2013-2014 Catalog - Virginia Wesleyan College

2013-2014 Catalog - Virginia Wesleyan College

2013-2014 Catalog - Virginia Wesleyan College

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

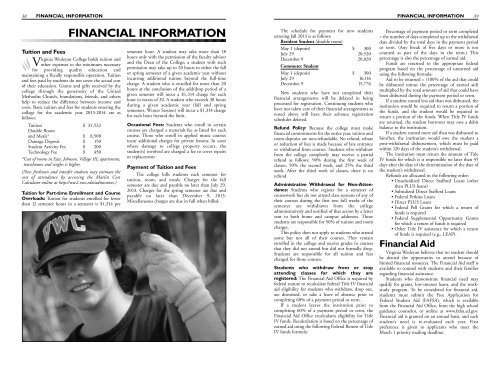

38 FINANCIAL INFORMATION FINANCIAL INFORMATION39FINANCIAL INFORMATIONTuition and Fees<strong>Virginia</strong> <strong>Wesleyan</strong> <strong>College</strong> holds tuition andother expenses to the minimum necessaryfor providing quality education andmaintaining a fiscally responsible operation. Tuitionand fees paid by students do not cover the actual costof their education. Grants and gifts received by thecollege through the generosity of the UnitedMethodist Church, foundations, friends, and othershelp to reduce the difference between income andcosts. Basic tuition and fees for students entering thecollege for the academic year <strong>2013</strong>-<strong>2014</strong> are asfollows:Tuition $ 31,532Double Roomand Meals* $ 8,508Damage Deposit $ 150Student Activity Fee $ 200Technology Fee $ 450*Cost of rooms in East, Johnson, Village III, apartments,townhouses and singles is higher.(New freshmen and transfer students may estimate thecost of attendance by accessing the Marlin CostCalculator online at http://ww2.vwc.edu/admissions.)Tuition for Part-time Enrollment and CourseOverloads: Tuition for students enrolled for fewerthan 12 semester hours in a semester is $1,314 persemester hour. A student may take more than 18hours only with the permission of the faculty advisorand the Dean of the <strong>College</strong>; a student with suchpermission may take up to 20 hours in either the fallor spring semester of a given academic year withoutincurring additional tuition beyond the full-timecharge. A student who is enrolled for more than 20hours at the conclusion of the add/drop period of agiven semester will incur a $1,314 charge for eachhour in excess of 20. A student who exceeds 38 hoursduring a given academic year (fall and springsemesters, Winter Session) will incur a $1,314 chargefor each hour beyond the limit.Occasional Fees: Students who enroll in certaincourses are charged a materials fee as listed for eachcourse. Those who enroll in applied music coursesincur additional charges for private lessons. In caseswhere damage to college property occurs, thestudent(s) involved are charged a fee to cover repairsor replacement.Payment of Tuition and FeesThe college bills students each semester fortuition, room, and meals. Charges for the fallsemester are due and payable no later than July 29,<strong>2013</strong>. Charges for the spring semester are due andpayable no later than December 9, <strong>2013</strong>.Miscellaneous charges are due in full when billed.The schedule for payment for new studentsentering fall <strong>2013</strong> is as follows:Resident Student (double room)May 1 (deposit) $ 300July 29 20,520December 9 20,020Commuter StudentMay 1 (deposit) $ 300July 29 16,116December 9 15,776New students who have not completed theirfinancial arrangements will be delayed in beingprocessed for registration. Continuing students whohave not taken care of their financial arrangements asnoted above will have their advance registrationschedules deleted.Refund Policy: Because the college must makefinancial commitments for the entire year, tuition androom deposits are non-refundable. No refund, rebateor reduction of fees is made because of late entranceor withdrawal from courses. Students who withdrawfrom the college completely may receive a partialrefund as follows: 90% during the first week ofclasses, 50% the second week, and 25% the thirdweek. After the third week of classes, there is norefund.Administrative Withdrawal for Non-Attendance:Students who register for a semester ofcoursework but do not attend class sessions of any oftheir courses during the first two full weeks of thesemester are withdrawn from the collegeadministratively and notified of that action by a lettersent to both home and campus addresses. Thosestudents are responsible for 50% of tuition and roomcharges.This policy does not apply to students who attendsome but not all of their courses. They remainenrolled in the college and receive grades in coursesthat they did not attend but did not formally drop.Students are responsible for all tuition and feescharged for those courses.Students who withdraw from or stopattending classes for which they areregistered: The Financial Aid Office is required byfederal statute to recalculate federal Title IV financialaid eligibility for students who withdraw, drop out,are dismissed, or take a leave of absence prior tocompleting 60% of a payment period or term.If a student leaves the institution prior tocompleting 60% of a payment period or term, theFinancial Aid Office recalculates eligibility for TitleIV funds. Recalculation is based on the percentage ofearned aid using the following Federal Return of TitleIV funds formula:Percentage of payment period or term completed= the number of days completed up to the withdrawaldate divided by the total days in the payment periodor term. (Any break of five days or more is notcounted as part of the days in the term.) Thispercentage is also the percentage of earned aid.Funds are returned to the appropriate federalprogram based on the percentage of unearned aidusing the following formula:Aid to be returned = (100% of the aid that couldbe disbursed minus the percentage of earned aid)multiplied by the total amount of aid that could havebeen disbursed during the payment period or term.If a student earned less aid than was disbursed, theinstitution would be required to return a portion ofthe funds, and the student would be required toreturn a portion of the funds. When Title IV fundsare returned, the student borrower may owe a debitbalance to the institution.If a student earned more aid than was disbursed tohim/her, the institution would owe the student apost-withdrawal disbursement, which must be paidwithin 120 days of the student’s withdrawal.The institution must return the amount of TitleIV funds for which it is responsible no later than 45days after the date of the determination of the date ofthe student’s withdrawal.Refunds are allocated in the following order:• Unsubsidized Direct Stafford Loans (otherthan PLUS loans)• Subsidized Direct Stafford Loans• Federal Perkins Loans• Direct PLUS Loans• Federal Pell Grants for which a return offunds is required• Federal Supplemental Opportunity Grantsfor which a return of funds is required• Other Title IV assistance for which a returnof funds is required (e.g., LEAP).Financial Aid<strong>Virginia</strong> <strong>Wesleyan</strong> believes that no student shouldbe denied the opportunity to attend because oflimited financial resources. The Financial Aid staff isavailable to counsel with students and their familiesregarding financial assistance.Students who demonstrate financial need mayqualify for grants, low-interest loans, and the workstudyprogram. To be considered for financial aid,students must submit the Free Application forFederal Student Aid (FAFSA), which is availablefrom the Financial Aid Office, from the high schoolguidance counselor, or online at www.fafsa.ed.gov.Financial aid is granted on an annual basis, and eachstudent’s need is re-evaluated each year. Firstpreference is given to applicants who meet theMarch 1 priority mailing deadline.