of Shares have occurred betweenthe shareholders. The Simdec Trust has received 700,000 Sharesfrom the Opito Family Trust and 4,537,200 shares from the trusteesof the employee share schemes (3 million of which weretransferred <strong>for</strong> and on behalf of Maurice Prendergast, and1,537,200 of which were transferred <strong>for</strong> and on behalf of ChrissyConyngham). The Simdec Trust is obliged to pay an amount <strong>for</strong>those Shares equal to the repurchase price per Share it will receiveunder the Repurchase Agreements.To give effect to the repurchase of shares from the SellingShareholders, <strong>Pumpkin</strong> <strong>Patch</strong> will secure the approval of all EntitledPersons (as that term is defined in the Companies Act 1993) to:• Repurchase shares from the Selling Shareholders pursuant tosection 107(1)(c) of the Companies Act 1993; and• Repurchase shares from Wynyard Wood Trustee Services Limitedand Nigel Philip Smith as trustees of the Simdec Trust (as one ofthe Selling Shareholders) notwithstanding that MauricePrendergast, Chrissy Conyngham and Sally Synnott as Directors,have relevant interests in such repurchase <strong>for</strong> the purposes ofsections 140 and 141 of the Companies Act 1993 pursuant tosection 107(3) of that Act.The Share Application Form is expressly stated to constitute anirrevocable and binding agreement on the part of each applicantunder the Share Offer to approve the repurchase of shares fromthe Selling Shareholders <strong>for</strong> the purposes of sections 107(1)(c) and107(3) of the Companies Act 1993.As a further prerequisite to the repurchase, the Directors of<strong>Pumpkin</strong> <strong>Patch</strong> must be satisfied on reasonable grounds that<strong>Pumpkin</strong> <strong>Patch</strong> will, immediately after the repurchase, satisfy thesolvency test prescribed by the Companies Act 1993 and, pursuantto section 108(2) of that Act, sign a certificate to that effect.securities act exemptions<strong>Pumpkin</strong> <strong>Patch</strong> has applied <strong>for</strong> and has been granted exemptionsfrom Regulation 12(1)(a) of the Securities Regulations 1983 andfrom clauses 1(4), 8(5), 13(a)(iii) and 10(1)(c) of the First Schedule tothose Regulations.Regulation 12The Securities Commission has granted an exemption fromRegulation 12(1)(a) of the Securities Regulations 1983 to allow<strong>Pumpkin</strong> <strong>Patch</strong> to include in the Investment Statement summaryhistorical financial <strong>statement</strong>s showing the amount of total assetsheld by <strong>Pumpkin</strong> <strong>Patch</strong> divided into current and fixed assets.50

Clauses 1(4) and 13(a)(iii) of Schedule 1The Securities Commission has granted an exemption from clauses1(4) and 13(a)(iii) of Schedule 1 to the Securities Regulations 1983.The exemptions from clause 1(4) and 13(a)(iii) are necessary as<strong>Pumpkin</strong> <strong>Patch</strong> is using a book build process to determine the FinalPrice <strong>for</strong> Shares and is using that Final Price as the Exercise Price <strong>for</strong>Options, rather than specifying a fixed dollar value <strong>for</strong> thesubscription price <strong>for</strong> the Shares and the Exercise Price of theOptions issued pursuant to the Share Offer and the Option Offerrespectively. The Prospectus instead states the Indicative PriceRange and the Company’s right to fix the Final Price outside theIndicative Price Range; describes how <strong>investor</strong>s can ascertain theFinal Price, the procedures <strong>for</strong> holding subscription moneys, howover-subscriptions will be treated and the procedure <strong>for</strong> makingrefunds; that the Company has applied to the NZX <strong>for</strong> permissionto list the Shares.Clause 8(5) of Schedule 1The Securities Commission has granted an exemption from clause8(5) of Schedule 1 to the Securities Regulations 1983. This exempts<strong>Pumpkin</strong> <strong>Patch</strong> from the necessity to provide historical summaryfinancial <strong>statement</strong>s of the net tangible asset backing per Sharecalculated on the basis that the subscription money has beenreceived. Given that the Final Price of the Shares will not bedetermined be<strong>for</strong>e the date of this Prospectus, it is not possible tocomply with Clause 8(5). This Prospectus instead shows thein<strong>for</strong>mation required by clause 8(5) calculated as if the number ofShares on which the assumptions are based are calculated byreference to the maximum number of specified securities thatwould be allotted if the subscription price of the Shares was at thehigh point, at the mid point and at the low point of the indicativeprice range stated in the Prospectus.Clause 10(1)(c) of Schedule 1The Securities Commission has granted an exemption from Clause10(1)(c) of Schedule 1. This exempts <strong>Pumpkin</strong> <strong>Patch</strong> from thenecessity to provide a prospective <strong>statement</strong> of cash flowsexpected during the year commencing on the date theProspectus is delivered to the Registrar of Companies in registrable<strong>for</strong>m.The Prospectus instead contains consolidated prospective<strong>statement</strong>s of cashflows <strong>for</strong> <strong>Pumpkin</strong> <strong>Patch</strong> and its subsidiaries ineach of the following periods:• the period of 12 months commencing on 1 August 2003 andending on the close of 31 July 2004; and• the period of 12 months commencing on 1 August 2004 andending on the close of 31 July 2005.The financial <strong>statement</strong>s <strong>for</strong> <strong>Pumpkin</strong> <strong>Patch</strong> <strong>for</strong> the 12 monthperiods commencing on 1 August 2003 and 1 August 2004 willinclude a comparison of the actual cashflows <strong>for</strong> the same periodsas stated in the Prospectus, in the manner required underparagraph 5.4 of the Financial Reporting Standard No. 9 (as ifthose <strong>statement</strong>s were required to comply with that standard).standstill agreements<strong>Pumpkin</strong> <strong>Patch</strong> and the following shareholders:• Perpetual Trustee Limited as trustee of the Quadrant Trust;• Wynyard Wood Trustee Services Limited and Nigel Philip Smith astrustees of the Simdec Trust;• Wynyard Wood Trustee Services Limited and Nigel Philip Smith astrustees of the Feruza Trust;• Maurice John Prendergast, Kerry Donna Prendergast and StuartGavin Callender as trustees of the Kezza Family Trust;• Adam Lindsay Gordon Ryall, Judith Mabel Ryall and StanleyAlexander Carwardine as trustees of the Punchestown FamilyTrust;• Mark Joseph Synnott, Sally Rene Synnott and the Gale TrusteeCompany Limited as trustees of the Opito Family Trust; and• Gregory John Muir, Debra Jane Muir and Geoffrey Alistair Lawrieas trustees of the Muir Trust;have entered into a deed in favour of the Lead Manager wherebythose shareholders have agreed that, <strong>for</strong> a minimum period of 12months from the date on which <strong>Pumpkin</strong> <strong>Patch</strong> is quoted on theNZX, they will not:• Dispose of, or agree or offer to dispose of, the Shares they hold;• Create, or agree or offer to create, any security interest(including the sale or purchase of options or similar financialinstruments) in their Shares; and/or• Do, or omit to do, any act or omission which would have theeffect of transferring effective ownership or control of theirShares.If the shareholder takes any of the steps set out above:• <strong>Pumpkin</strong> <strong>Patch</strong> will take such reasonable steps that are within itscontrol to give effect to the terms of the deed or to rectify thematter giving rise to the breach;• <strong>Pumpkin</strong> <strong>Patch</strong> will (to the extent reasonably permitted by law)refuse to acknowledge, deal with, accept or register any sale,assignment, transfer or conversion of any of relevant Shares;• <strong>Pumpkin</strong> <strong>Patch</strong>, <strong>for</strong> as long as the breach continues, will not payany dividends or distributions to any person in respect of therelevant Shares and will not count any votes cast in respect ofthose Shares, in any shareholder resolution; and• The relevant shareholder acknowledges that it will cease to beentitled to any dividends, distributions or voting rights in respectof its Shares while the breach continues.employee share schemerestructuringThe Company has established a number of employee shareschemes which have allowed employees (including executiveDirectors) to purchase shares in the Company. The Company hascommitted to restructure these schemes, such restructuring takingeffect prior to or upon the allotment of Shares under the ShareOffer. The effect of the restructuring will be:• All shares allocated under these schemes prior to listing will befully paid, and the Company will have provided interest freeloans in aggregate of $7,202,861 to pay <strong>for</strong> any Shares underthese schemes not already purchased by the relevantemployee in cash;• All shares allocated under these schemes will be ordinary fullypaid shares in the Company ranking equally in all respects withall other shares;51